If you read a company's financial statements, it's likely that you will come across the term 'depreciation'. Depreciation allows companies to spread the cost of an asset over its useful life. Say, a company bought a computer for Rs 50,000. With depreciation accounting, instead of recording the entire amount as an expense in a single year, the company can capitalise it in its balance sheet as an asset and then allocate it as depreciation expense under the profit-and-loss account for the useful life of the computer.

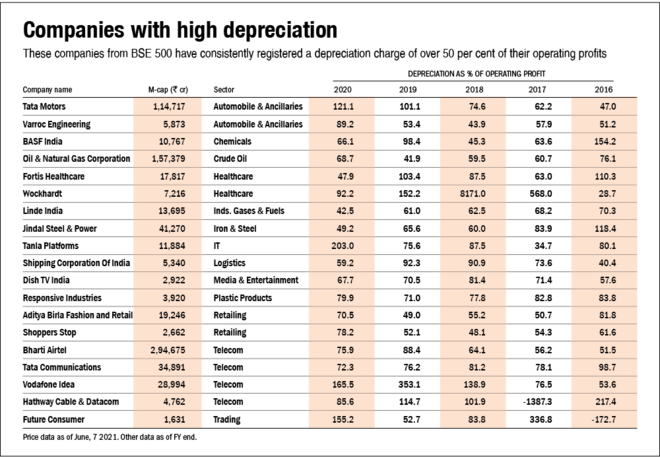

We checked the BSE 500 companies and zeroed in on those that have consistently (in four out of the last five years) recorded high depreciation (over 50 per cent) as a per cent of operating profit. Expectedly, asset-heavy sectors like automobile, telecom, iron and steel, retail, etc., have recorded high depreciation.

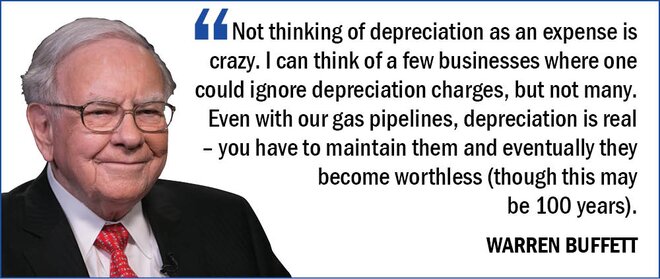

Some analysts tend to downplay depreciation as it is a non-cash charge. However, it still holds major relevance. If we don't pay attention to depreciation and evaluate a company's profitability through operating profits, we would be ignoring the costs incurred for generating revenues. Ignoring these costs gives out an unreal picture of the company's true earnings, especially for capital-intensive businesses, where depreciation and amortisation expenses are huge.