We are fast approaching the deadline of filing the income-tax return (ITR) for the financial year 2022-23. Individuals are required to file their return latest by July 31, 2023. Here's how you can do this important task in a matter of minutes. To illustrate, let's take the case of a salaried taxpayer who also has some taxable capital gains, resulting from the sale of his investments in mutual funds.

Documents you need while filing the ITR

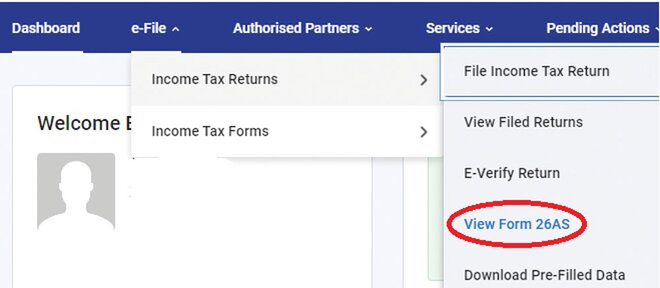

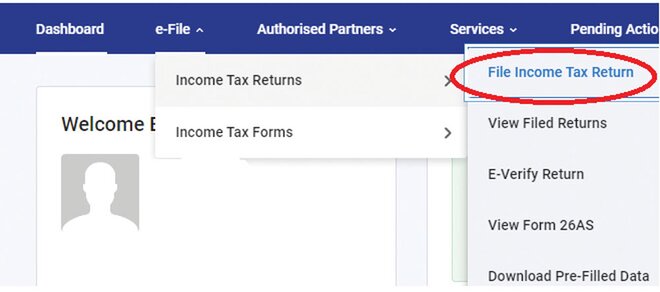

Form 26AS: This document details the tax that has already been deducted and deposited with the tax authorities on your behalf. Remember the big, fat figure under the head 'Tax Deducted at Source' (TDS) that sits on your salary slip and eats away into your salary before it hits your bank account? Well, it finds its way into the government coffers and gets accounted for on your Form 26AS. You can download it from the 'Income Tax Returns' section under the 'e-File' tab on the menu bar after logging into the new Income Tax portal.

Likewise, you can also download the Annual Information Statement (AIS) available under the 'Services' tab. It is precisely a statement of all the income and transactions reported to the income tax department against your PAN. While it is not necessary that it will have information of all the transactions, the statement can be handy to provide details for some common transactions that you may otherwise miss. For example, interest paid by bank.

Form 16: You must be familiar with this document. You get this from your employer every year and it details the tax computation on your salary and the tax deducted thereof. You may also get a separate Form 16 from your bank if your interest income exceeds Rs 40,000. The TDS amount appearing on your Form 16 should match the one mentioned in Form 26AS. Check with your employer and/or bank in case of any discrepancies.

Interest certificate: Get a statement of the interest credited to your account by your bank during the financial year. These include your savings accounts, fixed deposits, recurring deposits, etc. Those using internet banking can download it conveniently by logging into their account.

Home-loan account statement: If you have a home loan, get the interest certificate from the lender, mentioning the amount of the interest and the principal repaid during the financial year.

Capital-gain statement: If you have sold any mutual funds or stocks during the financial year, you will need a capital-gains statement. Like banks provide interest certificates, your stockbroker and the AMC would provide you with the statement of realised capital gains. For mutual funds, you can also download a consolidated statement for the transactions across fund houses serviced by CAMS from its website.

Filing your income-tax return

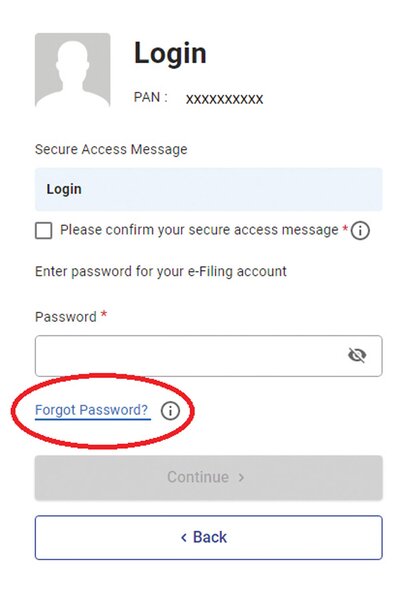

Log in: Go to the new income-tax portal, www.incometax.gov.in, and log in to your account. Your PAN would be your username. If you do not remember your password, reset it by clicking on the 'Forgot Password' tab.

