The ETF popularity has been surging in India. While the majority of ETF investments in India are still routed through the institutional path, retail investors have also started taking an interest in these passive investment avenues. This is because over the past few years, actively managed funds have been struggling to beat their benchmark and investors have to pay higher fund-management fees for these funds. So, investors are finding the simplicity and low-cost advantage of ETFs quite appealing.

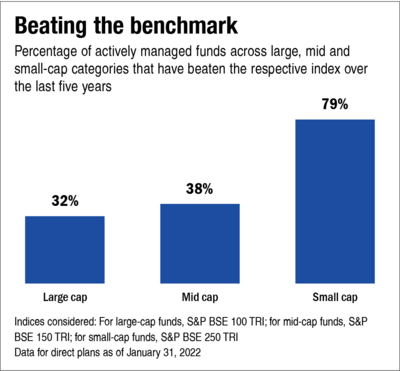

So, in this active-passive debate, are ETFs really better? The answer is not as straightforward as it seems to be. While it's true that active funds have higher costs, their history of generating outperformance over the benchmarks can't be entirely overlooked, especially in the mid- and small-cap segments.

The answer to the active-passive question actually doesn't lie on the extremes but somewhere in the middle. So, both active funds and ETFs have a role to play in your portfolio, depending on what your requirements are. Here are a few ways in which you can allocate assets between the two.

Allocation to the efficient market segment

An efficient market segment, such as large caps, is one where it's very difficult to beat the benchmark by stock selection. Hence, it's better to own the index itself through the ETF and save on costs. However, in the mid- and small-cap segments, it's still sensible to go with a good actively managed fund, given the ample scope of generating outperformance. See the chart titled 'Beating the benchmark.

Tactical allocation

If the core of your portfolio is made of actively managed funds, ETFs could be a good way to achieve tactical allocation in your portfolio, for example, to select thematic, sectoral and international funds. The reverse of this is also possible. If you are using broad-based ETFs as part of your core portfolio, then you can look to invest in a few actively managed funds in order to generate outperformance.

Exposure to smart-beta products

While a majority of ETFs currently available track broad-based indices, fund companies have started coming in with smart-beta ETFs, such as value ETFs, equal-weight ETFs, etc. These are based on some predetermined formula and lie between active and passive variants. Through ETFs, you can also take exposure to such innovative products to add colour to your portfolio.

Thus, as we can observe, it's not about whether you should go with active funds or passive ETFs. It's actually about your own requirements. You will need to assess which types of funds best fit your needs and then accordingly invest in them.

Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully.

All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (RMF).

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Center section available on the website of Mirae Asset Mutual Fund.