Rolex Rings is one of India's top five forging companies involved in producing and exporting bearing rings, gearbox parts, and other automotive components. The company, promoted by Rupesh Madeka and Manesh Madeka, began its manufacturing operations in 1988, with a single plant in Rajkot. Today it has a capacity of 1,44,750 MTPA comprising 22 forging lines in three manufacturing plants. The company also operates windmills with an installed capacity of 8.75 MW. It is in the process of expanding its renewable energy capacity by another 16 MW to reduce both its energy costs and carbon footprint.

For FY21, bearing rings constituted nearly 54 per cent of the company's revenue from operations - 44 per cent from domestic and 56 per cent from exports.

The company's IPO is mainly an offer for sale for one institutional shareholder (Rivendell PE LLC), with only Rs 56 crore out of Rs 731 crore raised being a fresh issue.

Strengths

- Geographically diversified revenue base: The company sold bearing rings and automotive components to customers in 17 countries such as the USA, Germany, France, Thailand, etc. The strength of the long-standing relationships can be gauged by the fact that 70 per cent of the largest 10 customers have been purchasing from the company for over a decade.

- Comprehensive portfolio: The company's products are suitable for a wide range of end-use applications such as industrial infrastructure, renewable energy, railways, etc. Apart from this, its products are also used in electric vehicles.

- Debt reduction: The company has been able to strengthen its balance sheet, and its debt-to-equity ratio has reduced from 1.8 times in FY19 to 0.6 times as of FY21.

Risks/weaknesses

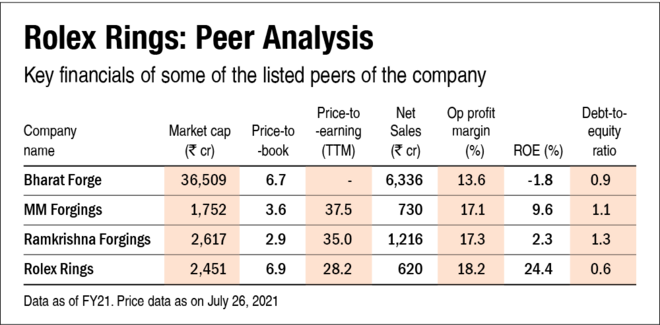

- Margins: Being an auto-ancillary player, the company does not have strong margins, and this is reflected in its low EBITDA margin of 18.12 per cent in FY21. Besides, it has a high dependence on raw material prices, constituting 51.4 per cent of its FY21 revenue from operations. The raw material (steel) prices are cyclical and are therefore not predictable. Also, it has a high degree of supplier concentration, with its top 10 clients accounting for 72 per cent of its revenues.

- Economic downturn: The company is heavily reliant on automobile sales and capital expenditure by corporates, both of which are dependent on the general economic cycle. The economic slowdown has hit the company badly. Its total income dropped from Rs 911 crore in FY19 to Rs 620 crore in FY21. The capacity utilisation of its factories is also very low at just 34 per cent.

- High price: The company had issued 2.63 million optionally convertible redeemable preference shares in March 2021, which were converted into regular equity shares on July 16, 2021 at a price of just Rs 10 per share. Given that the IPO is being priced at Rs 900 per share, it seems that the very low conversion price was designed to benefit the promoters at the cost of the existing shareholders.

IPO questions

The company/business

1. Are the company's earnings before tax more than Rs 50 cr in the last twelve months?

Yes, the company's profit before tax in FY20-21 was Rs 75 crore.

2. Will the company be able to scale up its business?

No, the company is operating in a very low-margin business.

3. Does the company have recognisable brand/s, truly valued by its customers?

No. The company does not have any brands and is operating in a commoditised market.

4. Does the company have high repeat customer usage?

Yes. Since the company operates primarily in the B2B space and supplies to OEMs, it has high repeat customer usage after it becomes a supplier.

5. Does the company have a credible moat?

No. The company operates in a heavily commoditised business and does not have a credible moat.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

Yes. Due to its international customer base, it is exposed to multiple geopolitical risks. But its long operating history shows that it is sufficiently robust to major geopolitical risks.

7. Is the business of the company immune from easy replication by new players?

No. The lack of entry barriers or credible moat and the commoditised nature of the market makes the company's business vulnerable to easy replication by new players.

8. Is the company's product able to withstand being easily substituted or outdated?

No. While some of the company's products are used in electric vehicles, most of its current end-use applications are in the non-EV space and, therefore, can become potentially substituted or outdated.

9. Are the customers of the company devoid of significant bargaining power?

No. Being a supplier of commoditised parts to leading OEMs, companies operating in the auto-ancillaries space do not have much bargaining power.

10. Are the suppliers of the company devoid of significant bargaining power?

Yes. Since the raw materials needed to manufacture products are commodities, there is no difference between suppliers, and hence, suppliers don't have any bargaining power.

11. Is the level of competition the company faces relatively low?

No, the market is quite competitive with potential competitors across the globe.

Management

12. Do any of the founders of the company still hold at least a 5 per cent stake in the company? Or do promoters totally hold more than 25 per cent stake in the company?

Yes, the company's promoter will continue to hold 57.6 per cent stake in the company post-IPO.

13. Do the top three managers have more than 15 years of combined leadership at the company?

Yes, Hemal Paresh Madeka, President of Supply Chain and Quality Assurance, has been associated with the company for over 18 years.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

Yes, we have no reasons to believe otherwise.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

Yes, the company is free of any material litigation.

16. Is the company's accounting policy stable?

Yes, we have no reasons to believe otherwise.

17. Is the company free of promoter pledging of its shares?

No, the entire promoter stake had been pledged before the IPO against the loans availed by the company. Though the lenders have temporarily released the pledge, it will be reimposed after the IPO.

Financials

18. Did the company generate the current and three-year average return on equity of more than 15 per cent and return on capital of more than 18 per cent?

Yes, both the average three-year ROE and ROCE stood at 23.8 per cent. The current ROE and ROCE for FY21 stood at 24.3 per cent and 17.3 per cent, respectively.

19. Was the company's operating cash flow positive during the previous three years?

Yes, the company reported positive cash flows from operating activities in the last three fiscal years.

20. Did the company increase its revenue by 10 per cent CAGR in the last three years?

No, the company's revenue decreased from Rs 904 crore in FY19 to Rs 616 crore in FY21.

21. Is the company's net debt-to-equity ratio less than 1 or is its interest-coverage ratio more than 2?

Yes, the company's net debt-to-equity ratio stood at 0.6 as of FY21.

22. Is the company free from reliance on huge working capital for day-to-day affairs?

No. Despite receiving credit from its suppliers, the company had net working capital of Rs 241.4 crore as of FY21. This constituted 30 per cent of its total asset size.

23. Can the company run its business without relying on external funding in the next three years?

Yes. Since there are no expansion plans right now, the company should be able to run its business without relying on external funding for the next three years.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

Yes, The company's short-term borrowings have declined from Rs 234 crore in FY19 to Rs 183 crore in FY21.

25. Is the company free from meaningful contingent liabilities?

Yes, the company reported contingent liabilities of Rs 14 crore in FY21, which is less than 0.4 per cent of its equity.

The stock/valuations

26. Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No, the company's stock will offer an operating earnings yield of 3.7 per cent on its enterprise value.

27. Is the stock's price-to-earnings less than its peers' median level?

Yes, the company's stock would trade at a P/E of 28.2, which is lower than its peer's median level of 36.2.

28. Is the stock's price-to-book value less than its peers' median level?

No, the company's stock would trade at a P/B of 6.9, which is higher than its peer's median level of 3.6.

Disclaimer: The authors may be an applicant in this Initial Public Offering.