Tatva Chintan Pharma Chem, a speciality chemical company, is involved in the manufacturing of structure-directing agents (SDAs, 40 per cent of FY21 revenue), phase transfer catalysts (PTCs, 27 per cent), electrolyte salt for supercapacitor batteries (1 per cent), and pharma and agrochemical intermediaries (30 per cent). PTCs are catalysts that are used in chemical processes to eliminate unsafe elements, increase yield and minimise wastage. Whereas SDAs are made through forward integration of PTCs and helps in forming particular channels and pores during the synthesis of zeolites. Zeolites are microporous minerals used as commercial adsorbents. The company's products have application in green chemistries wherein chemical processes are undertaken in an environmentally friendly manner. These products find their end-use in industries such as automotive, petroleum, pharmaceutical, agrochemicals, paints, and others.

The company counts significant players such as Merck, Bayer AG, Asian Paints, and others as its customers and derives around 70 per cent of its revenue from exports. It currently operates two plants with a total capacity of 280 KL along with an R&D centre in Gujarat.

Globally, a need for conducting chemical processes in environmentally less harmful ways has given impetus to green chemistries. This will lead to a rise in the global PTC market to $132.8Bn in 2024 from $103.1Bn in 2019. The introduction of BS VI vehicles in India and China has led to a sharp increase in demand for zeolites (and hence SDA) which helps in reducing emission levels. Additionally, though a niche for the company right now, the electrolyte salt division is expected to experience good growth on the back of demand for electric vehicles and battery storage devices.

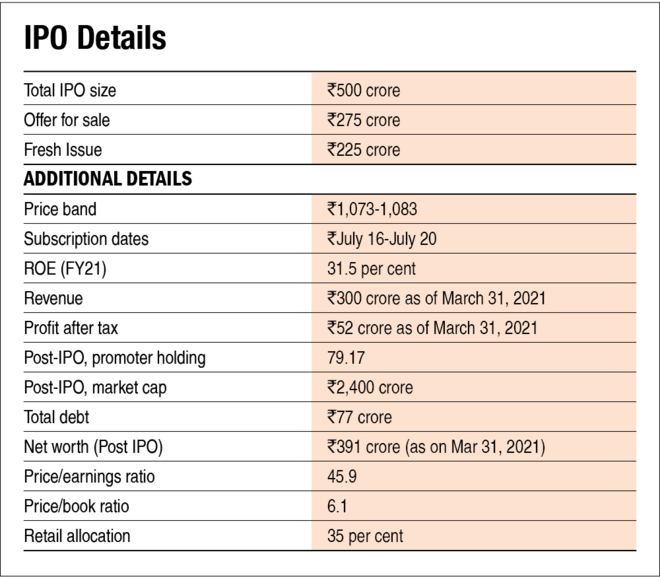

Tatva Chintan is raising Rs 500 crore, out of which Rs 225 crore will be used for capacity expansion while the rest is an offer for sale. Led by three first-generation entrepreneurs, the company intends to launch new products and further enhance its R&D expertise.

Strengths

- The company is the largest and only commercial manufacturer of SDAs for zeolites in India.

- It has a DSIR approved R&D facility in Vadodara and, in the past 10 years has commercialised 82 products. In the past three years, it has invested around 1.7-1.9 per cent of its revenue towards R&D, and its products are highly technical.

- Long product approval timelines coupled with stringent product quality requirements lead to high switching costs for the company's customers.

- The company's products find application in various end-use industries such as automotive, petroleum, pharmaceutical, agrochemicals, paints and coatings, dyes and pigments, and others protecting it from cyclicity of the chemical sector.

Risks/weaknesses

- The company doesn't have any patents or exclusive contracts with any of its customers which can provide a sustainable moat. On its part, the management has indicated that patent filing can lead to the copying of its processes.

- The company doesn't enter into any supply contracts with its suppliers, making its margins vulnerable to input price increases.

- The top 10 customers account for 60 per cent of the topline, making it vulnerable to high customer concentration.

- The working capital cycle of more than 150 days in FY21 puts a strain on the balance sheet as the company has to rely on short-term debt. The management explained that the company maintains high inventory at its subsidiaries in the US and Netherlands to cater to immediate customer needs.

IPO questions

The company/business

1. Are the company's earnings before tax more than Rs 50 cr in the last twelve months?

Yes. For FY21, the company's profit before tax stood at Rs 60.7 crore.

2. Will the company be able to scale up its business?

Yes. The company's current capacity utilisation at around 68.8 per cent coupled with demand for its products across various sectors such as automotive, medical, agriculture, and pharma applications, should help the company scale up its business. Going forward, demand for the company's products will see a further rise as the chemical companies switch to green chemistries.

3. Does the company have recognisable brand/s, truly valued by its customers?

Not applicable. The company is involved in manufacturing specialty chemicals and sells its products to B2B customers. Within such businesses, recognition of brands is not of high importance.

4. Does the company have high repeat customer usage?

Yes. For FY21, around 53.14 per cent of the company's customers had been with the company for more than five years. Additionally, lengthy approval times with customers and stringent quality control needs lead to the formation of long-term relationships and high repeat customer usage.

5. Does the company have a credible moat?

Yes. The company's products, such as SDAs, PTCs, and electrolyte salts, are highly technical and niche products. Also, the company is the largest and only commercial manufacturer of SDAs for zeolites in India and the second largest in the world. Technical knowledge, dominant market share, and high switching costs for its customers provide the company a credible moat.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

No. The hazardous nature of chemical companies makes them prone to regulatory risks. However, the company has de-risked itself by using green chemistries in its processes and has also converted one of its facilities into a zero liquid effluent discharge. Additionally, since around 70 per cent of its revenue comes from exports to various countries such as the USA, China, Germany, and others, the company faces geopolitical risks.

