In the first part of this series, we saw how businesses can be classified on the basis of the strength of free cash generation and earnings growth. We also saw the most rewarding types of companies in the second part. Let's now study the least rewarding types of companies based on this criterion.

Fatigued Cash Machines: Weak earnings growth despite consistently positive free cash flows Although these companies are profitable in their core business (many of them will have high ROCEs as well), they cannot find enough avenues for capital redeployment to grow their businesses. Their free cash flows are strong and positive due to low rates of capital redeployment. Some of these companies might have once belonged to the category of Relentless Cash Machines but subsequently faced saturation in their core businesses.

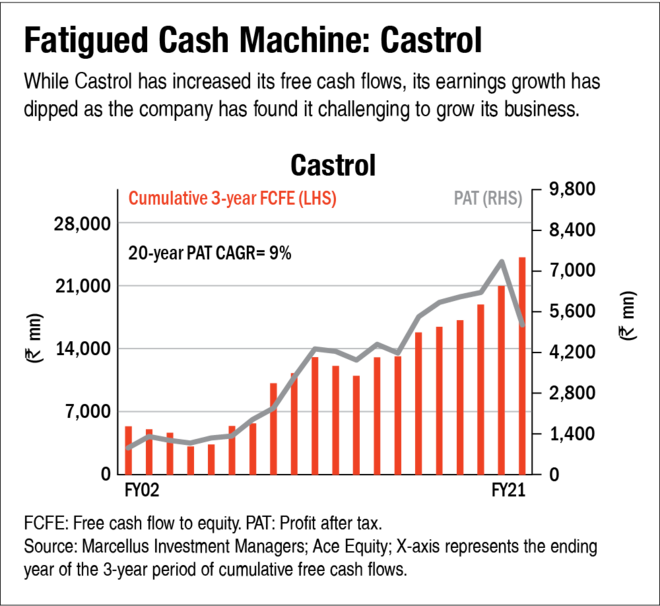

It is worth noting that as a Relentless Cash Machine transitions into a Fatigued Cash Machine, its free cash flows might continue to grow at a healthy pace, temporarily though, because of a sharp drop in capital reinvestment rates. Many such companies are part of the large-cap universe of listed equities in India. For investors, it is important to recognise the lethargy or fatigue in these companies in order to avoid being attracted by their free cash generation or to avoid being attracted by their glorious past. We have often seen investors dilute the quality of their equity portfolio by failing to exit from a company which used to be a Relentless Cash Machine but has now become more like a Fatigued Cash Machine. Castrol is an example of such companies which are highly cash-generative but with very low capital reinvestment rates and hence relatively weak earnings growth (see the chart 'Fatigued Cash Machine: Castrol')

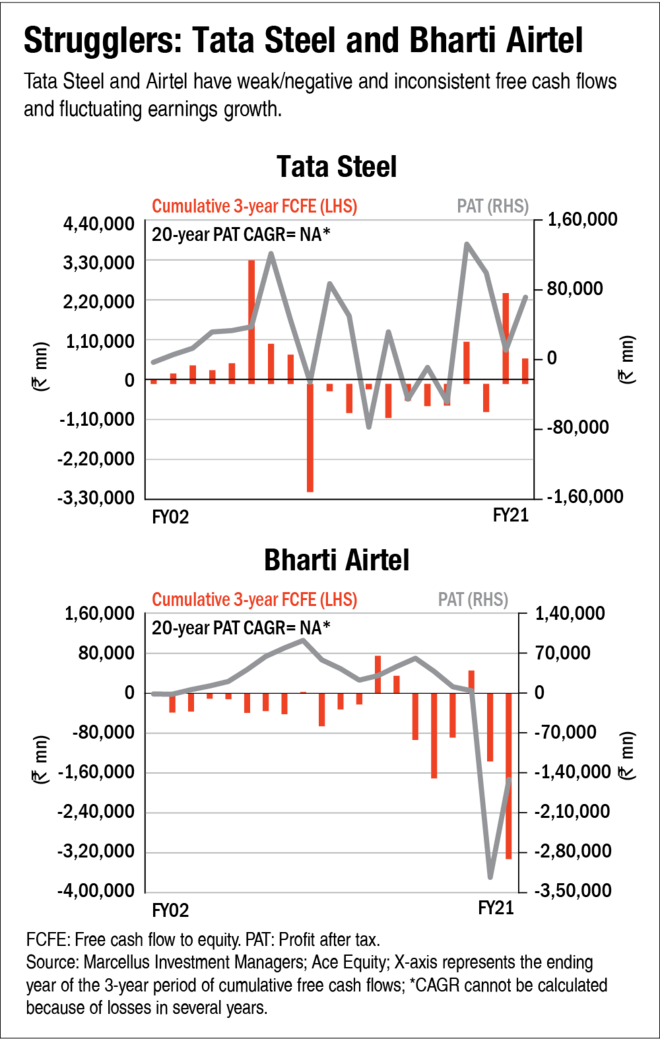

Strugglers: Weak earnings growth and negative or zero free cash flows These companies form the largest part of the Indian stock market. Their low pricing power results in weak earnings compounding over time. Their capital misallocation results in poor ROCEs on incremental capital deployed, which in turn ensures weak/negative and inconsistent free cash flows. These companies can generate wealth compounding for investors only if the investor correctly times the entry and exit from their stock over relatively short holding periods. Investing in these companies is exciting, given the risks around their fundamentals at any point of time. However, investing in these companies can be damaging to an investor's wealth if the investor is not an expert at playing these timing-related risks well enough. These companies are part of all segments (large/mid/small cap) of the stock market. Historical fundamentals of firms like Tata Steel and Bharti Airtel are representative of this category (see the chart 'Strugglers: Tata Steel and Bharti Airtel).

Also in this series:

The power of free cash flows: Types of businesses

The power of free cash flows: Relentless & Emerging Cash Machines