Mutual fund trends have always been interesting as they lend themselves to deeper analysis of investor choices and behaviour. We looked at broad trends in the investor flows and spotted four categories which we find to be very useful, but to which investors have been giving a cold shoulder. In the first part of this series, we discuss about Aggressive Hybrid category and present you the reasons why we think investors should hold onto this category.

The 'core' hybrid

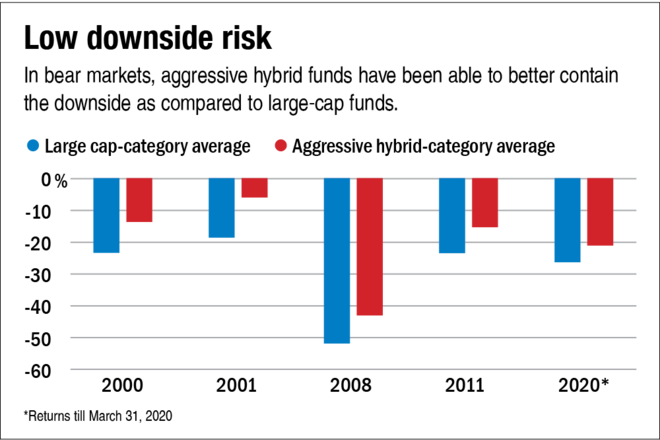

If you are a regular reader of Value Research, you know how useful we believe aggressive hybrid funds are for an investor's portfolio, given their equity-debt allocation. These funds maintain an equity exposure of 65-80 per cent and debt exposure of about 20-35 per cent. Their equity allocation takes care of high growth, thus countering the effect of inflation, and their debt allocation provides stability. The graph titled 'Low downside risk' shows how well the debt blanket of aggressive hybrids has helped investors tide over the rough markets as compared to large-cap funds. Therefore, aggressive hybrid funds fit the bill for first-time or conservative investors, who don't like wild swings in their portfolios. For them, the 20-35 per cent of the debt portfolio turns out to be a decent safeguard. Overall, this category comes across as a low-maintenance solution for your core portfolio.

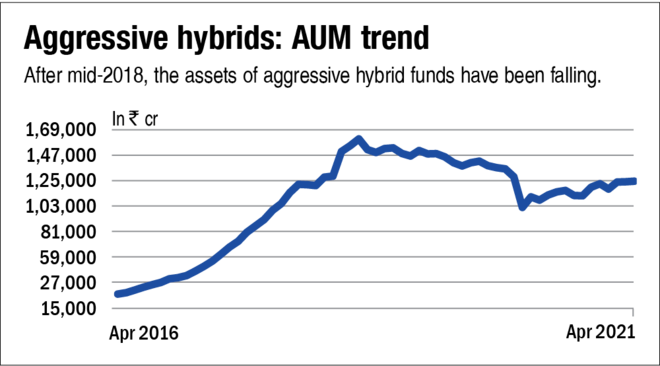

While the category ticks all the boxes for a core portfolio, it is seen dwindling a bit owing to consistent outflows over the past few years. The long-term trend in AUM highlights a general lack of interest after the assets peaked in mid-2018 (see the chart 'Aggressive hybrids: AUM trend').

D P Singh, Chief Business Officer at SBI Mutual Fund, says there are two parts here. "One, some of the industry players started selling the concept of assured monthly dividends, which was not sustainable, thereby, of late the place of aggressive hybrid funds has been taken over by balanced advantage or dynamic asset-allocation funds. He adds, "With the same kind of taxation benefits, dynamic asset-allocation funds seem to be a safer bet."

Ankur Thakore, Chief Distribution Officer at L&T Mutual Fund concurs, "One reason is that dividends were in some cases a reason for investors to invest in this category. Dividends getting taxed at marginal tax rate led to HNIs/SME leaving this (aggressive hybrid) category. Another reason is that new inflows muted as conservative customers are now opting for dynamic-allocation funds instead of fixed allocation of hybrid funds. Thus, outflow continuing and new sales reducing has led to a higher net negative. Our sense is we have reached the trough of this cycle and over the next few quarters, this trend will change for positive sales on account of the merit of the product."

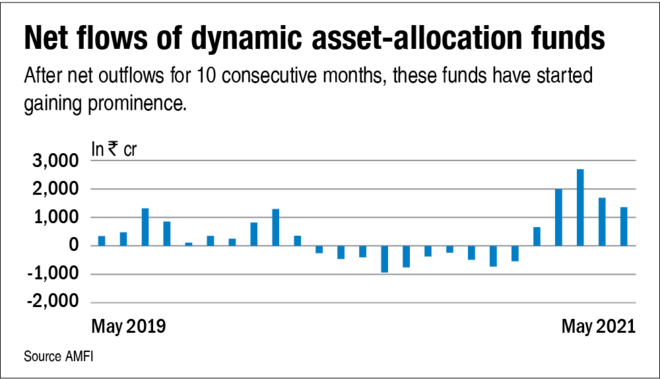

Investors are surely flocking to the dynamic asset-allocation category and the traction comes after it witnessed net outflows for 10 consecutive months (look at the graph 'Net flows of dynamic asset-allocation funds').

