Chemical companies are the flavour of the season and India Pesticides is the latest one to come out with its IPO. It is an agro-chemical manufacturer of niche technicals (approximately 80 per cent of FY21 revenue) and formulations (approximately 20 per cent). Technicals, also commonly known as active ingredients, are raw materials that are used in making the final agro chemical, while the process of forming this final product is known as formulations. The company primarily exports (56.7 per cent) technicals to various markets such as Australia, North America and others and has a diverse customer base in MNCs such as Syngenta, UPL and others. However, formulations are mainly sold domestically. India Pesticides currently runs a capacity of around 26,000 MT across two facilities and is further enhancing it to 30,000 MT.

By 2024, the Indian crop protection market is expected to grow to $5.7bn from the current $4.2bn, while the exports are expected to form around 55 per cent of this market. Further, various factors such as need for increase in crop yield, providing farmers with better remuneration and others are giving impetus to this sector. Importantly, supply chain disruption caused by Covid has influenced many MNCs to follow a 'China plus' strategy, wherein, India is being looked upon attractively for supply of technicals and formulations due to low workforce costs and technical expertise. Government is also encouraging domestic manufacturing of active ingredients to cut reliance on imports from China.

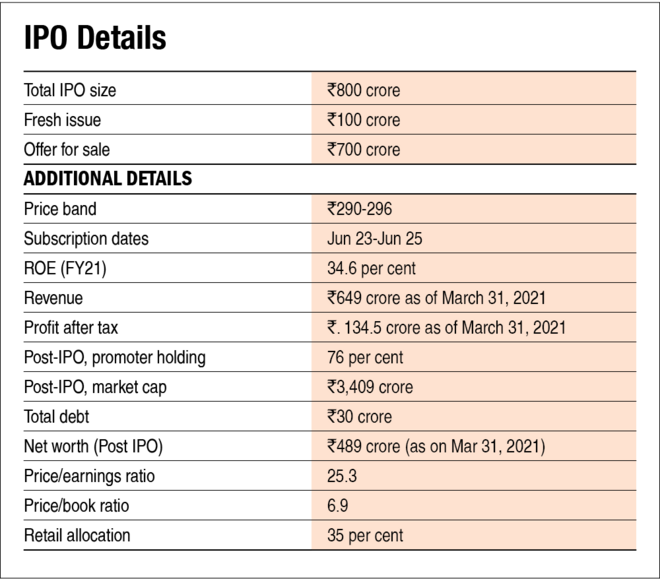

Riding these tailwinds, India Pesticides is coming out with a Rs 800 crore IPO, under which, Rs 100 crore is for fresh issue (to meet working capital needs) while the rest is offer for sale.

Strengths

- The company deals in niche molecules and is the sole Indian manufacturer of five technicals. It's a leading global manufacturer of a few other herbicides and fungicides.

- Active ingredient producers work closely with their customers and have a long-term relationship with them. Customer onboarding is a time consuming process leading to higher switching costs.

- The company has focussed on R&D and as a result, since 2018, it has managed to commercialise three technicals, which form 42 per cent of FY21 revenue.

Risks/Weaknesses

- The company doesn't have any differentiating factor such as patents, technical collaborations with global innovators, etc., that can provide a competitive advantage.

- It had a revenue of Rs 655 crore in FY21. Small scale of operations in a highly competitive and commoditised agro-chemical sector leaves it vulnerable to price fluctuations.

- Working capital cycle of more than three months puts stress on the balance sheet as the company needs to rely on short-term borrowings.

- The IPO is at a rich valuation at Rs 296, compared to capital raised in January 2021 at Rs 33.7.

- The government last year proposed a ban on 27 pesticides which included Captan and Ziram, molecules produced by the company. In FY21 revenue of Rs 114 crore was made from sale of these products in India.

- Bio pesticides are gaining increasing prominence as they are environmentally friendly compared to conventional pesticides. However, the company has no presence in this business segment.

