Backed by Blackstone, a global private equity firm, Sona BLW Precision Forgings (Sona Comstar) is involved in manufacturing auto components such as differential assemblies (17.6 per cent of FY21 revenue), differential gears (27.8 per cent), starter motors (50 per cent) and others. In simple terms, differentials transfer rotational power from engine to wheels while starter motors engage and turn the engine over during ignition. Sona Comstar plays on the growth of Battery Electric Vehicles (BEV) and hybrid vehicles as it derives around 40 per cent of its revenue from such vehicle types. The company derives almost 75 per cent of its revenue from international markets such as North America (36 per cent) and Europe (25 per cent) and counts marquee automakers as its customers from such markets.

Merger with Comstar in 2019 vertically integrated the company with presence in both differential assembly and motor. The company is aiming for superior growth by targeting the global EV market, which is expected to grow by 36 per cent between 2020 to 2025. For this, the company has also heightened its R&D spend in recent years and is now focussing on embedded software development. Sona Comstar has been able to maintain superior operating margins of around 25-30 per cent in recent years even as the auto sector has experienced slow growth. However, intense competition coupled with moderate global market shares in various product segments remain key watch outs.

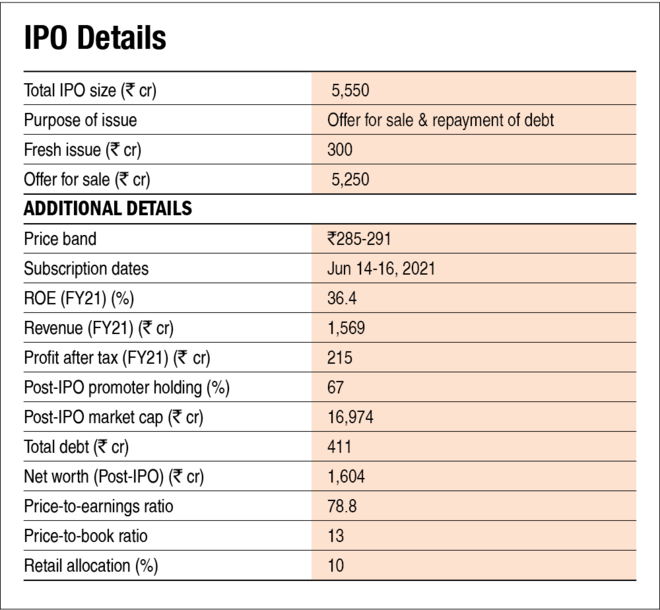

The Rs 5,550 crore IPO is primarily an exit for Blackstone, which will reduce its stake from around 67 per cent to 34 per cent in the company. While Rs 300 crore fresh issue proceeds will be used towards debt repayments.

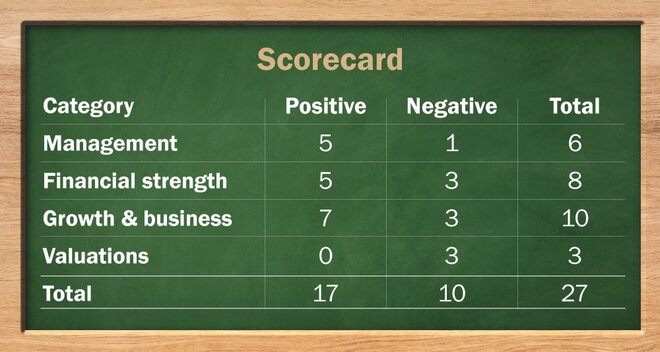

Strengths

1. The company derives almost 75 per cent of its FY21 revenue from new age businesses such as electric vehicles, hybrid and power source neutral vehicles. Unlike other auto ancillary makers which run the danger of product obsoletion in coming years due to emergence of EVs, Sona BLW is safeguarded from such challenges.

2. Auto component makers work in close tandem with the original equipment manufacturers (OEMs) and generally have long-term relationships with its customers. In Sona BLW's case, the company has long-standing relationships of 15 years and more with 13 of the top 20 customers.

