Incorporated in 2007-08, the company was engaged in manufacturing frit, which is one of the raw materials used to manufacture tiles. Over the years, the company has diversified to manufacturing and marketing of vitrified tiles used majorly for flooring solutions. Its business operations are broadly divided into two product categories - double charged vitrified tiles and glazed vitrified tiles.

The company markets its products under the brand "Exxaro" and has 1,000+ designs in its product basket, mainly in six different sizes. With over a decade of operational history, the company has supplied its products for various projects for residential, commercial, educational institutions, hotels, hospitals, builders/developers, and government projects.

Strengths

- The company has an extensive dealer network of more than 2,000 registered dealers. Through this network, the company caters to the needs of its consumers across 24 states. Apart from this, it also exports its products to over 12 countries, which forms around 14 per cent of its revenue in FY21.

- Its integrated business model allows it to develop insights across the entire value chain - from product design, process development, and manufacturing to marketing.

- The company has an installed capacity of 13.2 sq mt million and has one of the single largest plants of glazed vitrified tiles under one roof in India.

- Rising disposable income, various government initiatives, rising demand for affordable housing, and increasing exports due to anti-China sentiments are some of the tailwinds for the company.

Risks

- The company provided security regarding loans from banks by creating a charge over its movable and immovable properties. The total outstanding amount payable by the company stands at Rs 142 crore as of FY21.

- It carries high trade receivables on its balance sheet, accounting for 94 per cent of its current assets and 24 per cent of its total assets. As the company plans to expand, this can increase the quantum of trade receivables and inventories.

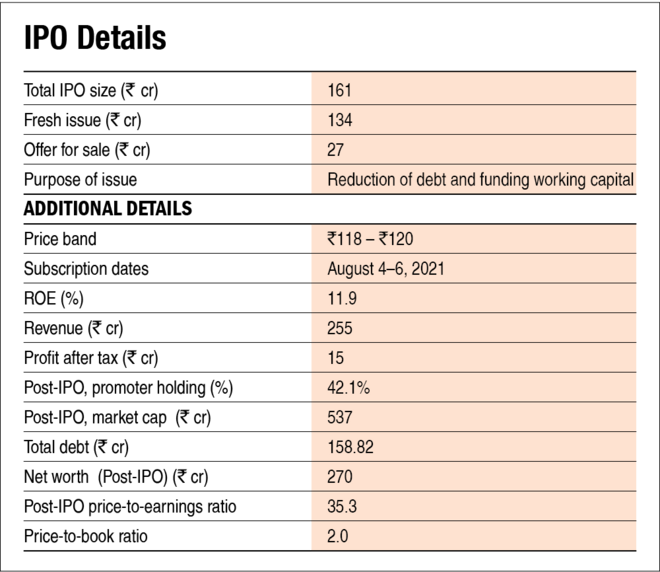

IPO questions

The company/business

1. Are the company's earnings before tax more than Rs 50 crore in the last twelve months?

No. The company's profit before tax in FY21 was 17.2 crore.

2. Will the company be able to scale up its business?

Yes, increasing demand for housing and infrastructure will generate high demand for the company product. Also, the company stands to benefit from rising exports as many countries have established anti-dumping duties towards Chinese imports. The company has been able to scale up its export at a rate of 47.9 per cent CAGR between FY19 to FY21.

3. Does the company have recognisable brand/s, truly valued by its customers?

No. Though the company markets its products under 'Exxaro' brands, it operates in a highly competitive industry dominated by large and renowned listed peers such as Kajaria and Somany.

4. Does the company have high repeat customer usage?

Yes, the company claims to have a history of high customer retention and manufacturing for some of them for more than ten years.

5. Does the company have a credible moat?

No, the company operates in a highly fragmented market with high numbers of organised and unorganised players. Also, as of FY20, the company had a market share of just 0.7 per cent.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

Yes, the company just has to adhere to standard industry and property laws.

7. Is the business of the company immune from easy replication by new players?

No, in this highly fragmented industry, new players can easily enter the market with moderate investments.

8. Is the company's product able to withstand being easily substituted or outdated?

No, the company is into the production of vitrified tiles, which can be easily substituted with other types of floor tiles and products like mosaic, granite, and marble.