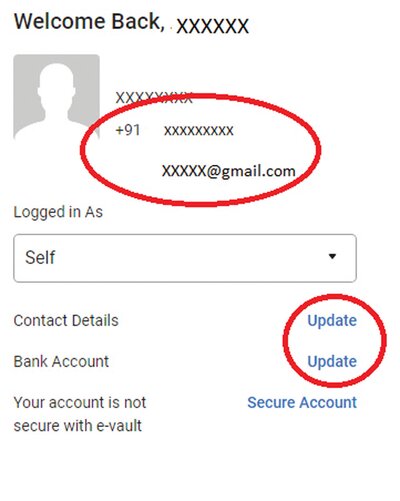

Verify bank details: Verify your contact details and bank details appearing on the left panel. Mention the details of all the bank accounts that you have. Also, pre-validate your bank details by using the link provided after adding them. If you don't pre-validate your bank details, your refund, if any, may be delayed.

Click on 'File Income Tax return' tab: Look for the 'e-File' tab in the menu bar and select 'File Income Tax return'.

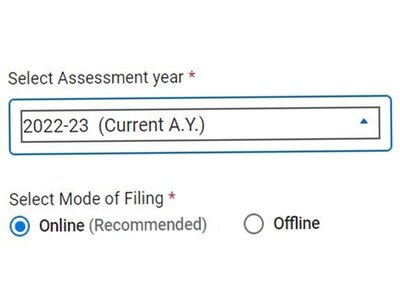

Select assessment year: Select 2023-24 as the assessment year and the online option to file your return.

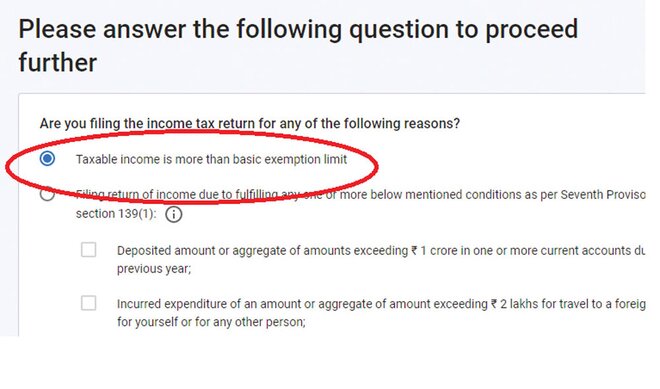

Choose the appropriate ITR form: Salaried individuals who do not have any taxable capital gains can select the form ITR-1 (a simpler two-page form), while those who also have capital gains need to opt for the form ITR-2. Select the 'Taxable income is more than basic exemption limit' option as the reason for filing the return.

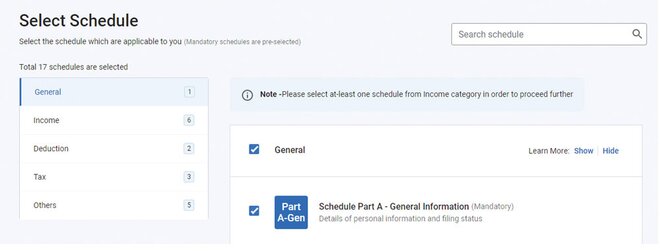

Select relevant schedules: The portal will now throw a list of numerous schedules spread across five categories (General, Income, Deductions, Tax and Others) with a description of each. Go through their descriptions and select the checkbox against the schedule that applies to you, such as Salary, Capital Gains, TDS, etc.

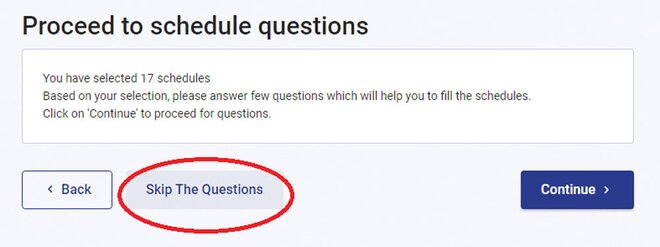

Skip the questions: The portal will now start asking questions to submit the details in relevant schedules. Skip them and all the schedules will get automatically pre-filled on the basis of the information with the Income Tax Department. The link would be on the left side at the bottom of the screen.

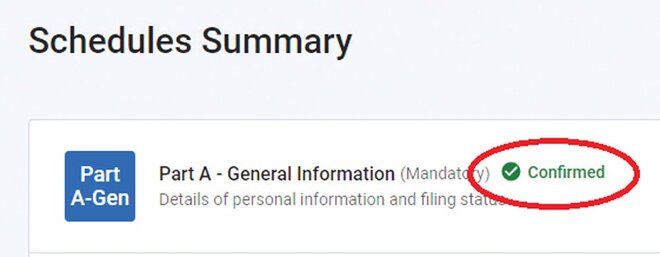

Verify the pre-filled data: Start opening the schedules one by one, compare and check the pre-filled data and make changes wherever required. Most of the required figures will be available in the documents that we have collected in the initial stage, like Form 16, etc. After putting in the required details and checking the pre-filled data, click on the 'confirm' tab. A green tick mark would appear in front of the selected schedule.

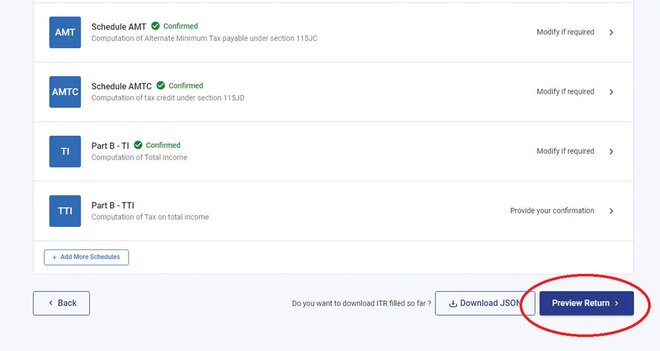

Preview your return: Here you can preview the return filed by you and make any changes wherever required.

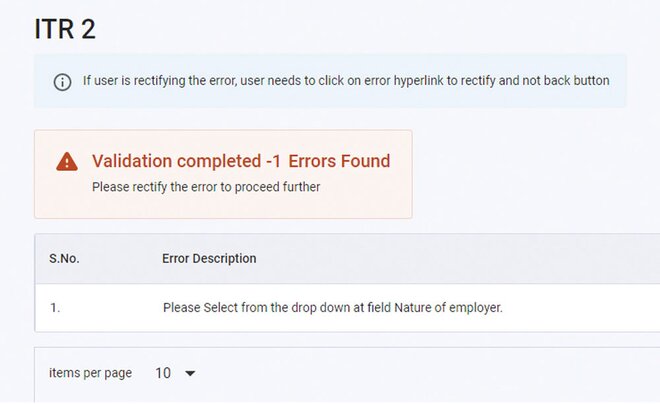

Validate: On proceeding further, the portal would validate all the details submitted by you and would automatically list down the errors, if any. Click on the errors in the list to correct them and submit your return.

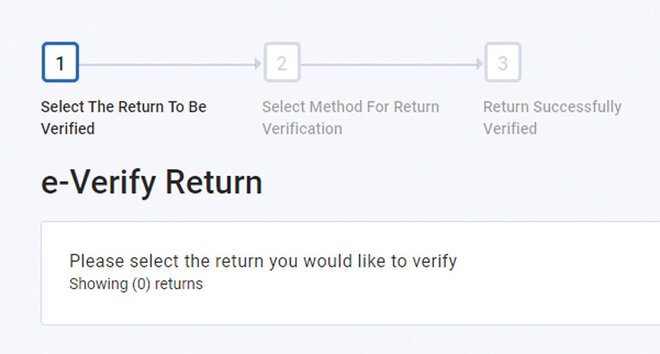

E-verify: The last step is to e-verify your return. Otherwise, it won't get processed. Although there are multiple ways to verify your return, the easiest one is by using an OTP that is sent to your mobile number linked with your Aadhaar. Select this option, submit the OTP, wait for the confirmation and you are all done!