3. The company has focussed on heightened product development and R&D spend in the recent years (4-year average R&D spend: 3.2 per cent of revenue). Precision forging is a highly technical business and the company is enhancing its capabilities further by investing in software development.

4. Presence of Blackstone PE firm brings in global management expertise, along with intercompany learning from other umbrella companies of the PE group.

Risks and weaknesses

1. Sona BLW faces substantial competition from various global players. The company doesn't command leading global market share in any of its major product segments.

2. The company faces customer concentration risk as its top three customers account for around 45 per cent of FY21 revenue.

3. Almost 75 per cent of the company's revenue comes from outside India, making it prone to foreign exchange risk.

4. The disruption taking place in the automobile industry around the world due to the advent of EVs and assisted vehicles will result in the company needing to make more investments in R&D, which can impact its short-to-medium term profitability.

IPO questions

Company/business

1. Are the company's earnings before tax more than Rs 50 crore in the last twelve months?

Yes. The company registered profit before tax of Rs 300 crore as of March 2021.

2. Will the company be able to scale up its business?

Yes. The company derived around 14 per cent of its revenue from the battery electric vehicles market in FY21. Currently, at just 3.3 per cent of the global auto market, electric vehicles market is expected to grow at an annual growth rate of 36 per cent between mid-2020 and 2025. Line up of EV & hybrid-enabled products (differential gears, differential assemblies, 48BV BSG Motor), contract wins for FY21 and FY22, long standing relationship with global OEMs and global focus of auto makers towards reduction in carbon footprint should help the company scale up its business.

3. Does the company have recognisable brand/s, truly valued by its customers?

Not Applicable. The company is involved in B2B supply of precision forging auto components. Globally, the auto industry is dominated by top 10 automakers which account for 71 per cent of market share. In such a concentrated B2B industry, brand value plays a negligible role for customers.

4. Does the company have high repeat customer usage?

Yes. Auto component suppliers work in close proximity with their customers (OEMs). Infact, acquisition of new customers could take upto two-three years from proposal to final award. The company has had long-standing relationships of 15 years and more with 13 of its top 20 customers.

5. Does the company have a credible moat?

Yes. Despite slow growth in the global auto market in the last few years, the company has been able to maintain an operating margin of 25-30 per cent during the last three years till FY21. High switching costs for customers and highly technical nature of differential assembly and bevel gears, especially for EVs, provide credible moat to the company.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

Yes. The company derives its revenue from a diverse set of markets including North America (36.1 per cent of FY21 revenue), Europe (26.5 per cent) and others. Drivetrain technology in automobiles is a fairly mature technology. Additionally, EVs are fast becoming globally accepted. Though from time to time the company has faced changes in regulatory requirements (change in axle weights in India), these changes are incremental in nature.

7. Is the business of the company immune from easy replication by new players?

Yes. Precision forging is a highly technical business. Additionally, merger of the company with Comstar in 2019 has provided integration of driveline and motor technology. The complexity of driveline technology will further increase with EVs making companies immune to easy replication by new players.

8. Is the company's product able to withstand being easily substituted or outdated?

Yes. Nearly 75 per cent of the company's current revenue comes from EVs, hybrid and power source neutral types of vehicles. Additionally, its main products such as differential gears, assembly and hybrid starter motors will not become obsolete due to the advent of EVs. However, the value in automobiles is fast moving from hardware to software. The company is making substantial R&D investment towards developing software systems and solutions.

9. Are the customers of the company devoid of significant bargaining power?

No. As discussed before, top 10 automakers control more than 70 per cent of the global auto market. The company derives around 45 per cent of its revenue from the top three customers itself. Additionally, the company's global market share in various products such as differential gear (5 per cent in FY20), starter motor (3 per cent) and EV differential assemblies (8.7 per cent) is not significant enough for its customers to be devoid of bargaining power.

10. Are the suppliers of the company devoid of significant bargaining power?

No. The company's main raw materials include steel alloy bars, iron castings, copper wires, aluminium bearing die casting, magnets and others. The pricing of these products is impacted by the underlying price of commodities such as steel, copper, etc., and the company is a price taker.