IPO Questions

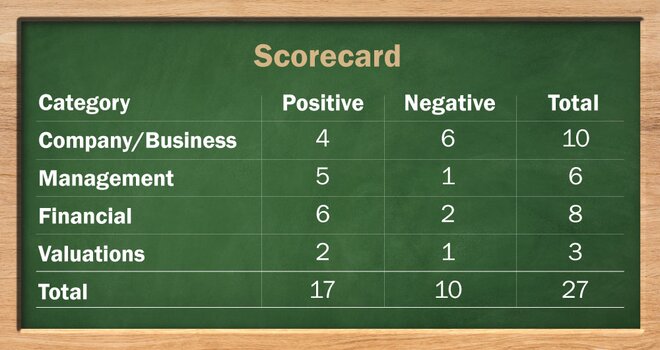

The company/business

1. Are the company's earnings before tax more than Rs 50 cr in the last twelve months?

Yes. For FY21, the company had an earning before tax of Rs 180 crore.

2. Will the company be able to scale up its business?

Yes. The company is experiencing a healthy tailwind in its technical (active ingredients) segment as customers diversify their supply chain along with the government's focus on domestic active ingredients, thereby cutting reliance on imports from China. Additionally, proceeds of Rs 100 crore from fresh issue should relieve the working capital. Though the company is expanding its facilities, it is currently running at around 75 per cent utilisation.

3. Does the company have recognisable brand/s, truly valued by its customers?

N.A. The company sells its technical and formulation products to B2B customers. For such types of customers, the concept of brand recognition isn't of great importance.

4. Does the company have high repeat customer usage?

Yes. Active ingredient players tend to work closely with their customers and have long-term associations. In the company's case, it derives around 57 per cent of its revenue from top 10 customers. Long-term associations, coupled with high customer concentration, point towards high repeat customer usage.

5. Does the company have a credible moat?

No. The company operates in a commoditised business of manufacturing active ingredients used in making pesticides. It is a generic producer of such compounds and doesn't have any patents or exclusive contracts with customers to provide a competitive advantage. Additionally, a small scale of operations in a highly competitive and commotised market leaves it with no pricing power.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

No. Due to the critical and essential nature of agro chemicals, the company is prone to regulatory scrutiny. Before launching a product in a market, the company has to get it registered with the regulator, which is a tedious and time consuming process. Several of its product approval applications are pending with the regulator for approval. Additionally, the hazardous nature of chemical compounds makes them vulnerable to pollution control regulators.

7. Is the business of the company immune from easy replication by new players?

No. Though the company is the sole indian manufacturer of five technicals, it basically is a generic producer for off-patent active ingredients. Additionally, it doesn't have any patents, technical collaborations with global innovators, etc., to provide it immunity from relocation from new players.

8. Is the company's product able to withstand being easily substituted or outdated?

Yes. A secular demand in agro-chemicals is expected in coming years on the back of growing global population, need for better farmer remuneration, improving lifestyle and others. Additionally, India's per capita consumption of pesticides remains low at 0.6 Kg/Ha as compared to that in developed countries. Though bio pesticides provide an alternative to conventional pesticides, the nature of agro chemicals is highly unlikely to be substituted or outdated.

9. Are the customers of the company devoid of significant bargaining power?

No. Customers of the company include multinational players such as Syngenta, UPL, etc., along with regional players. The top 10 customers accounted for 57 per cent of sales in FY21. Additionally, the active ingredients market is highly competitive with China dominating the world exports. These factors provide customers of the company with adequate bargaining power.

10. Are the suppliers of the company devoid of significant bargaining power?

No. The company doesn't enter into any long-term supply contracts for purchase of raw materials and typically sources raw materials from third-party suppliers or the open market. Additionally, around 35 per cent of the raw material is imported from China and Taiwan. These factors provide the suppliers with adequate bargaining power.

11. Is the level of competition the company faces relatively low?

No. India's crop protection market is highly fragmented with presence of more than 150 active ingredient manufacturers, more than 1,000 formulators and more than two lakh companies engaged in distribution. Globally, China dominates the agrochemical exports market with a 27 per cent share. Hence, the company faces intense competition, both domestically and internationally.

