Broadly, the real-estate sector could be divided into residential and commercial segments. In the residential segment, demand mainly comes from the migration and nuclearisation of families and customers looking for an upgrade. On the other hand, for the commercial segment, economic growth drives the demand. On the supply side, the availability of capital and land are key growth factors. In India, speculations over the price increase led to an oversupply of residential real estate. Therefore, despite a shortfall of houses in India, there was an unsold inventory of around 7.4 lakh units at the end of FY20.

HISTORICAL PERSPECTIVE

During the real-estate boom in 2000s, developers invested more in acquiring residential projects. This led to an increase in land prices, thereby resulting in a vicious cycle where gains were used to acquire more land. Funding was readily available and many developers went overboard on leveraging their assets until the global financial crisis hit in 2008.

As a result, a series of events, such as increasing interest rates during 2013-14, slow-paced economic growth, demonetisation, RERA and credit crisis led to a slump in the sector. With customers holding up progress payments, developers were left with under-construction stocks, land banks and operational and financial liability, which became difficult for them to service from current cash flows. Ultimately, it resulted in several developers going bust.

OUTLOOK

As 2019 was a record year of leasing activities, 2020 was expected to be a revival year for the real-estate market. But the pandemic played a spoilsport. However, gradually, a host of positive developments, including the revival of the economy, low interest rates of home loans, rock-bottom housing prices, attractive special offers from cash starved developers, interest subsidy under Pradhan Mantri Awas Yojana and a reduction in stamp duty have revived the demand for real estate, albeit at a slower pace.

As noted by Godrej's management, the sector's cycle has started to turn, since demand is picking up and inventory is getting absorbed in a steady manner. Godrej has also announced the launch of 10 projects in Q4 (highest in any quarter). DLF recorded a 9 per cent increase in net profit in Q3 driven by residential demand. On the other hand, Oberoi Realty's Q3FY21 sales volume was at 5.1 lakh sq feet, up around 2.3 times YoY, driven by buyers' preference for available inventories/near-completion projects. While the real-estate market is experiencing an upthrust, the work-from-home culture can reduce the overall long-term demand for commercial real estate. This would be exacerbated by the recent second wave of the pandemic.

Methodology

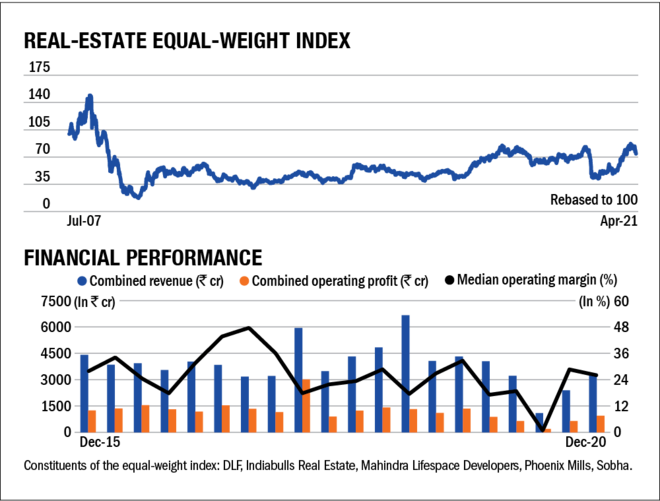

Equal-weight index: Sectoral cycles are a long-term phenomenon and to observe them we require a long-term index. Since the available stock indices generally don't have such a history and homogeneity, we had to create our own index. To do so, we considered companies that had a 20-year history.

Within a sector, there could be multiple industries, so we tried to make the index as inclusive as possible. We then assigned all the components equal weights. This gave us our 'equal-weight' index.

Financial performance: In order to see whether the various sectors are on the road to recovery, we assessed the combined five-year revenues, profits and median margins of the companies constituting the equal-weight index. An upcycle often results in an uptick in these three. Do note that the idea here is not to assess the quantum of revenues or profits but to assess the trend.