11. Is the level of competition the company faces relatively low?

No. The company faces substantial competition from various global auto component players in its various product lines. Additionally, its global market share is not substantial in any of the product lines such as starter motors (3 per cent in FY20), BEV differential assembly (8.7 per cent) and others.

Management

12. Do any of the founders of the company still hold at least a 5 per cent stake in the company? Or do promoters totally hold more than 25 per cent stake in the company?

Yes, the Kapur family (founders), through their company Sona Autocomp, own around 33 per cent in Sona BLW. Besides, post IPO, the promoters (Blackstone and Sona Autocomp together) will hold around 67 per cent stake in the company.

13. Do the top three managers have more than 15 years of combined leadership at the company?

No. The current MD has been associated with the company since 2016 while the CFO has been associated with the company since 2019.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

Yes. One of the promoters of the company is the Blackstone group (34 per cent holding post IPO) and the management is completely professional in nature.

15. Is the company free of any litigation in court or with the regulator that casts doubts on the intention of the management?

Yes. The company is free from any material litigation.

16. Is the company's accounting policy stable?

Yes. As per the auditors' report, the accounting policy is stable.

17. Is the company free of promoter pledging of its shares?

Yes. None of the promoters' stake is pledged pre IPO.

Financials

18. Did the company generate a current and three-year average return on equity (ROE) of more than 15 per cent and return on capital employed (ROCE) of more than 18 per cent?

Yes. The last three years' average ROE/ROCE stood at 35.7 per cent/34.7 per cent as of FY21.

19. Was the company's operating cash flow positive during the previous three years?

Yes. For each of the last three years, cash flow from operations was positive.

20. Did the company increase its revenue by 10 per cent CAGR in the last three years?

No. During the past three years till FY21, the company increased its revenue by 8.4 per cent.

21. Is the company's net debt-to-equity ratio less than 1 or is its interest-coverage ratio more than 2?

Yes. The company had a net debt to equity ratio of 0.3x as of FY21.

22. Is the company free from reliance on huge working capital for day-to-day affairs?

No. The company's working capital requirement during the past three years has been between 20-25 per cent of sales. Additionally, at 85 days, its net working capital cycle is higher than peers like Bosch (26 days), Motherson Sumi (-5.6 days).

23. Can the company run its business without relying on external funding in the next three years?

Yes. The company's capacity utilisation stood at around 75-80 per cent for driveline business while for starter motor business it stood at around 50 per cent in FY21. Additionally, various business wins that will commence in FY21-22 provide the company with ample growth opportunities.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

No. The company's short-term borrowings have increased from Rs 65 crore in FY18 to Rs 114 crore in FY21.

25. Is the company free from meaningful contingent liabilities?

Yes. The contingent liabilities account for less than one per cent of the FY21 equity.

Valuations

26. Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No. The company will give an operating earning yield of around 3 per cent based on March 2021 operating earnings.

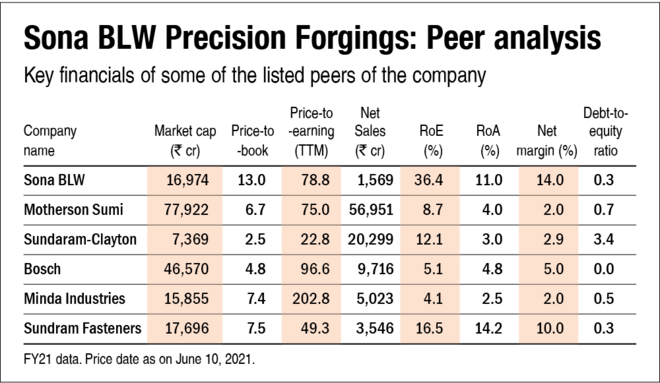

27. Is the stock's price-to-earnings less than its peers' median level?

No. Post IPO, the company will trade at a P/E of around 79, which is a little higher than its peers' median P/E of 75.

28. Is the stock's price-to-book value less than its peers' average level?

No. Post IPO, the company will trade at a P/B of around 13 which is higher than its peers' median P/B of 6.7.

Disclaimer: The author may be an applicant in this Initial Public Offering.