7. Is the business of the company immune from easy replication by new players?

Yes. The company has, over the years, successfully forward integrated from the manufacturing of PTCs to SDAs. These products are highly technical and, at the same time, niche enough not to attract the attention of any big player. Though the company doesn't have any patents, the management concedes that patent filing can lead to copying its processes by other players. Additionally, long product approval timelines and stringent quality control requirements make the business immune from easy replication.

8. Is the company's product able to withstand being easily substituted or outdated?

Yes. Globally, chemical companies are in need to move towards conducting their business in less environmentally harmful ways. The need for such catalysts that can achieve faster reactions, higher yields, and lower by-products is expected to rise. Company's products such as PTCs and SDAs will find growing applications across the sectors, making them withstand being quickly outdated.

9. Are the customers of the company devoid of significant bargaining power?

No. The top 10 customers of the company account for around 60 per cent of its revenue. The large size of customers provides them with ample bargaining power.

10. Are the suppliers of the company devoid of significant bargaining power?

No. Company's primary raw material includes tertiary amines, alkyl halides, general solvents, and other general and fine chemicals, which form around 50 per cent of revenue. Also, the top 10 suppliers account for about 48 per cent of these purchases. Since the company doesn't enter into any long-term contracts with its suppliers and has a relatively small size of operations, its suppliers have reasonable bargaining power.

11. Is the level of competition the company faces relatively low?

No. Though the company is the exclusive producer of SDA in India, it faces competition from international players. Moreover, currently, the company is operating in a very niche segment, and the popularity of its products is in its nascent stage. However, several domestic and international competitors in the chemical industry might get attracted to these products as their acceptance increases.

Management

12. Do any of the founders of the company still hold at least a 5 per cent stake in the company? Or do promoters totally hold more than 25 per cent stake in the company?

Yes, the promoter and promoter group will continue to hold 79.17 per cent stake in the company post-IPO.

13. Do the top three managers have more than 15 years of combined leadership at the company?

Yes, the promoters of the company, who are also the executive directors, have been part of the company since its inception in 1996.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with Sebi guidelines?

Yes, we have no reasons to believe otherwise.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

Yes, the company and its management are free of any material litigation.

16. Is the company's accounting policy stable?

Yes, we have no reasons to believe otherwise.

17. Is the company free of promoter pledging of its shares?

Yes, there is no pledging of any sort.

Financials

18. Did the company generate the current and three-year average return on equity of more than 15 per cent and return on capital of more than 18 per cent?

Yes, the three-year average ROE and ROCE stood at 29.8 and 24.5 per cent, respectively. The current ROE and ROCE stood at 31.5 and 26.8 per cent, respectively, in FY21.

19. Was the company's operating cash flow positive during the previous three years?

Yes, the company has reported positive cash flows from operations in the last three years.

20. Did the company increase its revenue by 10 per cent CAGR in the last three years?

Yes, the company's revenue increased by 30.4 per cent CAGR in the last three years.

21. Is the company's net debt-to-equity ratio less than 1 or is its interest-coverage ratio more than 2?

Yes, the company's net debt-to-equity ratio stands at 0.18 times on post-IPO equity.

22. Is the company free from reliance on huge working capital for day-to-day affairs?

No. The company has working capital days of more than 150 days, primarily because of the high inventory that the business carries at its foreign subsidiaries' warehouses. The management has explained that it maintains such inventory to meet its customer needs quickly. However, this does put a strain on working capital needs.

23. Can the company run its business without relying on external funding in the next three years?

Yes. The current capacity utilisation is around 68 per cent, and the company is further expanding capacity using the IPO proceeds. These factors should enable the company to grow without needing external funding in the near future.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

No, the company's short-term borrowings increased 23.5 per cent from Rs 40 crore in FY19 to Rs 49 crore in FY21.

25. Is the company free from meaningful contingent liabilities?

Yes, the company is free from meaningful contingent liabilities.

The stock/valuations

26. Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No, the company's stock will offer an operating yield of 2.6 per cent on its enterprise value.

27. Is the stock's price-to-earnings less than its peers' median level?

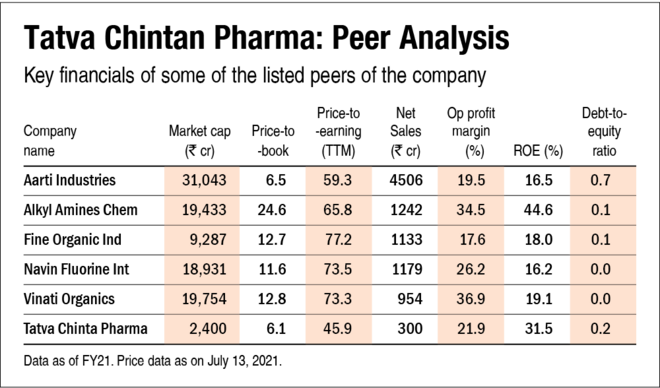

Yes, the company's stock would trade at a P/E of 45.9, which is lower than its peer's median level of 73.3.

28. Is the stock's price-to-book value less than its peers' average level?

Yes, the company's stock would trade at a P/B of 6.1, which is lower than its peer's median level of 12.7.

Disclaimer: The author may be an applicant in this Initial Public Offering.