The Indian stock market is having a dream run right now with Sensex gaining 26 per cent from January 2021 and 114 per cent from the March lows. So, it is not a surprise that promoters were excited to take their company public through an IPO at a time when the market was enthusiastic. Dalal Street has witnessed 49 main-board IPOs so far; this number would become 50 once the IPO for Tarsons Products opens. This has also been a great opportunity for the Indian startup unicorns to introduce themselves to the public. Companies like Zomato, Paytm, Nykaa, and Policybazaar have raised more than a combined total of Rs 38,000 crore, which is 38 per cent of all the issues.

In our previous article where we discussed about India's biggest IPOs in the last decade, we saw that 72 per cent of the money raised were offers-for-sale (OFS). This made us curious about the recent IPOs that we have been witnessing during this year. Is bull-run once again seen as an exit opportunity? Is the money being raised for the company or for the promoters?

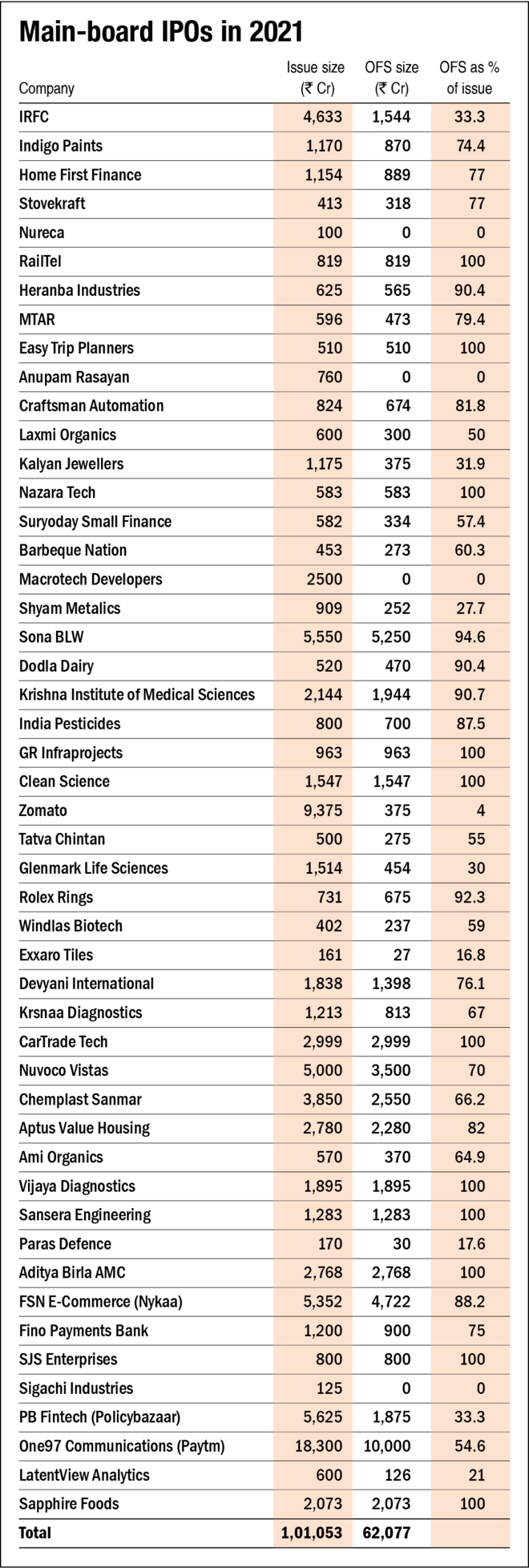

Out of the total Rs 1,01,053 crore raised from IPOs in 2021, around Rs 62,077 crore is just OFS. This is a whopping 61.4 per cent that goes into the pockets of promoters and other shareholders. Out of the 49 IPOs that have come so far, 31 of them have more than 60 per cent OFS out of the total issue, 26 of them have more than 70 per cent OFS out of the total issue, and 11 of them are complete OFS.

As much as we love seeing various companies and young startups getting listed and opening up an opportunity for the public to invest, it is also important for the promoters to not see this enthusiasm as nothing but an exit opportunity. With more IPOs lined up, this number may only increase, but investors must be wary of where the money is actually going.

Read our article on India's biggest IPOs, where are they now?

Also, read our analysis on the recent IPOs:

One97 Communications (Paytm) IPO: Information analysis