Sapphire Foods is another franchisee of the globally reputed fast-food company Yum! Brands that has come up for listing. Earlier in the year, we had Devyani International, also a franchisee of Yum! Brands. The company is among the largest operators of quick-service restaurants (QSR) in India and is also Sri Lanka's largest international QSR chain operator in terms of revenue and number of restaurants, as of March 31, 2021. It also has a small presence in the Maldives.

The company primarily operates three international brands:

KFC: A global restaurant brand focussed on selling fried chicken with over 25,000 outlets in over 140 countries. Sapphire Foods operates 209 KFC stores in India and the Maldives, as of June 30, 2021.

Pizza Hut: One of the largest pizza chains in the world with over 17,000 restaurants. Sapphire Foods operates 239 Pizza Hut stores in India, Sri Lanka and the Maldives.

Taco Bell: It is the world's largest Mexican-inspired restaurant chain in terms of store count. The company operates 2 stores in Sri Lanka, as of June 30, 2021.

All combined, the company operates 482 stores in India, Sri Lanka and the Maldives, as of September 30, 2021.

Strengths

- The company operates in an industry that has witnessed rapid growth and is expected to maintain momentum in the future as well. As per the report commissioned by Technopak, the QSR chain segment will continue to lead the foodservice sector, and the sales value of the QSR channel is expected to grow at a CAGR of 23 per cent from FY20 to FY25.

- Yum! Brands provides the company with the flexibility to operate and manage its in-house supply chain and have direct relationships with vendor partners. Sapphire Foods also benefits from its 'One System' commercial negotiations where it negotiates with its suppliers, jointly with Yum! Brands and its other franchisees in India.

- The company adopts an omnichannel strategy of utilising its brick-and-mortar restaurants and digital stores across various revenue channels of dine-in, take-away, own delivery and aggregator delivery services. In FY21, the company derived 31.2 per cent, 26.9 per cent and 41.9 per cent of its restaurant sales from dine-in, take-away and delivery services, respectively. This helps reduce the dependency on the dine-in format in current times.

Risks

- The company has a history of incurring losses, which can continue to run in the future. The company has a very high level of attrition which stood at 80.8 per cent in FY21.

- If the company fails to meet its annual targets for opening new stores under the KFC or Pizza Hut Development Agreement with Yum! Brands, the company may be penalised in the form of loss of incentives such as waivers of the initial fees and marketing expenses.

- The QSR chain segment of the food services industry is very competitive. Sapphire Foods competes with not only international QSR chains operating in India but also local restaurants and restaurant chains. Brands in the casual dining restaurant and fast dining restaurant segments are also venturing into the QSR space.

IPO questions

The company/business

1. Are the company's earnings before tax more than Rs 50 crore in the last 12 months?

No, the company has reported a loss of Rs 100 crore in FY21.

2. Will the company be able to scale up its business?

Yes, the company has been expanding its stores at a CAGR of 7.8 per cent from 376 stores in FY19 to 437 stores in FY21 and plans to increase its store network following its omnichannel strategy and by optimising restaurant size.

3. Does the company have recognisable brand/s, truly valued by its customers?

Yes, the company operates a franchisee chain of globally renowned brands such as KFC, Pizza Hut, and Taco Bell.

4. Does the company have high repeat customer usage?

No. Though FY20 and FY21 have been exceptional years due to the pandemic, the company's stores have historically witnessed very low same-store sales growth compared to its peers.

5. Does the company have a credible moat?

No, the company faces stiff competition in the industry from both international QSR as well local restaurant chains.

6. Is the company sufficiently robust to major regulatory or geopolitical risks?

Yes, the company is sufficiently robust to major regulatory and geopolitical risks.

7. Is the business of the company immune to easy replication by new players?

No, there are companies in the casual dining segment that are moving into the QSR space. Moreover, the increasing popularity and lower capital expenditure requirement of cloud kitchens also make them a competitor.

8. Is the company's product able to withstand being easily substituted or outdated?

No, the company operates in the food and beverage industry, which is highly competitive, and products can be easily substituted.

9. Are the customers of the company devoid of significant bargaining power?

No, the company operates in a highly competitive industry, and customers of the company have many options to choose from.

10. Are the suppliers of the company devoid of significant bargaining power?

Yes, the company sources its raw materials from vendors that are pre-approved by the franchisor and meet international safety and quality standards.

11. Is the level of competition the company faces relatively low?

No, the company operates in a highly competitive foodservice industry with a lot of players.

Management

12. Do any of the founders of the company still hold at least a 5 per cent stake in the company? Or do promoters totally hold more than 25 per cent stake in the company?