9. Are the customers of the company devoid of significant bargaining power?

No, the company's buyers have plenty of other options to choose from other players and well-renowned brands in the market.

10. Are the suppliers of the company devoid of significant bargaining power?

No, the company does not have long-term agreements with its suppliers and instead relies on a spot order basis. Also, the costs of raw materials are a significant portion of its revenues at 35.4 per cent in FY21.

11. Is the level of competition the company faces relatively low?

No, the company operates in a highly fragmented industry and faces stiff competition from many other organised and unorganised players in the market.

Management

12. Do any of the founders of the company still hold at least a 5 per cent stake in the company? Or do promoters totally hold more than a 25 per cent stake in the company?

Yes, the promoters will continue to hold 42 per cent stake in the company after the IPO.

13. Do the top three managers have more than 15 years of combined leadership at the company?

Yes, the Managing Director and Wholetime Directors together have more than 15 years of leadership experience at the company.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

Yes, we have no reasons to believe otherwise.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

Yes, the company does not have any litigation to cast doubts on the intention of the management.

16. Is the company's accounting policy stable?

Yes, we have no reasons to believe otherwise.

17. Is the company free of promoter pledging of its shares?

Yes, the promoters have not pledged any part of their shareholding.

Financials

18. Did the company generate the current and three-year average return on equity of more than 15 per cent and return on capital of more than 18 per cent?

No. While the current return on equity is around 12 per cent, the three-year average return on equity has been 10.2 per cent. Similarly, while the current ROCE is 16 per cent, the three-year average ROCE was 14 per cent.

19. Was the company's operating cash flow positive during the previous three years?

Yes, the company's cash flow from operations was positive in the previous three financial years.

20. Did the company increase its revenue by 10 per cent CAGR in the last three years?

No, the company's revenue increased by only 6 per cent CAGR in the last three years.

21. Is the company's net debt-to-equity ratio less than 1 or is its interest-coverage ratio more than 2?

Yes, while the company's net debt to equity ratio is 1.2, its interest-coverage ratio was around 2.2 times as of FY21.

22. Is the company free from reliance on huge working capital for day-to-day affairs?

No, the company has a stretched working capital cycle of around 160 days in FY21, much higher than the prominent players.

23. Can the company run its business without relying on external funding in the next three years?

Yes, the company plans to repay part of its debt from the IPO proceeds, which will reduce its interest expense in the future. Also, the company has been generating positive cash flows from operations, and its capacity utilisation stands at 70 per cent, which can easily help increase its output.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

No. The company's short-term borrowings increased by 15.1 per cent CAGR during the period FY19-21.

25. Is the company free from meaningful contingent liabilities?

No. The company had contingent liabilities worth Rs 35 crore, more than twice its FY21 profit after tax.

The stock/valuations

26. Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No, the company's stock will offer an operating-earnings yield of 6 per cent on its enterprise value.

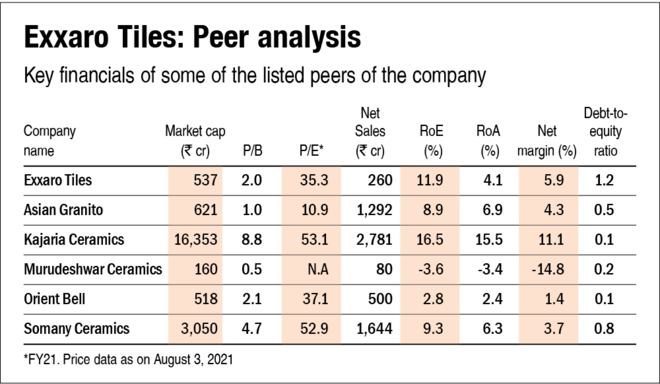

27. Is the stock's price-to-earnings less than its peers' median level?

Yes, the stock's price-to-earnings ratio of 35.3 is less than its peers' median level of 45.

28. Is the stock's price-to-book value less than its peers' average level?

Yes, the stock's price-to-book value of 2 is less than its peers' average level of 3.4.

Disclaimer: The authors may be an applicant in this Initial Public Offering.