In the first part of this series, we studied the importance of free cash flows and how we can classify businesses on the basis of the strength of free cash generation and earnings growth. Let's now see the two most rewarding types of businesses based on these criteria:

Relentless Cash Machines: High earnings growth and consistently positive free cash flows

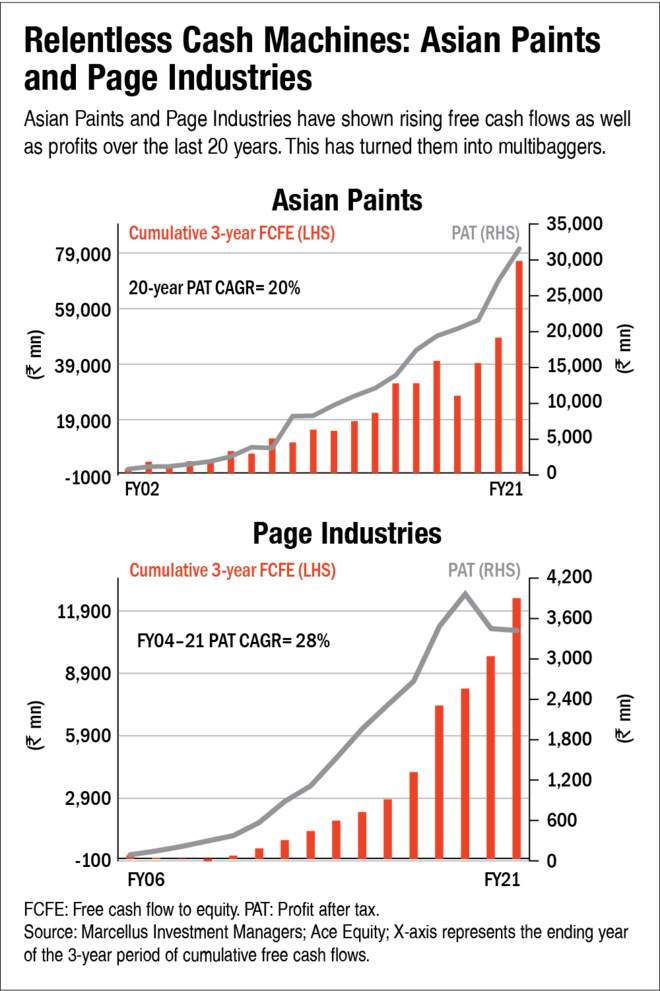

These companies sustain high pricing power (and hence high ROCEs) over long periods of time. They also redeploy large parts (typically 40-70 per cent) of their surplus capital back into their business to help grow revenues, profits and free cash flows. Thanks to scale efficiencies and high ROCEs, operating profits of these companies are higher than the amount of capital they need to redeploy into the business to generate growth. Since these companies are already generating healthy and positive free cash flows, their share prices are more aligned to their free cash flows rather than to their profits (although for many such companies, profits and free cash flows might grow at the same pace). Their free cash flows and hence share prices exhibit a high rate of compounding with low volatility. The fair valuation of these companies is largely dependent on the longevity of strong free-cash-flow compounding. These companies are a very small minority of the listed universe. Asian Paints and Page Industries are good examples of such companies (see chart 'Relentless Cash Machines: Asian Paints and Page Industries').

Emerging Cash Machines: High earnings growth but inconsistent free cash flows:

These companies typically are relatively early in their business evolution cycle (i.e., they are younger businesses than the Relentless Cash Machines) and perhaps also smaller in size. Their capex investments are significant, compared to their profits and they might not have yet achieved significant economies of scale. If these companies generate high ROCEs and have tangible high pricing power even as they scale up, they are likely to transition into Relentless Cash Machines in future. For an investor in these companies, free-cash-flow forecasting and hence valuations need to factor in: (a) conviction on when they will start generating consistently positive free cash flows; and (b) quantum and longevity of free-cash-flow generation in future. These companies are also a small minority of the listed universe; most of them belong to the small/mid-cap segment rather than the large-cap segment. For instance, Relaxo Footwears was an Emerging Cash Machine until a decade ago (and has been a Relentless Cash Machine over the last decade). See the chart 'From an Emerging Cash Machine to a Relentless one: Relaxo'.

Also in this series: