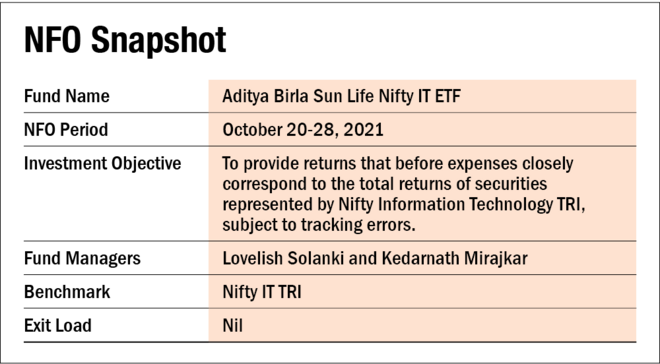

Aditya Birla Sun Life Mutual Fund has rolled out a new fund offer (NFO) that will provide exposure to the information technology (IT) sector in an ETF (exchange-traded fund) format. It will close for subscription on October 28, after which it can be purchased and sold on the stock exchanges. The fund aims to provide returns that closely correspond to the total return of the Nifty India IT Index, subject to tracking errors. The scheme will be managed by Lovelish Solanki and Kedarnath Mirajkar.

The AMC believes that India is booming as an internet economy, and the Government too is focused on IT growth. This has resulted in various services like delivery and location services, social media, and e-commerce becoming part of the digital growth story. Further, the burgeoning IT sector, supported by a conducive growth environment, is poised to achieve new highs and milestones.

About the strategy

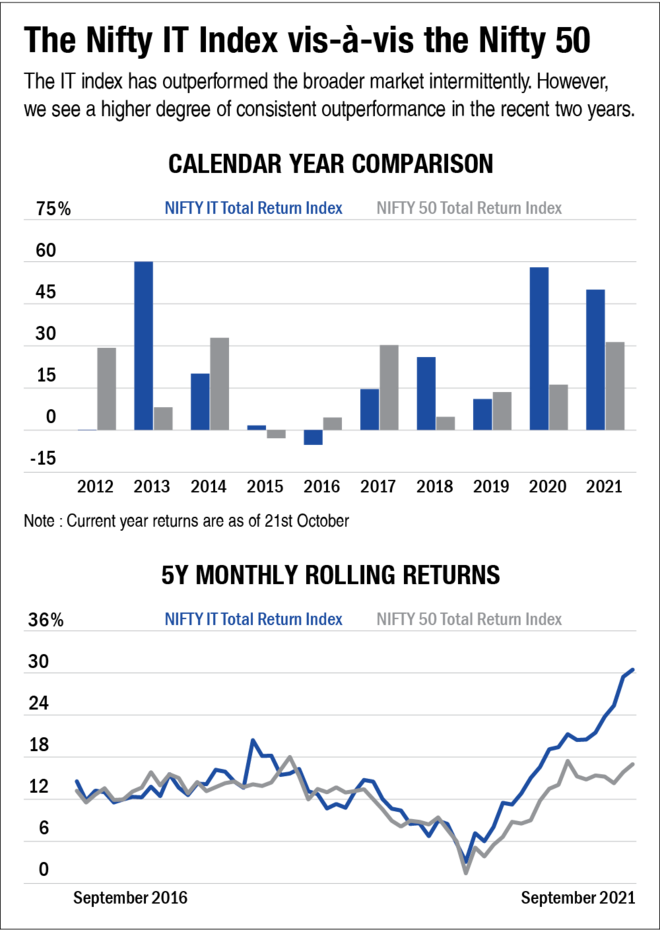

The NIFTY IT Index enlists the top 10 IT companies based on the market cap from expanding IT sub-sectors such as IT services, cloud computing, enterprise software, BPM, IT hardware, etc. To see how the index has done on the performance front relative to the broader market, we compared the NIFTY IT TRI with that of the NIFTY 50 TRI (see the chart 'The Nifty IT Index vis-à-vis the Nifty 50').

A look at the calendar year returns over the last decade shows that the technology index has outperformed the broader market intermittently five out of 10 times. However, the sector has seen quite a run-up in recent times. This reflects even in its long-term performance (based on five-year rolling returns). The pandemic circumstances seemed to have helped the IT sector rally. But all these are historical trends, and one cannot extrapolate them to predict the future.

In terms of market-cap exposure, the index is primarily large-cap. As on September 30, 2021, the top constituents in the index are Infosys Ltd and Tata Consultancy Services Ltd with about 26 per cent weightage each, about 9 per cent each in HCL Technologies Ltd, Wipro Ltd, and Tech Mahindra Ltd.

We at Value Research believe that sectoral funds are best avoided, given their volatile nature. Investors should instead look at diversified equity funds that have allocation across different sectors. For instance, as on September 30, 2021, the flexi-cap funds have about 14 per cent allocation to the technology sector on average.

Having said that, investors having a conviction on any particular sector can look to have a small allocation of the same in their portfolio.

Technology-focused funds

At present, there are 10 technology-oriented funds with a collective AUM of about Rs 20,000 crore spread across eight AMCs. Of them, five are passively managed, with three being relatively new launches. ICICI Prudential and Nippon offer the two ETFs that have a reasonable history.

Given the large-cap composition of the index, replicability doesn't seem to pose any significant challenge. To get some further validation, we compared the average tracking error of IT-focused ETFs of Nippon and ICICI with that of other ETFs tracking the Nifty 50 TRI (a much broad-based index). With an average tracking error of 0.10 per cent in one year, the tracking error of these two IT ETFs seems relatively comparable with the average tracking error of 0.08 per cent of other ETFs that track the Nifty 50 TRI. This suggests that replicability doesn't seem to be an issue.

About the AMC

With over Rs 95,000 crore equity assets spread across 23 actively managed funds, ABSL AMC ranks fifth. The AMC's passive equity basket (index funds and ETFs) has an AUM of about Rs 1,160 crore, ranking it tenth among the 25 AMCs with a passive equity bouquet. This suggests that when it comes to the passive line-up of the AMC, it is a far cry from the kind of money it manages in the active space.

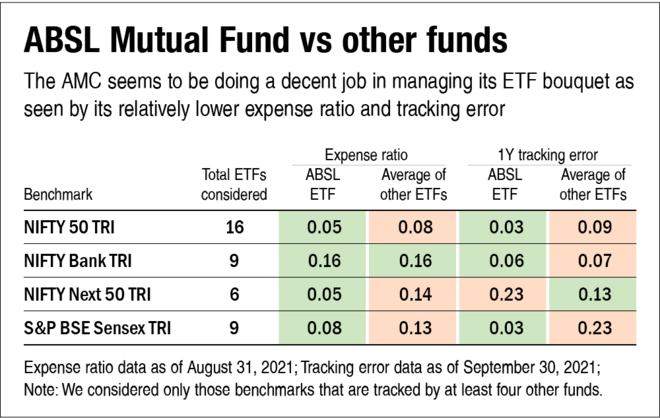

The AMC has four ETFs in its equity ETF product suite. The two most important metrics of managing passive funds are expense ratio and tracking error. And it seems ABSL AMC seems to be doing a decent job on both fronts vis-à-vis other funds tracking the same index (see the below table).