The construction-materials sector mainly caters to the housing market (accounting for 60 per cent of the total demand) and the infrastructure space. During high economic growth, companies in the sector try to increase their market share by pushing volumes and selling at low prices. It leads to overcapacity. However, during bad times, companies opt for consolidation, with smaller players fading away and bigger players emerging as winners. In recent years, consolidation in the sector has led to the top two players Ultratech and Ambuja cornering a market share of 52 per cent in 2020 (source: IBEF). Despite this, capacity utilisation of the sector has hovered at around 70 per cent during the last few years, owing to the continuous legacy asset build-up but moderate demand.

HISTORICAL PERSPECTIVE

The 2000s, a high-growth period for the Indian economy, saw a huge inflow of infra financing (mainly through banks). Further, an increase in infrastructure and housing requirements paved the way for the sector's growth. However, the economic crisis in 2008-09, coupled with a crack in government machinery because of various corruption cases, led to a plethora of incomplete projects. Project appraisals done with rosy future estimations also played a major role.

OUTLOOK

Given the previous experience, banks are now reluctant to fund infrastructure projects. However, the country is estimated to require an investment of Rs 50 trillion in infrastructure by 2022 for sustainable development, a target that cannot be achieved without the participation of private companies. Recently, the government has taken various steps. In December 2019, it announced the set-up of the National Infrastructure Pipeline (NIP), under which infra projects of Rs 102 lakh crore would be implemented until FY25. To mobilise resources for funding, the government has also set up a National Infrastructure Investment Fund (NIIF) and a Development Finance Institution (DFI).

On the other hand, after facing several headwinds, the cement industry is expected to see a turnaround on the back of strong demand, market share concentrated with top five players and focussed capacity additions. Cement companies reported a strong set of numbers in Q3FY21. UltraTech grew its Q3 operating profit by 61 per cent, while Ambuja Cements by 40 per cent. After a long lull, UltraTech has announced a cumulative 19.5 million tonnes of capacity addition in the next two-three years. In Q3, the bellwether L&T saw one of the highest quarterly order inflows in its history.

Methodology

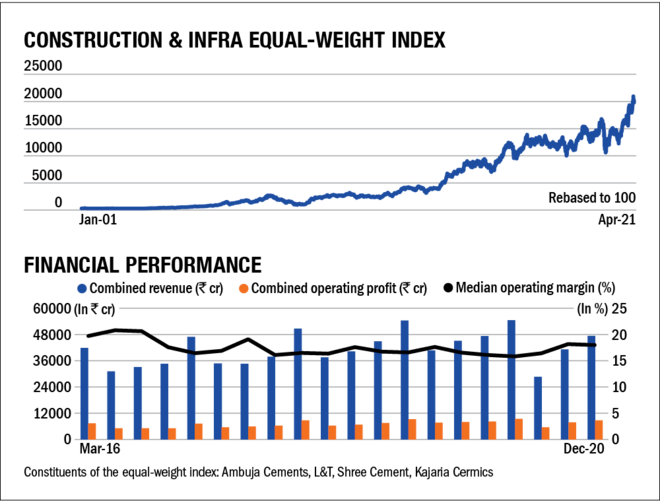

Equal-weight index: Sectoral cycles are a long-term phenomenon and to observe them we require a long-term index. Since the available stock indices generally don't have such a history and homogeneity, we had to create our own index. To do so, we considered companies that had a 20-year history.

Within a sector, there could be multiple industries, so we tried to make the index as inclusive as possible. We then assigned all the components equal weights. This gave us our 'equal-weight' index.

Financial performance: In order to see whether the various sectors are on the road to recovery, we assessed the combined five-year revenues, profits and median margins of the companies constituting the equal-weight index. An upcycle often results in an uptick in these three. Do note that the idea here is not to assess the quantum of revenues or profits but to assess the trend.