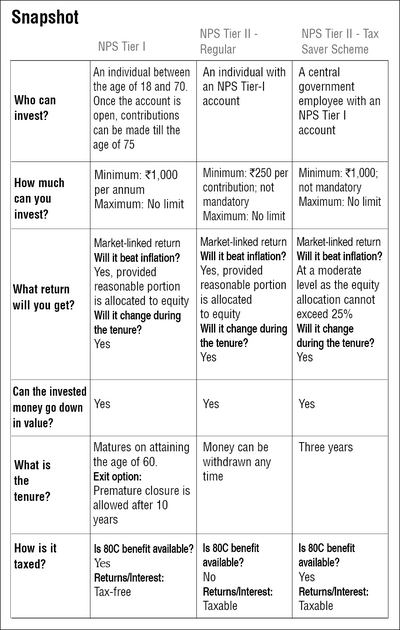

The National Pension System is an initiative of the government to extend pension benefits to all Indian citizens. It is mandatory for central-government employees and the employees of some state governments to invest in the NPS. As per the earlier government directive, private-sector employees were proposed to be given a choice between the Employees' Provident Fund Organisation (EPFO) and the NPS which was later withdrawn. The employee contribution is generally 10 per cent of the basic salary and DA, with a matching contribution made by the employer. For central-government employees, the contribution by the government has been raised to 14 per cent. You can open two types of account under NPS - Tier I and Tier II. Now there is an additional account called Tier II - Tax Saver Scheme (NPS - TTS) available only for central- government employees.

Features of NPS

1) Eligibility

- Any citizen of India, whether resident or non-resident.

2) Entry age

- Between 18 and 65 years on the date of application.

3) Minimum investment

- Initial contribution, along with the subscription application, is Rs 500 for the Tier I account and Rs 1,000 for the Tier II account (both regular and TTS).

- Minimum amount to be deposited annually in the Tier 1 account is Rs 1,000. There is no annual minimum for the Tier II account (both regular and TTS).

4) Interest

- Not guaranteed

5) Account-holding categories

- Individual

- A non-resident Indian can join if he is KYC compliant and between age 18 and 70 years.

6) Nomination

- Facility is available

Investment objective and risks

The main objective of the National Pension System is to instil the discipline to save and invest in an old-age pension. The NPS is a defined-contribution scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA), where the investment is to be maintained until retirement. On retirement, a part of the corpus is allowed to be withdrawn as a lump sum and the balance is mandatorily paid out as a pension annuity.

Suitability and alternatives

- Suitable for conservative investors seeking to build their retirement corpus and tax exemption under Section 80CCD.

- Not suitable for investors who can assume more risk by investing in equity mutual funds, which can generate better returns in the long term.

- Alternatives are equity mutual funds/ direct stock investing.

Aspects of National Pension System

1) Capital protection and inflation protection

Your capital is not protected, as the NPS invests a certain amount in equities. The returns are, therefore, market-linked. However, equities are expected to beat inflation over the long term, thus building a certain level of inflation protection into the National Pension System.

2) Liquidity

In the case of the NPS, after three years of being in the scheme, you can withdraw up to 25 per cent of the contributions for defined expenses. These defined expenses are children's higher education or marriage, construction or purchase of the first house and treatment of critical illness for self, spouse, children or dependent parents. The regulations have defined 13 critical illnesses and have extended this facility to accidents or other ailments of a life-threatening nature, including COVID-19.

The point to note is that the 25 per cent limit will be calculated on the contributed amount, not on the account balance. Suppose you have contributed Rs 5,000 per month for three years. You would be eligible to withdraw Rs 45,000, i.e., 25 per cent of Rs 1.8 lakh. You can make up to three withdrawals (with a gap of five years) during the tenure.

3) Exit option

- Tier I: If you wish to exit before age 60, you must use 80 per cent of the corpus to buy an annuity. You can withdraw 20 per cent of your corpus, but it will be taxed as per your income-tax slab.

60 per cent withdrawals from the National Pension System are tax-free for those who retire at 60 years. You will have to use the balance to purchase an annuity. However, if the total corpus does not exceed Rs 5 lakh, the entire amount can be withdrawn as a lump sum without any need to purchase an annuity. - Tier II - Regular: In this voluntary account, you are free to withdraw your savings whenever you wish. There are no limits on deposits and withdrawals.

- Tier II - TTS: You can withdraw your money after a lock-in period of three years without any limit.

4) NPS scheme tax benefits: Tax implications

Tax deduction on investments up to Rs 1.5 lakh (under Section 80CCD) and Rs 50,000 [under Section 80CCD (1B)] can be availed in a financial year. 60 per cent of the amount received at the completion of the term is tax-free. However, this tax benefit is not available for Tier II - Regular NPS account.

Where to open the account

You can open an NPS account with many PoP (Point of Presence) including some public and private banks. To view the list of empanelled POP, visit https://enps.nsdl.com/eNPS/

How to open an account

- Visit a point of presence (PoP). Fill out the prescribed form and submit the required documents for KYC compliance. Alternatively, you can open an account online at enps.nsdl.com and follow the steps mentioned therein.

- Once registered, the Central Record Keeping Agency (CRA) will send you a Permanent Retirement Account Number (PRAN), which is unique to all subscribers.

- Select the amount to invest and investment option.

If you are not KYC compliant, you will need the following:

- Aadhaar card. In the absence of the same, you need to provide a copy of the acknowledgement of your Aadhaar application along with an address and identity proof.

- Self-declaration stating that you are not a pre-existing member of the NPS

- Coloured passport-size photograph

Types of National Pension System accounts

The NPS works on a defined-contribution basis and has three types:

- Tier I: This is a mandatory no-withdrawal pension account and is eligible for tax benefits.

- Tier II - Regular: It's a voluntary-withdrawal savings account from which, individuals can withdraw money anytime. It has no attendant tax benefits.

- Tier II - TTS: It offers tax benefits under section 80CCD and allows withdrawals after a three-year lock-in. This scheme is available only for central government employees.

List of Pension Fund Managers (PFMs)

The following is the list of NPS managers:

- HDFC Pension Management Company

- ICICI Prudential Life Insurance Company

- Kotak Mahindra Asset Management Company

- LIC Pension Fund

- SBI Pension Funds

- UTI Retirement Solutions

- Birla Sun Life Pension Management

Currently, the following annuity service providers are empanelled with the PFRDA:

- Life Insurance Corporation of India

- HDFC Life Insurance Co Ltd

- ICICI Prudential Life Insurance Co Ltd

- SBI Life Insurance Co Ltd

- Star Union Dai-ichi Life Insurance Co Ltd

- Kotak Mahindra Life Insurance Co Ltd

- IndiaFirst Life Insurance Co Ltd

- Max Life Insurance Co Ltd

- Canara HSBC Oriental Bank of Commerce

- Bajaj Allianz Life Insurance Company Ltd

- Tata AIA Life Insurance Company Ltd

- Edelweiss Tokio Life Insurance Company Limited

Investment options: ECGA of the NPS

The National Pension System offers different funds with varying exposure to equity funds (E), corporate debt (C), government securities (G) and alternative investment schemes (A). Of these asset classes, equity carries the maximum risk (and chances of maximum returns) and government securities carry minimum risk (and least returns). The following are the investment options available:

- Active-choice investment: The investor can mix the E, C and G options as per their choice. The maximum allocation towards alternative investments is 5 per cent. For equity, it can be 75 per cent for someone who is less than 50 years. Earlier, it was 50 per cent. This limit reduces by 2.5 per cent per year as the person grows older and thus becomes 50 per cent at age 60 years and above.

- Auto-choice investment: Here investment allocation is done based on the investor's age. In the default version of this scheme (moderate life-cycle fund), the equity portion is 50 per cent till age 35, after which it reduces 2 per cent per year until it becomes 10 per cent by age 55. The corporate debt portion is 30 per cent till age 35, after which it reduces 1 per cent per year until it becomes 10 per cent by age 55. Other options within auto-choice are the aggressive and conservative life-cycle funds, which begin with an equity allocation of 75 per cent and 25 per cent, respectively. These are reduced as the NPS subscriber's age advances.

The newly introduced Tier II - TTS scheme has a fixed mandate of investing between 10 and 25 per cent in equity and the remaining in fixed income for the pension funds. Exposure to cash and money-market securities has been restricted to a maximum of 5 per cent. There is no investment choice to the subscriber.

Also read:

Which NPS fund should I invest in?

ELSS vs NPS vs PPF

How to reduce your NPS transaction costs?