The cyclicality in crude oil depends on a host of factors. Global economic growth has a decisive impact on the demand for crude oil. An increase in economic output leads to an increase in the demand for crude oil and vice versa.

On the supply side, the crude-oil output is controlled by various forces across the globe. The revolutionary introduction of shale technology in the US has led to a remarkable increase in the oil supply over the last decade. Besides, OPEC - a cartel of 13 countries - accounts for more than half of the total world output.

This cartel tends to collectively control oil production for its members in order to manage global oil prices. Besides, global geopolitical tensions contribute to the cyclicality of this commodity. It was observed when the US imposed sanctions on Iran's export of crude oil. Recently, the trade war between the US and China led to a global economic slowdown, thereby decreasing the demand for crude oil.

HISTORICAL PERSPECTIVE

During the financial crisis of 2008, crude oil hit its all-time high of $145 per barrel. But thereafter, its demand plummeted. The fear of global recession, coupled with a bleak future outlook, resulted in the bottoming of crude oil prices to $32 per barrel by the end of 2008. Postcrisis, economies around the globe started gaining pace, with crude oil also reaching a high of over $100 per barrel by 2014. Large oversupply because of the US shale output and tepid global macro environment led to a massive fall in the oil prices to as low as $30 per barrel till early 2016. Thereafter, the oil prices started recovering. However, the demand was tepid mainly because of the global economic slowdown. At the beginning of 2020, the COVID-19 pandemic resulted in the crashing of oil prices.

OUTLOOK

The revival of the global economy, along with record production cuts by OPEC countries, has led to an increase in crude-oil prices. With the global economy rebounding, the demand for crude oil is on a steady rise. So, oil prices are expected to remain high in the near future.

Several factors, including the growing demand for electric vehicles and alternative energy sources, are expected to change the sector's outlook. However, till then, global dependence on oil is likely to remain high.

Methodology

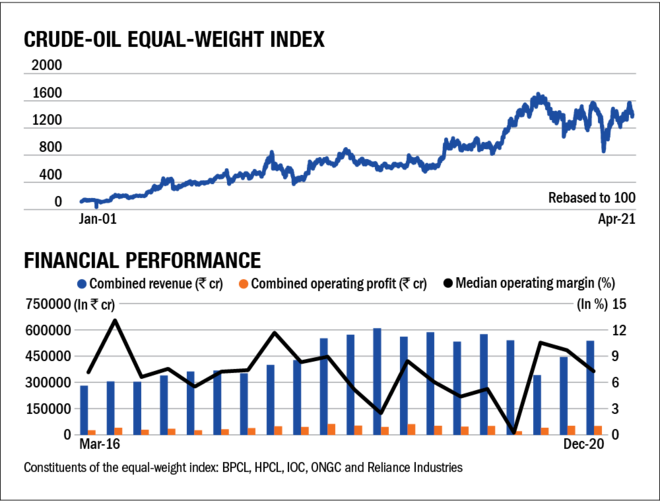

Equal-weight index: Sectoral cycles are a long-term phenomenon and to observe them we require a long-term index. Since the available stock indices generally don't have such a history and homogeneity, we had to create our own index. To do so, we considered companies that had a 20-year history.

Within a sector, there could be multiple industries, so we tried to make the index as inclusive as possible. We then assigned all the components equal weights. This gave us our 'equal-weight' index.

Financial performance: In order to see whether the various sectors are on the road to recovery, we assessed the combined five-year revenues, profits and median margins of the companies constituting the equal-weight index. An upcycle often results in an uptick in these three. Do note that the idea here is not to assess the quantum of revenues or profits but to assess the trend.