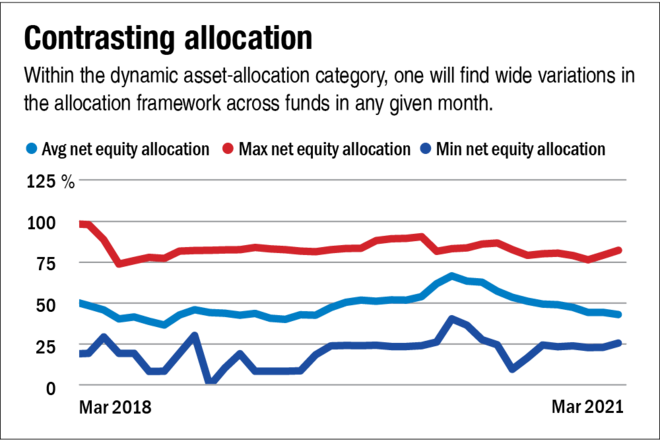

These go-anywhere funds have the flexibility of dynamically managing their asset-allocation framework without any fixed exposure limit to any particular asset class. In case of dynamic asset-allocation funds, the notion that the fund will be able to participate in market rallies and then swiftly move heavily into debt during a market fall to protect those gains doesn't really work that way. On the contrary, if it goes wrong with its call on the markets, that can be quite expensive. The wide variation in the net equity allocations of different dynamic asset-allocation funds in any given month shows that they can have widely different views on the market at a point in time, and some of them are bound to be wrong (see the graph 'Contrasting allocation').

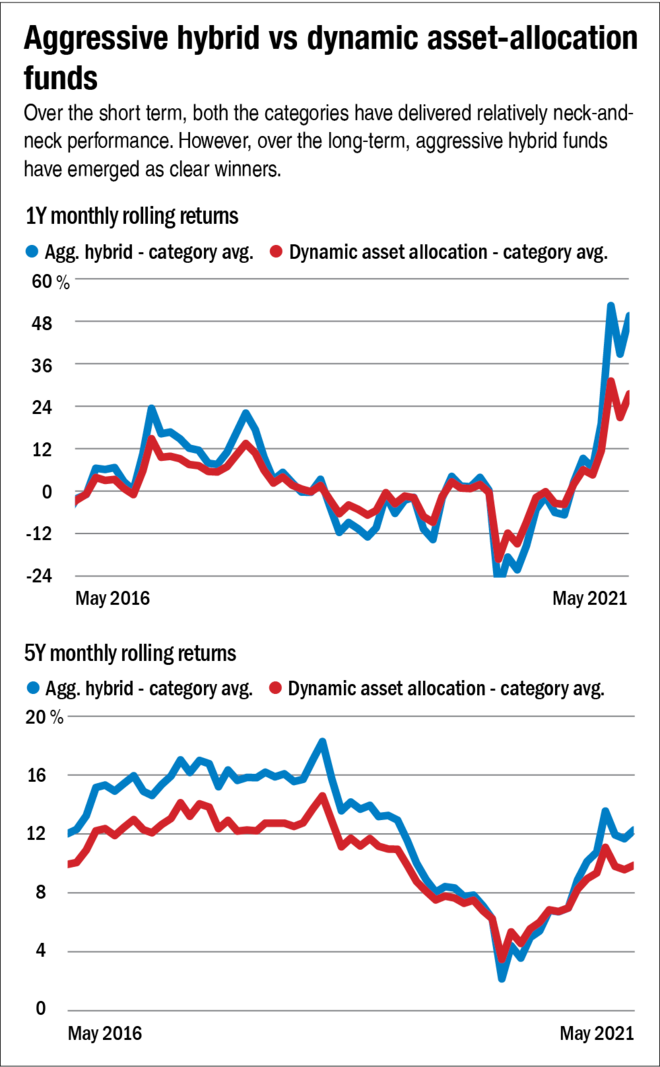

On the other hand, a static asset allocation matched to your investment horizon is primed to deliver better outcomes, even if with a slightly higher volatility in the interim. We compared the performance of aggressive hybrids with their dynamic counterparts across both short- and long-term periods (see the charts 'Aggressive hybrid vs dynamic asset-allocation funds'). A one-year rolling return comparison shows that both the categories have delivered relatively neck-and-neck performance, with dynamic-asset allocation funds giving you a slightly better cushion but at the cost of returns. However, the five-year rolling return comparison shows that aggressive hybrids have emerged as clear winners. So, the hardcoded equity exposure in case of aggressive hybrids makes them a bit more volatile but over a longer term, they are better poised to deliver returns. Therefore, these funds are a better fit for investor's core portfolio.