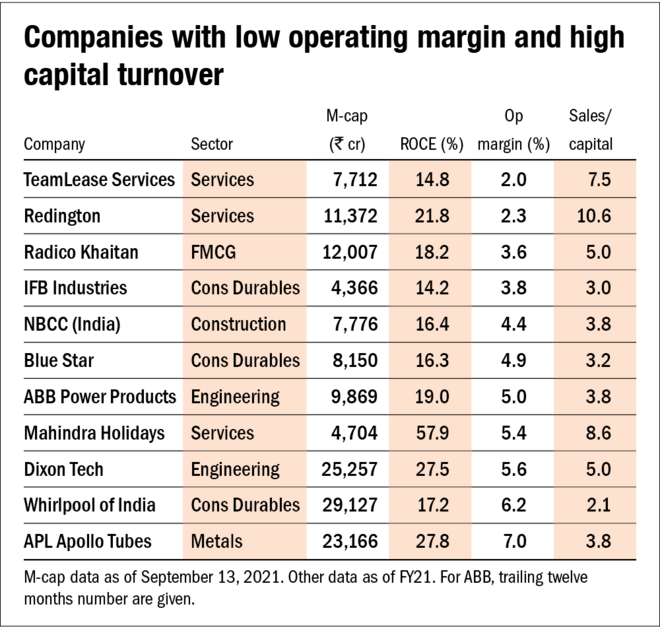

At the outset, a business that earns a low operating (earnings before interest and tax or EBIT) margin is considered bad. Well, is that always correct? Going by this yardstick, you are eliminating retail (Avenue Supermarts, Trent), staffing (SIS, TeamLease), contract manufacturers (Dixon, Amber), logistics (Blue Dart Express, VRL Logistics) players from your screener, as they fit in the category of low-margin businesses. More importantly, you are depriving yourself of the opportunity to participate in some of the best secular up-trending sectors in India. Interestingly, many of these stocks have already been multibaggers in the last few years.

So, where does the disconnect lie? Intuitively, low EBIT businesses should have less profits left over for the equity shareholders after accounting for interest and income taxes. But as we will see now, it is this low EBIT that is the most attractive feature and allows fortunes to be built. To understand how, it is useful to see the mechanics of the return on capital.

Warren Buffett said, "The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine."

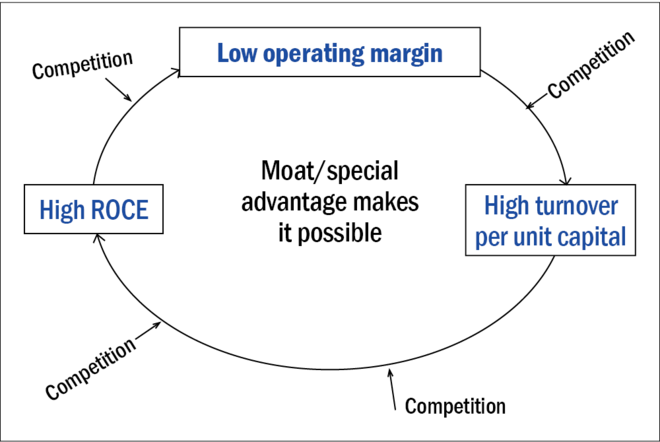

Return on capital = EBIT/capital employed

EBIT/capital employed = (EBIT/sales) x (sales/capital employed)

= Operating margin x capital turnover

Hence, even if a business earns a low return on capital, if somehow it can enhance its capital turnover (sales per unit of capital employed), it could create that phenomenon of a high return on capital and in turn emerge as a compounder.

The ability to operate at a thin margin can only be enjoyed if the company has some special advantage (moat). This edge could come from the process, technology or people. When done repeatedly, over time, this transforms into a flywheel, gathers momentum and forms a self-powered giant wheel. What follows then is above-normal profits for the successful players year-after-year and a decimated competition.

The idea then is to spot such companies which could be inherently earning low margins but possess some special advantages which are applied to increase turnover by keeping their capital requirements low. If such is the case, you have a winner!