Management

12. Do any of the founders of the company still hold at least a 5 per cent stake in the company? Or do promoters totally hold more than 25 per cent stake in the company?

Yes. One of the founders and promoters of the company, Mr Anand Swarup Agarwal, will continue to hold a 30.6 per cent stake in the company on post-IPO basis.

13. Do the top three managers have more than 15 years of combined leadership at the company?

Yes. The CEO of the company, Mr Dheeraj Kumar Jain, has been associated with the company for more than 25 years.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with Sebi guidelines?

Yes. We have no reasons to believe otherwise.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

No. There have been several litigations against the company in relation to misbranding of the products on claims that the contents of the insecticides were not as per the branding on the container.

16. Is the company's accounting policy stable?

Yes. As per the auditors' report, the company has had a stable accounting policy.

17. Is the company free of promoter pledging of its shares?

Yes. None of the promoter stake is pledged.

Financials

18. Did the company generate the current and three-year average return on equity of more than 15 per cent and return on capital of more than 18 per cent?

Yes. The three-year average ROE and ROCE stood at 28.5 per cent and 37.7 per cent, respectively. Also, the current ROE and ROCE stands at 34.6 per cent and 45.2 per cent, respectively.

19. Was the company's operating cash flow positive during the previous three years?

No, the company posted negative cash flow from operating activities in the year 2019. However, it has remained positive thereafter.

20. Did the company increase its revenue by 10 per cent CAGR in the last three years?

Yes, the company's revenue increased at a rate of 24 per cent CAGR in the last three years.

21. Is the company's net debt-to-equity ratio less than 1 or is its interest-coverage ratio more than 2?

Yes. The company is net-debt free.

22. Is the company free from reliance on huge working capital for day-to-day affairs?

No. Higher proportion of sales on credit has led to working capital forming around 35-39 per cent of total sales. Moreover, higher working capital days of more than three months leads to reliance on working capital needs.

23. Can the company run its business without relying on external funding in the next three years?

Yes. The company is planning to raise its current capacity at its Sandila plant to 30,000 MT (Currently at 21,000 MT). For this, the management has indicated that this expansion will be done through internal accruals.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

Yes. The company's short-term borrowings have declined from Rs 44 crore in FY19 to Rs 22 crore in FY21.

25. Is the company free from meaningful contingent liabilities?

Yes. The company is free from contingent liabilities as of FY21.

The stock/valuations

26. Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No. The company's stock offers an operating yield of 5.3 per cent on its enterprise value post IPO.

27. Is the stock's price-to-earnings less than its peers' median level?

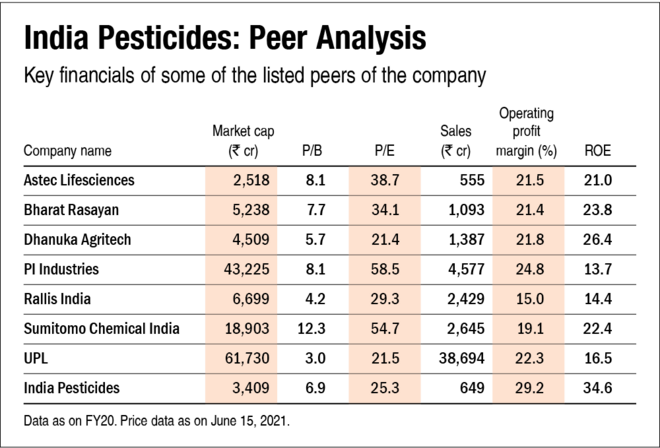

Yes. The company's stock trades at a P/E of 25.3, which is less than its peers' median level of 34.1

28. Is the stock's price-to-book value less than its peers' average level?

Yes. The company's stock has a P/B value of 6.9, which is less than its peers' median level of 7.7.

Disclaimer: The author may be an applicant in this Initial Public Offering.