In the first three parts of this four-part series, we discussed about three categories that investors have been ignoring and the reasons we think these categories are still worthwhile. These included Aggressive Hybrid funds, Equity savings funds and Value-oriented funds. In the final part of our 'Offbeat Outlier' series, we will discuss about Equity-linked savings schemes, popularly known as tax-saving funds.

The promise of ELSS funds

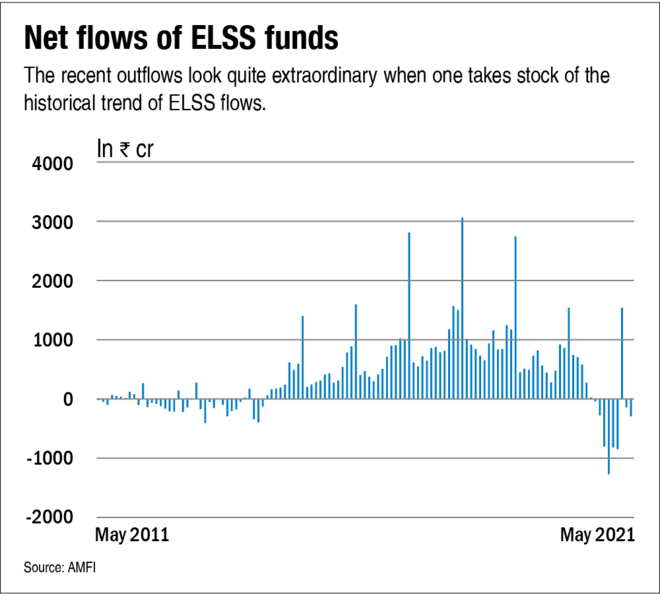

Tax-saving funds are an ideal investment for all types of investors. It's the combination of equity and tax-saving that makes ELSS funds the mainstream category. However, the category has largely been seeing net outflows since August 2020 barring March 2021. The historical trend suggests that the magnitude of outflows seen in the past few months does look like quite out of the ordinary (see the graph 'Net flows of ELSS funds'). In the graph, you can majorly see positive numbers but in the later leg, all you can see are negative numbers.

Perhaps a combination of factors has been contributing to this trend. Firstly, all equity categories have largely witnessed outflows during the same period. On top of it, there is already the seasonality factor attached to the ELSS category, which tends to hamper the inflows in certain months. Lastly, perhaps the confusion around the alternate tax regime also has a role to play here. The alternate tax regime offers lower tax rates if taxpayers forgo most of the tax deductions, including the one under Section 80C.

Another factor could be investors looking at cheaper options like the National Pension System (NPS) Tier 1, which also provides tax benefits. No doubt the NPS is a good offering but it has limited equity exposure (maximum 75 per cent) coupled with a long lock-in period. We did a comparative analysis of ELSS funds with that of NPS Tier 1 equity plans on the basis of five-year rolling returns and found that ELSS has fared better than the latter on most occasions, though they have moved in sync in recent times (see the chart 'ELSS vs NPS').

NPS has a clear (and big!) cost advantage but given the long lock-in till the age of 60, one can see it as a retirement solution. However, the relatively better liquidity of ELSS has its own charm of linking it to goals other than retirement. Investors can align their tax-saving goal with other goals like saving for child education with a single investment in ELSS. These funds merit a place in the investment portfolio of every taxpayer who is looking to save and invest for long-term growth.