Free-cash-flow generation, simply put, is the difference between the 'profits' of a company and 'capital investments' around working capital and capital expenditure. These are two distinct dimensions of business execution. Note, however, that this definition of free cash flows does not apply to lenders or insurers in the financial-services sector.

The ability of a company to deliver on the first dimension, which is 'profits', is determined by attributes such as its pricing power (i.e., how the firm beats its competitors to gain market share without compromising on its profits) and operating efficiencies (i.e., how the firm achieves the same revenues as its competitors but with lower expenses).

The second dimension of free-cash-flow generation is 'capital investments', which is dependent on the company's capital efficiencies (how the existing capital resources can be used more optimally to generate higher revenues and profits) and capital reinvestment (what the incremental areas of capital reinvestment are to help grow the business in the future).

The fair valuation of a company is the net present value of all its expected future cash flows. The higher the quantum, growth and longevity of these free cash flows, the greater is the fair value of the business. Hence, investment in a portfolio of high-quality stocks requires conviction in the ability of these companies to generate strong, positive, and growing free cash flows in future (because it is these cash flows which finance the growth in revenues in the years to come).

However, a simple analysis of historical free-cash-flow generation of the BSE 500 universe of stocks highlights some interesting aspects of these businesses. (Note: In our analysis, we have taken cumulative three-year free cash flows since a single year's free cash flow can be negative if a company does a large capex in a given year.)

There are 422 non-lending and non-insurance businesses in the current BSE 500 index. Since free cash flows cannot be analysed for lending and insurance businesses, we will omit them from this analysis. Of these, only 65 (i.e., a mere 15 per cent) delivered positive free cash flows consistently on a three-year rolling basis, over the past 20 years. Remarkably, even on a 20-year cumulative basis, there are 89 companies that have generated negative free cash flows.

Lack of positive free-cash-flow generation is not always a sign of weakness though. During the early stages of a business' evolution, there is bound to be more capital investments compared to operating profits since the company might be aggressively investing in building capacities and capabilities.

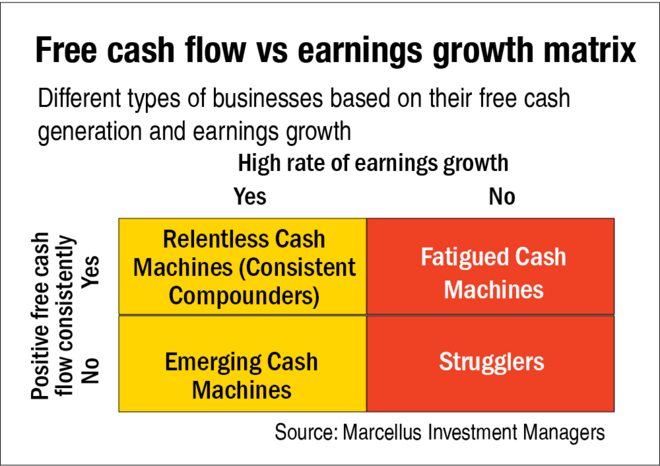

Similarly, consistent positive free cash flows are also not always a sign of significant strength. If a business has strong-enough pricing power to generate profits but cannot find avenues for capital redeployment, then the absence of capex will lead to positive free cash flows. However, such a business might not be able to grow over time. Figure 'Free cash flow vs earnings growth matrix' shows a 2 × 2 matrix categorising different types of businesses based on their free cash generation and earnings growth.

Read the subsequent parts of this series for detail on each of these types.