In the first two parts of this four-part series, we discussed about the aspects affecting the popularity of Aggressive Hybrid funds and Equity savings funds and the reasons we think these categories still hold merit for investors. Another category that investors have been ignoring is the Value Oriented category. In the third part of our 'Offbeat Outliers' series, we will discuss about the reasons for this trend and why this category is still worth it.

The 'value' orientation

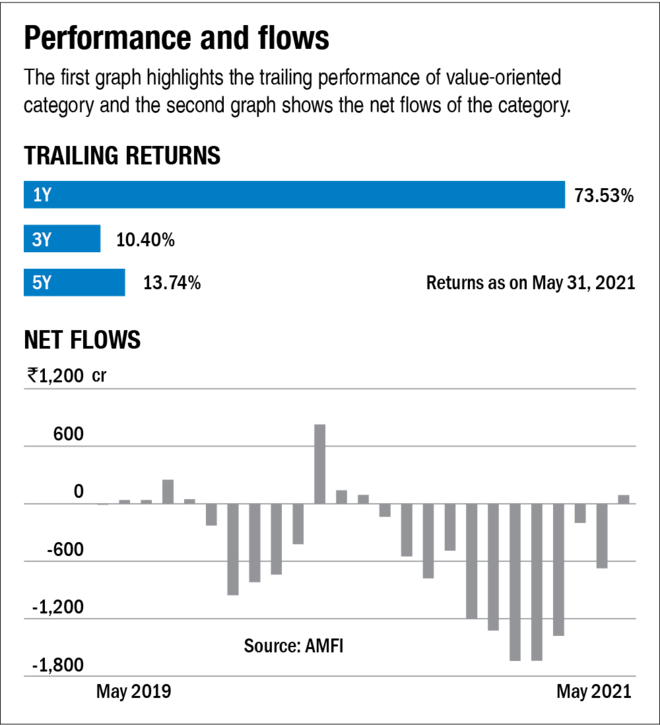

The value style of investing has been around for long, but it got a separate identity after SEBI carved out a distinct value category. The current noise around the theme is driven by the improvement one sees in the category returns in last one year. However, the long-term returns have been lagging behind for a while now. As a result, the category has largely been seeing outflows, suggesting that investors have perhaps lost their patience with the value theme. Look at the graphs titled 'Performance and flows'.

Usha Nair, Head of Distribution, DSP Investment Managers says, "The value theme as a concept, both in India and globally, is a long-drawn investment journey and not a short, sweet (quick) one. There can be prolonged periods when your portfolio may remain in value, and the theme may not generate returns. Then suddenly things can change. Having said that, there was a period in 2017, when the value stocks did well and value style funds garnered AUM. Then there was a period of underperformance of this style. And many investors believed value style investing is no longer relevant. Again, in the post-COVID recovery, there is a broad-based rally and value stocks are doing well. So, the interest is picking up."

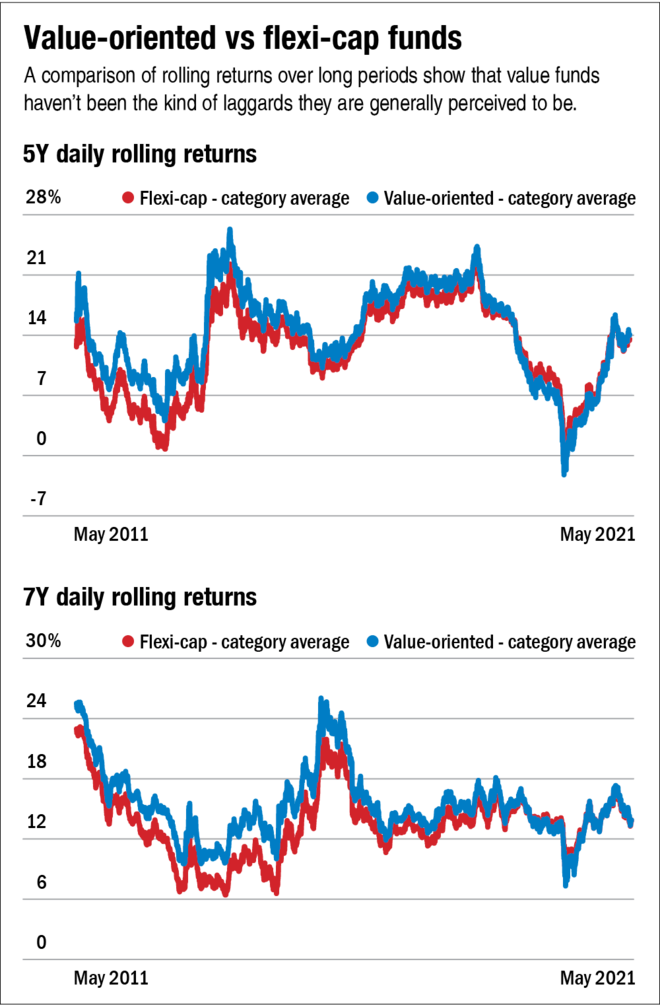

Value-oriented funds aim to invest in companies which are out of favour but hold long-term growth potential and are also available cheap. So basically, the fund manager spots businesses which he/she believes to be more worthy than their trading price. Flexi-cap funds, the more popular cousin of value-oriented funds, generally get all the attention. These funds can have a growth orientation or follow the value style or it could be a combination of both. Having said that, value-oriented funds often end up playing the second fiddle to their flexi counterparts in terms of returns with comparatively higher volatility.

A comparison of rolling returns over longer periods show that value funds haven't been the kind of laggards they are generally perceived to be (Look at the graph 'Value-oriented vs flexi-cap funds').

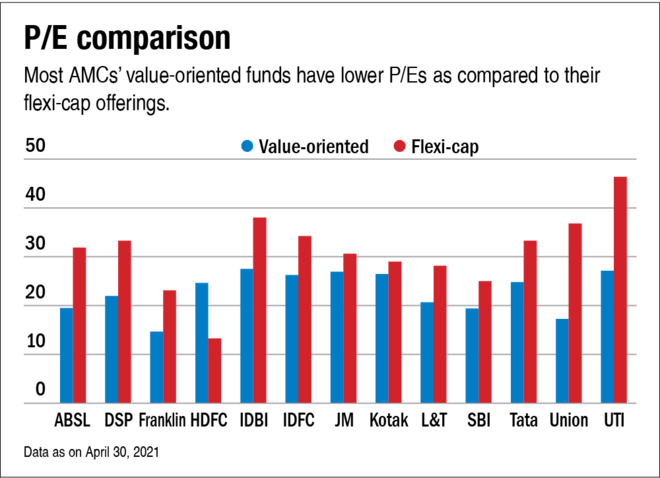

A comparison of the P/E scores based on April-end portfolios of the value-oriented funds and the flexi-cap funds of the same AMCs highlight the difference within the categories. The graph titled 'P/E comparison' shows, value-oriented funds have notably a lower P/E ratio than their flexi counterparts in case of many AMCs. Thus, for investors looking to build a portfolio of three-four equity funds, picking at least one from the value category can be pretty useful from a diversification perspective.

Having said that, the trait that a value investor needs to have is patience. In the words of Nair, "Value investing is a part of an investor's portfolio because it can complement one's existing portfolio of growth-style stocks. Today one-year returns look good, and this segment is getting attention but I think this should not be the reason to invest. The reason should be buying good companies at discounted price. Value investing definitely is a long-term investment process and it will not give you quick-fix results."