Zomato is a pure-play technology platform that connects customers, restaurant partners, and delivery partners. Its customers use its platform to search and discover restaurants, read and write customer-generated reviews, view and upload photos, order food delivery, make dine-in reservations and make payments through its app. On the other hand, the restaurant partners are catered with various marketing tools to help them increase customer engagement and acquisition and provide the last-mile delivery service. The company is backed by Info Edge, which is also the owner of Naukri.com.

The company's business is built around the idea that over time, people in India are actively eating out, and thus to capture this shift in behaviour, the company has been offering various product offerings such as:

- Food delivery: The company has close to 1.7 lakh delivery partners through whom it caters to the delivery service of around 1.5 lakh active food delivery restaurants. The company generated most of its revenues from food delivery and related commissions charged to restaurants for using its platform. The restaurants also pay for advertising on Zomato's app.

- Dining-out: The company's app is one of the preferred destinations for dining-out-related services. However, this service has been severely impacted due to the Covid-19 related restrictions on dining out, unlike the food delivery business. The restaurant partners pay advertising fees for enhanced visibility on its platform.

- Hyperpure: Apart from its above two B2C offerings, the company also provides B2B service under which it sources supplies for its restaurant partners, helping them manage their supply chains more effectively. The company started this service in 2019 and currently supplies to more than 9,000 restaurants across six cities in India. Revenue from this segment grew from Rs 15 crore in FY19 to Rs 200 crore in FY21.

- Zomato Pro: This is an exclusive paid membership program that provides discounts and offers to its members for a fixed fee. This allows the restaurant partners to market themselves to a select group of audience.

Strengths

- The company is not just into food delivery. It has a presence over the food ecosystem, and with hyperpure service, it has further increased its foothold. Its end-to-end food service makes it a unique foodservice platform globally.

- Online food delivery is a highly underpenetrated market in India. Out of the active internet users, only 8 per cent order food online, which is very low compared to 38 per cent in the US and 53 per cent in China.

- Increasing smartphone and internet penetration in India will lead to increased demand for online food ordering services, which will be highly beneficial for the company for its growth in the future.

- As per RedSeer, Zomato has consistently gained market share over the last four years to become a category leader in the food delivery space in India.

Risks

- The company has been incurring losses in the last three fiscal years and can continue to do so in the near future. The company expects to provide discounts to its customers and see it has an option to grow, which may lead to further losses.

- Food delivery market is a highly competitive market in India, characterised by low entry costs, shifting customer preferences, and frequent introductions of new services and offerings. The company competes with other food delivery companies such as Swiggy, chain restaurants with their own delivery fleets, and other restaurant delivery services.

- National Restaurant Association of India (NRAI) has recently announced plans to launch their foodservice app to take on Zomato and Swiggy. NRAI represents more than 5,00,000 restaurants across the country.

IPO Questions

Company/Business

1.Are the company's earnings before tax more than Rs 50 cr in the last twelve months?

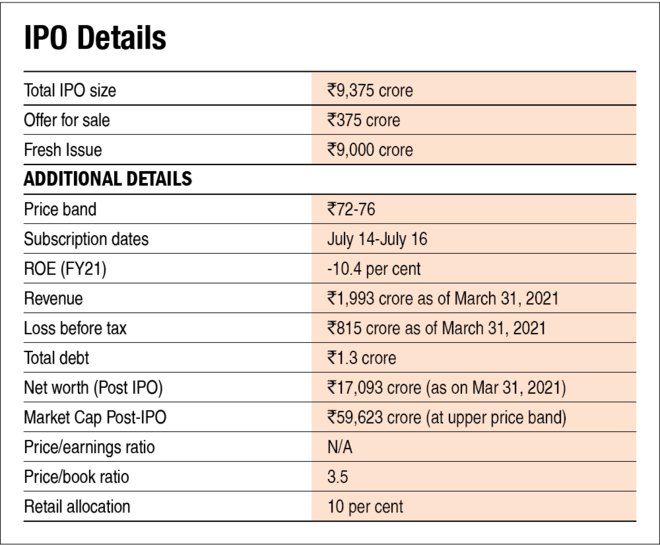

No, the company has been reporting losses in the last three fiscal years. It incurred a loss of Rs 815 crore as of FY21.

2.Will the company be able to scale up its business?

Yes, the company operates a platform-based business, making it easy to scale up its business and expand for future growth. The company's management has decided to seize their international operations and focus only on India due to enormous growth opportunities.

3. Does the company have recognizable brand/s, truly valued by its customers?

Yes, Zomato food delivery app is highly accepted and trusted by users who prefer to order food online and use the dine-in services.

4.Does the company have high repeat customer usage?

