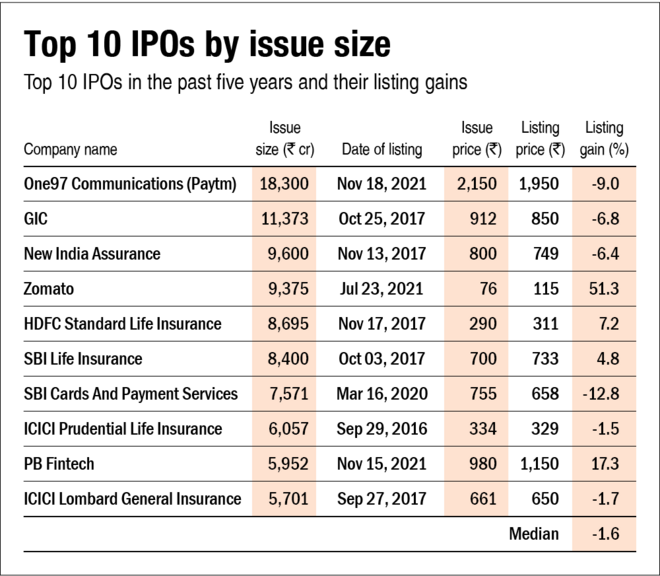

Today, One 97 Communications or Paytm, got its shares listed in the exchanges at a discount of 9 per cent from its issue price. This broke the trend of startup listing gains. While we may think that this is a typical case for Paytm, it has been the trend for many other companies in the last five years. All those companies had one thing in common - massive issue-size.

The top-10 IPOs by issue-size in the last five years had a median listing gain of -1.6 per cent, with the only major exception being Zomato which had a good listing gain of 51 per cent.

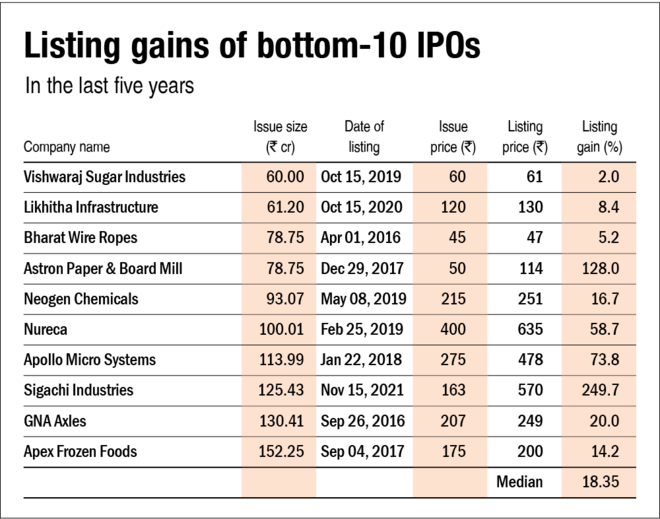

If issue-size does really influence the listing gains of IPOs, then the result should be the opposite for the bottom-10 IPOs in the last five years. We did the number crunching and the result was glaring. The bottom-10 IPOs had median listing gains of 18.4 per cent.

Read more articles where we discuss IPOs:

Investing on listing day: is it a good idea?