If a company makes a profit at the end of the year, it basically has four choices for using that cash. First, pay it as dividends or buybacks, second, reinvest in the business, third, if there is any debt on books then pay it off or fourth, retain the balance sheet in cash or investments. Of course, companies can choose to do a mix of all. However, whichever decision the management takes ultimately, it should benefit the shareholders. If the company decides to pay dividends instead of reinvesting in business, it should be based upon sound logic that the management is not able to find such investment prospects that will generate a higher return than the cost of the capital.

However, investors in India perceive dividends as an important part of investing in stocks. That's why more than 70 per cent of companies (out of BSE 500) pay at least some dividend every year. And this brings us to our hypothesis. Are non-dividend paying companies better in terms of returns and also fundamental performance than dividend payers?

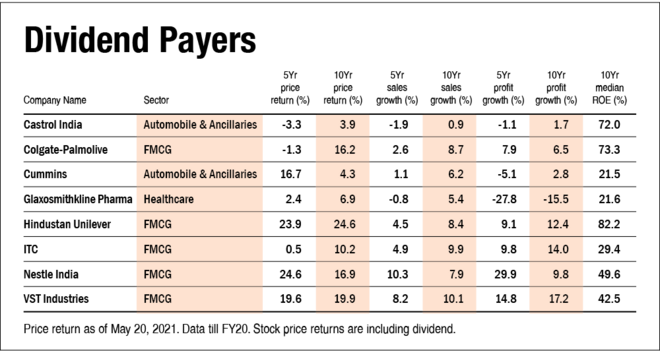

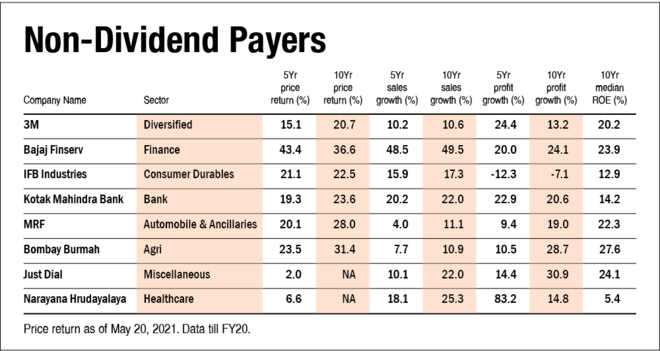

Our universe of stocks was BSE 500 which had recorded profit in each of the last 10 years till FY20. Ideally, it's a profitable company that should pay dividends. Next we checked, what is the median dividend payout from profits for BSE 500 companies, which came around 20 per cent. To create our portfolio of dividend payers, we took companies that have paid more than 40 per cent of their profits in each of the last 10 years in dividends while non-dividend payers have paid less than 5 per cent of profits in dividends in at least 8 of the last ten years. This analysis gave us a list of eight top dividend and non-dividend payers each. Here are our observations:

Composition of companies

Our top dividend payers primarily comprised FMCG companies and ownership by foreign players. FMCG, being a defensive and steady growth sector, requires companies to put little additional capital expenditure. While foreign owners also ensure dividend payouts.

Whereas the non-dividend payers comprised companies from various sectors and most of them with Indian owners.

Does it pay to reinvest?

From our list of dividend payers and non-dividend payers, the last five-year median stock price return was double for non-dividend payers at 19.7 per cent return a year compared to 9.6 per cent by dividend payers. This trend was also true for 10-year stock price returns.

Is performance supported by fundamentals?

The high stock price returns were supported by superior fundamental performance of non-dividend payers over dividend payers. The median 10 year sales and profit growth for non-dividend payers were more than double that of dividend payers. This meant that these companies were able to redeploy their earnings profitably.

Insights into dividend payers

All the top dividend paying companies have either negligible or zero debt. These companies enjoy a high ROE on account of their dominant position in a particular sector coupled with efficient business practices. For example, Castrol and Cummins are able to access global R&D and technology and hence are able to maintain their margins.

Insights into non-dividend payers

3M India, despite being a foreign owned company, has never in its history paid any dividend. Companies like Bombay Burmah and Just Dial, instead of investing in business, have deployed cash in various short and long-term investments.