In the first part of this series, we saw how businesses can be classified on the basis of the strength of free cash generation and earnings growth. We also saw the most rewarding types of companies in the second part. Then in the third part, we studied businesses that have failed to grow their earnings despite generating free cash flows and those that generated neither free cash flows nor earnings growth.

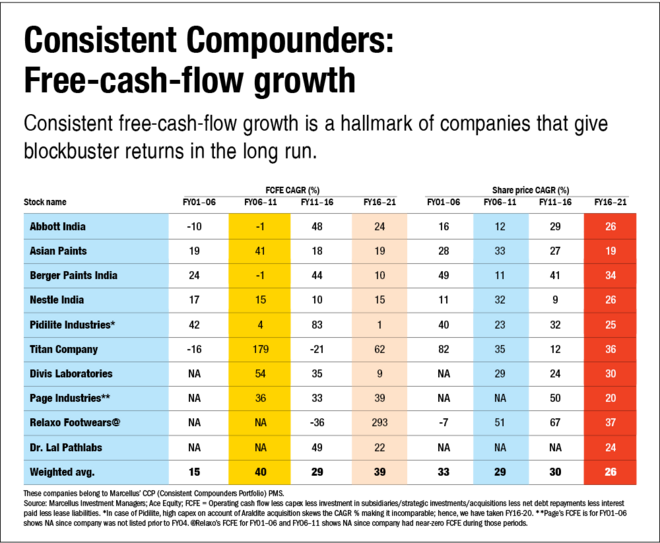

The table 'Free-cash-flow growth of Marcellus' CCP PMS companies' shows the compounding of free cash flows of the non-financial-services companies in Marcellus' Consistent Compounders Portfolio (CCP) and how that compares against their historical share-price performance.

The following are the key conclusions from it:

1. Free-cash-flow compounding of these stocks has been healthy and consistent at around 25 per cent CAGR over the past 20 years. The share prices of these companies have moved in sync with their free cash flows, compounding over the entirety of the last 20 years, including the last five years.

2. The compounding rate of free cash flows has accelerated over time, with the more recent five-year and 10-year periods exhibiting faster rates of compounding vs the preceding periods. This has been contrary to the notion that the growth of historically successful companies should moderate as they grow bigger and more dominant in their industries. The acceleration in growth is reflective of the use of technology by our portfolio companies to compress their working-capital cycles, increase their asset turnovers and strengthen their competitive advantage through tech investments over the last five and 10 years.

3. Over the last five years, the healthy growth in free cash flows has come despite several disruptive events like demonetisation, GST introduction, the IL&FS/DHFL financial crisis and now COVID. Although these disruptive events have adversely affected the fundamentals of the industries within which our portfolio companies operate, the CCP companies have benefited from the challenges faced by their competitors. Furthermore, these events have given the CCP companies opportunities to disrupt and evolve their business models to deepen their competitive advantages.

Note: Abbott India, Asian Paints, Berger Paints, Nestle India, Pidilite, Titan, Divis Labs, Page Industries, Relaxo Footwears, HDFC Life and Dr Lal Pathlabs are part of many of Marcellus' portfolios.

Also in this series:

The power of free cash flows: Types of businesses

The power of free cash flows: Relentless & Emerging Cash Machines

The power of free cash flows: Fatigued Cash Machines & Strugglers