Anil (47) has recently sold his ancestral property worth Rs 1.45 crore. He plans to earmark this amount for his retirement, as he couldn't save much for it. According to one of his friends who is an accountant, taxable long-term capital gains of the property sold amount to Rs 26 lakh. So, he advised Anil to invest in capital-gain bonds. It will make the gains on selling his property completely tax-free under the Section 54EC of the Income Tax Act. Anil is seeking our advice about whether this would be the right step. Also, he wants to know where he should invest the remaining money.

WHAT ARE CAPITAL-GAIN BONDS?

- The profit on selling an immovable property held for more than two years is taxable as long-term capital gains at the rate of 20 per cent.

- The income-tax law allows adjusting the purchase price for inflation, brokerage paid to the mediator and any other expenses related to the transaction. But one can't save tax by investing in regular products like Public Provident Fund, tax-saving funds, life or health insurance premium and so on.

- Section 54EC of the Income Tax Act allows a deduction of up to Rs 50 lakh from the profit if it is invested in capital-gain bonds within six months from the day you sell your property.

- These bonds are fixed-income instruments issued by infrastructure companies, which are backed by the Government of India. Currently, they are issued by Rural Electrification Corporation (REC), Power Finance Corporation (PFC) and the National Highways Authority of India (NHAI).

- Capital-gain bonds have a lock-in period of five years and offer annual interest of 5 per cent. The interest income is added to the taxable income and taxed as per the applicable slab.

AN ALTERNATIVE STRATEGY

- Anil falls in the tax bracket of 30 per cent and therefore, about one-third of the interest that he earns on capital-gain bonds would be used to pay taxes. The post-tax return would be only 3.5 per cent.

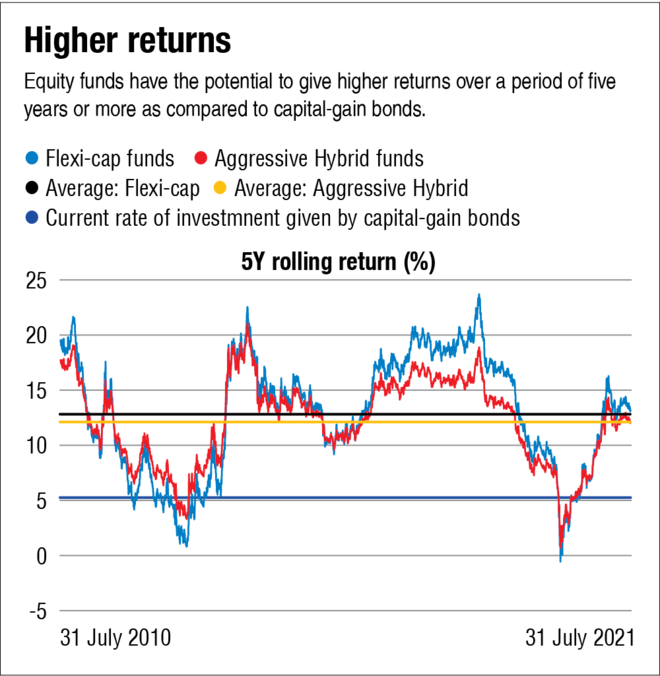

- He should instead consider investing in equity mutual funds after paying the applicable capital-gain tax, as he plans to retire after eight to 10 years. Equity funds have the potential to give a much higher return over a period of five years or more and would even recover the capital-gains tax that he needs to pay right now. The average five year category return of aggressive hybrid funds rolled on a daily basis over the last 10 years is close to 12 per cent. In the case of flexi-cap funds, it is 13 per cent.

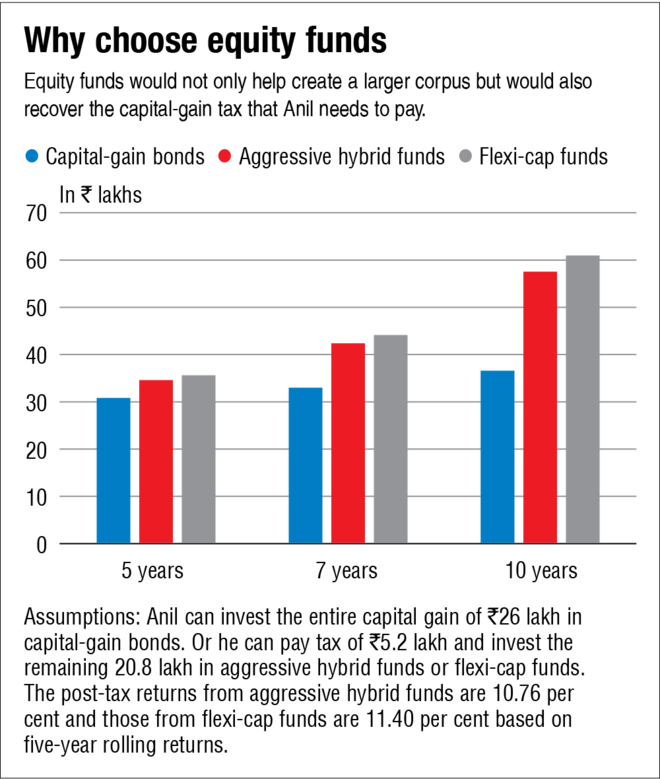

- Given the 10 per cent long-term capital-gain tax on equity, the post-tax average of five-year category return works out to be 10.76 for aggressive hybrid funds and 11.40 per cent for flexi-cap funds. But gains on mutual funds are taxable only when they are realised. So, Anil will also be able to defer the tax on the returns until he redeems them. On the other hand, in the case of capital-gain bonds, one needs to pay tax every year on the interest income. This will help him earn at least 12 per cent more over the next five years even after paying the capital-gain tax of Rs 5.2 lakh right now.

- Further, he can opt for the direct plan of mutual funds, which have a lower expense ratio. This will automatically increase his return by about 50 basis points to 1 per cent point. Staying invested for a longer time, say seven to 10 years, will further help him reap the benefits of compounding.

WHICH FUNDS TO INVEST IN?

- Anil can choose to invest in aggressive hybrid funds, as they invest 65-80 per cent of the portfolio in equity and the remaining in fixed income. The allocation to fixed income provides a cushion during severe market crashes without compromising on long-term returns. However, if Anil has prior experience of investing in equity and he does not get anxious with the market's ups and downs, he can choose to invest in three-four flexi-cap funds to earn higher returns. But they will be more volatile.

- Further, he should not invest the money at one go. It should be spread over 36 months to avoid entering the market at the wrong level and average the cost of purchase. Likewise, he should start moving towards a fixed-income avenue two to three years before his retirement.

- Even after retirement, at least a third of the portfolio should be maintained in equity for inflation adjusted income. Also, the annual withdrawals should not exceed 4-5 per cent of the total corpus so that he can avoid any financial crisis during the later years of retirement.

DO NOT FORGET

- Have a contingency fund equivalent to at least six months' expenses in a combination of a sweep-in deposit and a liquid fund.

- Buy a pure term plan for life cover. You need life insurance only if you have financial dependents and the worth of your financial assets is not enough to meet their expenses in your absence.

- An adequate health insurance cover for all the members of the family is a must.