Yes, the company has witnessed repeat customer usage on its platform. It claims that users who had joined its platform in 2018 have collectively increased their spending by more than 2.4 times over the past three years. This has helped the company to decrease its advertising expense as well.

5. Does the company have a credible moat?

No, the company operates in a highly competitive industry and has a platform-based business that can be easily replicated. However, the company's expertise built using the customer data and behaviour might help it perform better than new players.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

No, the company has to adhere to various regulations such as the IT Act, Food Safety and Standards Act, and Consumer Protection Act, to name a few.

7. Is the business of the company immune from easy replication by new players?

No, the company generated the majority of revenues from food delivery services through its mobile app. Thus, platform-based business does not possess high barriers to entry and can be easily replicated by new players.

8. Is the company's product able to withstand being easily substituted or outdated?

No, the company already operates in a highly competitive industry and faces tough competition from other delivery service platforms and other big foodservice chain restaurants.

9. Are the customers of the company devoid of significant bargaining power?

No, the company's customers have various other options to choose from, like other food delivery apps or to order directly from the restaurants. However, the company tries to provide a one-stop solution to its customers for food-related services.

10. Are the suppliers of the company devoid of significant bargaining power?

Yes, the company's suppliers include restaurant partners and delivery partners with fewer options to choose from in the case of food delivery platforms. However, the company faces a threat from NRAI for its food delivery app.

11. Is the level of competition the company faces relatively low?

No, the company operates in a highly competitive industry and faces stiff competition from other food delivery companies and chain restaurants.

Management

12. Do any of the founders of the company still hold at least a 5 per cent stake in the company? Or do promoters totally hold more than 25 per cent stake in the company?

Yes, the founder of the company, Deepinder Goyal, holds 5.55 per cent stake in the company. However, this stake will further dilute to 4.7 per cent post IPO. At present, the company is professionally managed and does not have an identifiable promoter.

13. Do the top three managers have more than 15 years of combined leadership at the company?

Yes, CEO Deepinder Goyal and CTO Gunjan Patidar have been the company's co-founders and associated with it for over ten years.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with Sebi guidelines?

Yes, we have no reasons to believe otherwise.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

No, there isn't any material litigation against the management of the company.

16. Is the company's accounting policy stable?

Yes, we have no reasons to believe otherwise.

17. Is the company free of promoter pledging of its shares?

Yes, there is no pledging of any sort.

Financials

18. Did the company generate current and three-year average return on equity of more than 15 per cent and return on capital of more than 18 per cent?

No, the company has incurred losses in the last three years.

19. Was the company's operating cash flow positive during the three years?

No, the company has reported negative cash flows from operating activities in the last three years.

20. Did the company increase its revenue by 10 per cent CAGR in the last three years?

Yes, the company revenue grew at 62.3 per cent CAGR in the last three years.

21. Is the company's net debt-to-equity ratio less than 1 or is its interest coverage ratio more than 2?

Yes, the company is net-debt-free.

22. Is the company free from reliance on huge working capital for day-to-day affairs?

Yes, the company has a negative working capital cycle, wherein it receives payment well before it has to pay its suppliers.

23. Can the company run its business without relying on external funding in the next three years?

Yes, the company has cash balances of more than Rs 3,000 crore and further intends to raise Rs 9,000 crore from the fresh issue of this IPO, which will reduce its dependence on external funding in the next three years.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15%)?

Yes, the company's short-term borrowings are negligible and stand at Rs 1.3 crore as of FY21.

25. Is the company free from meaningful contingent liabilities?

Yes, the contingent liabilities account for less than 1 per cent of the equity.

The stock/valuations

26. Does the stock offer operating earnings yield of more than 8 per cent on its enterprise value?

No, the company's stock will offer an operating yield of -1.4 per cent as per its losses in the last financial year.

27. How do its valuations compare with those of similar companies?

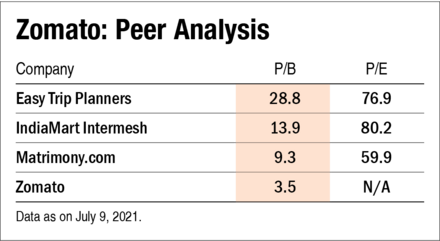

N/A, the company has a platform-based business model. Though there are no other companies listed in India that are into a similar business line, there are other companies that provide platform-based services.

Internationally, Doordash listed on New York Stock Exchange operates an online food ordering and food delivery platform and is the largest food delivery company in the United States. The company is also loss-making, and its stock trades at a price-to-book ratio of 10.5 times as compared to 3.5 times for Zomato.

Disclaimer: The author may be an applicant in the IPO.