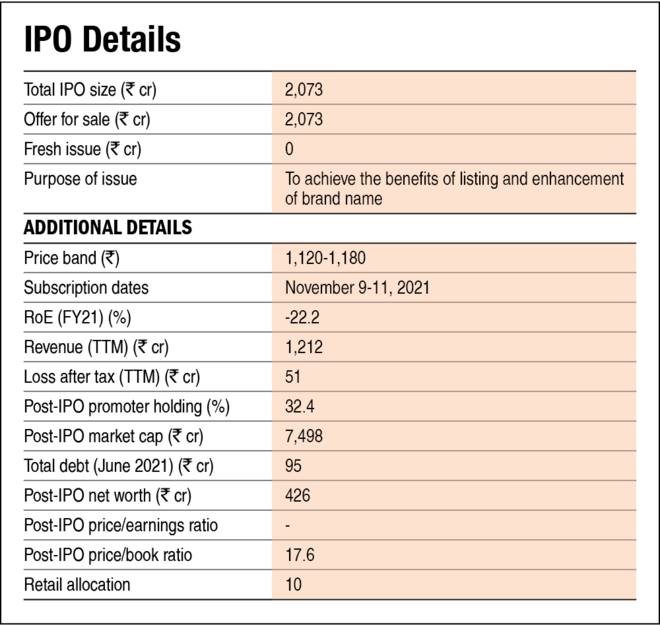

Yes, the company's promoters will continue to hold a 32.4 per cent stake in the company post-IPO.

13. Do the top three managers have more than 15 years of combined leadership at the company?

No. As the company has been operating in the QSR business since 2015 only, the senior management has been with the company for less than 15 years.

14. Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

Yes, we have no reasons to believe otherwise.

15. Is the company free of litigation in court or with the regulator that casts doubts on the intention of the management?

Yes, while there are litigations regarding food safety, none of them seems to cast doubts on the intention of the management.

16. Is the company's accounting policy stable?

Yes, we have no reasons to believe otherwise.

17. Is the company free of promoter pledging of its shares?

Yes, the promoters' shares are free of any pledging.

Financials

18. Did the company generate the current and three-year average return on equity of more than 15 per cent and return on capital of more than 18 per cent?

No, the company has been reporting losses in the last three years.

19. Was the company's operating cash flow positive during the previous three years?

Yes, the company reported positive cash flow from operations in the last three years.

20. Did the company increase its revenue by 10 per cent CAGR in the last three years?

No, the company's revenue fell from Rs 1,194 crore in FY19 to Rs 1,020 crore in FY21.

21. Is the company's net debt-to-equity ratio less than one or is its interest-coverage ratio more than two?

Yes, the company had a debt-to-equity ratio of 0.2 and a negative interest coverage ratio in FY21.

22. Is the company free from reliance on huge working capital for day-to-day affairs?

Yes, the company has a negative working capital cycle of 31 days, wherein it receives payment well before it has to pay to its suppliers.

23. Can the company run its business without relying on external funding in the next three years?

No, the company has been reporting losses. Thus, the company might have to rely on external funding in the future to open new stores.

24. Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

Yes, the company's short-term borrowings have decreased from Rs 31 crore in FY19 to Rs 27 crore in FY21.

25. Is the company free from meaningful contingent liabilities?

Yes, the company's contingent liabilities stood at Rs 24.3 crore, less than 6 per cent of its equity.

The stock/valuations

26. Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No, the stock will offer a yield of 2.4 per cent post-IPO based on a TTM basis.

27. Is the stock's price-to-earnings less than its peers' median level?

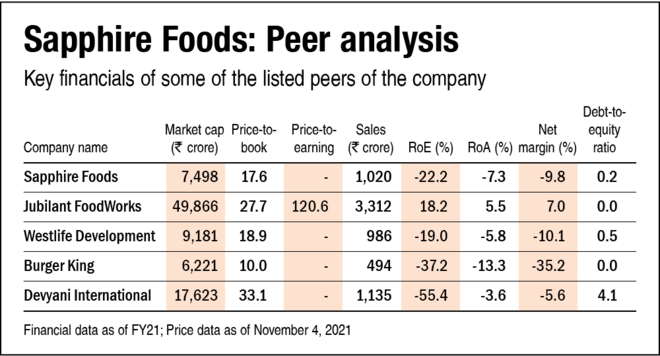

Not applicable. Since the company is loss-making, the P/E ratio is not applicable.

28. Is the stock's price-to-book value less than its peers' average level?

Yes, the company's P/B ratio will be 17.6, which is less than its peers' average level of 22.4.

Disclaimer: The author may be an applicant in this Initial Public Offering.