In the story beginner's guide to mutual funds, we learnt about the basics of mutual funds, its types and benefits. Here, we will dive deeper and understand the other aspects related to mutual funds.

Capital protection and inflation protection

Mutual funds do not offer any capital protection in a legally enforceable way. Mutual funds invest in market-linked investments and losses are always possible. However, AMCs are allowed to run 'capital-protection-oriented' funds. These funds invest a high proportion in safe fixed-income securities and a small proportion in equities. Investors who stay invested for a fixed period of time are unlikely to suffer any capital loss. Mutual funds do not offer any kind of contractual or formal inflation protection. However, when you invest in well-chosen equity funds for a period of several years, your chances of beating inflation is better than that in any other type of investment.

Liquidity

As per SEBI rules, all mutual funds must offer liquidity. However, there are nuances. Liquidity depends on whether a fund is open-end or closed-end. Open-end funds are perpetual funds that are always available for investment or redemption. In the case of open-end funds, the AMC itself redeems the money at the NAV-based selling price within three working days.

Closed-end funds are launched for a fixed period (generally three to ten years) and you can invest in them only at the time of the initial offer. For closed-end funds, AMCs get the fund listed on a stock exchange so that you can sell your units like a stock through a stockbroker. However, this is not agreat option because the stock-exchange price of a fund is generally a lot less than the NAV. In practice, you should consider closed-end funds to be locked in for their full duration.

Tax-saving funds have a three-year lock-in. These funds help you save tax as per Section 80C of the Income Tax Act but you cannot redeem them for three years as per the tax law.

How to invest in mutual funds

You can invest in mutual funds directly through the AMC or through an intermediary.

- Directly through the AMC: To invest directly through an AMC, you can get the AMC's details through its website. Most AMCs also have a toll-free phone helpline, which can also be a good starting point if you do not use the internet. All AMCs have direct plans for their existing fund schemes. These are meant for investors who want to invest themselves without any help of an intermediary. Hence, they have a lower expense ratio compared to regular schemes, which are available through intermediaries. This means that you, as an investor, will get an opportunity to earn a slightly higher return from your mutual fund as compared to that of the corresponding regular scheme, despite the same portfolio.

- Intermediaries: There are a wide variety of intermediaries available. These include banks, stockbrokers, fintech platforms and a large number of individuals and small financial-advisory companies.

Investing in a fund involves going through a 'know your customer' (KYC) process, much like other financial transactions. You will need the following documents for the KYC process: an identity proof (PAN card copy, copy of the passport, driving licence, etc.) and address proof (Aadhaar card, voter's ID card, etc.)

How to exit from a fund

If you invest online in a fund or if you have registered for online transactions, then you can seek online redemption and the proceeds will be deposited in your bank account. For offline investors, there is a redemption slip that comes with your account statement. This has to be filled up, signed and deposited at the nearest 'investor service centre'. The intermediary you have invested through will facilitate the process. In all cases, redemption proceeds come to your bank account.

Load

Load is a small percentage of your investment that can be deducted by the AMC during redemption. The actual percentage (and whether it will be charged at all) depends on the type of fund and the holding period. Typically, there would be a load of 1 per cent if you redeem your equity investment within a year and no load after that. Earlier, an entry load was also charged at the time of investment, but in August 2009, it was abolished by SEBI.

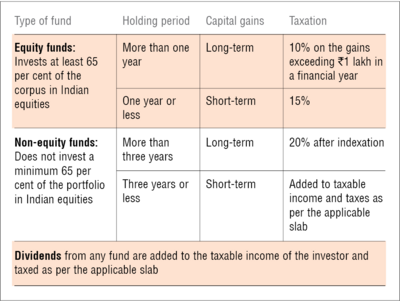

Taxation

Investments in equity-linked savings schemes (ELSS) qualify for tax deductions under Section 80C. Apart from this, all mutual funds attract capital gains tax liability, depending on the types of assets they invest in. Here is the tax summary:

Value Research fund classification

There are more than 1,500 fund schemes in the market. Value Research divides this entire universe into 46 categories. Grouping funds in these categories helps create a portfolio for every possible investor profile.

Of the 46 categories, 20 are pure equity categories, 7 are hybrids (equity and debt), 17 are pure debt categories and the last two are commodities. For equity-fund categories, the size (market capitalisation) of the companies that these funds invest in is used, except the ELSS which consists of all funds that are compliant with the section 80C of the Income-Tax Act. For hybrid-fund categories, the categorisation is based on the balance between debt and equity that a fund maintains. For debt-fund categories, funds are slotted according to the residual maturity of the securities they invest in. Across all these three categories, the underlying principle is to slice the universe along a risk-return continuum.

This process serves two goals. First, readers can zero in on the exact balance of risk and return that they are looking for and second, funds can be compared with others that are genuinely their peers without the comparison getting muddied by whatever marketing positioning a fund may take. The entire categorisation is based on actual portfolios that fund managers are running and not their self-stated intentions. You can view the detailed fund classification here.

Explore best mutual funds to invest in

Also Read: