After hitting a COVID-19-induced low in March 2021, the Nifty 50 has doubled, driven both by foreign flows (FPI inflows into the Indian stock market amounted to $14 billion over FY20-21)1 and domestic inflows (amounting to $25 billion over FY20-21)2. The sustained vigour of this bull-run has attracted millions of new investors into the Indian stock market - as per SEBI, 14.2 million new investors have entered the stock market over the past 12 months3. In fact, prior to COVID's onset in March 2020, there were about 11 million active investors in India; over the past 18 months, this number has more than doubled to about 25 million active investors.

This bull-run is not a flash in the pan. Over the past decade, the Nifty 50 Total Return Index (TRI) has compounded at 11 per cent per annum4 and created $1 trillion of wealth. The stock market has, therefore, become a potent source of sustainable wealth creation in India. It stands to reason, therefore, that if the wealth created by the stock market spreads across the country, it gives free-market reforms a degree of mass legitimacy that it has hitherto lacked in India. Furthermore, in a country where the RBI says a mere 5 per cent of household wealth is in the form of financial assets, the stock market can potentially drive financialisation of wealth5.

However, there is good reason to believe that this is NOT happening. In other words, the beneficiaries of the rise in the Indian stock market are a privileged minority of Indian investors. Data from AMFI, the mutual fund trade body, shows that 84 per cent of mutual fund investors (by value of assets) come from the 30 largest cities in India6.

So, why is this happening? Given the ease with which demat accounts can be opened and the extensive network of mutual fund distributors, why are the masses not investing in the stock market where the overall household financial savings rate is typically around 20 per cent of income7?

The answer mainly revolves around the cost of accessing the stock market through demat accounts and mutual fund folios. Comparing the cost of investing in mutual funds in India versus the United States throws up some interesting insights. In India, the cost of investing in a large-cap equity mutual fund is around 1.8 per cent (which falls to 1.1 per cent if the investor goes 'direct', i.e., without a distributor). See the table 'Expense ratios and returns of prominent large-cap funds'. Because these schemes struggle to beat the benchmark (see the 'median' performance in the table), this is an expensive way to access the stock market.

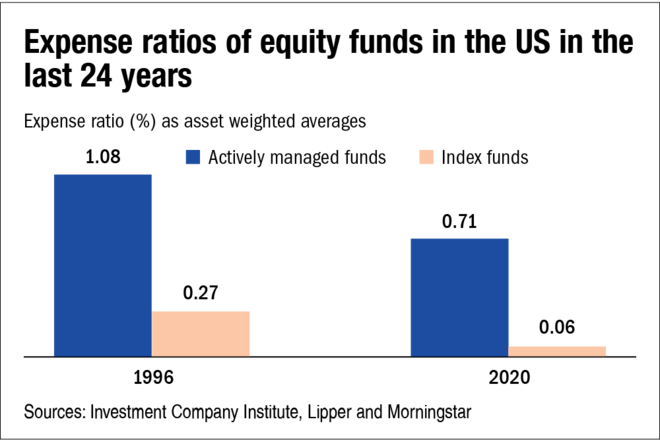

In contrast, the cost of an actively managed mutual fund in the USA is around 0.7 per cent (see the chart 'Expense ratios of mutual funds in the US...'). Furthermore, several index funds in India charge fees north of 10 bps, whereas the cost of such funds in the US is 6 bps.

A more-detailed comparison of the relative cost of investing in the two countries highlights the underlying source of the problem. The cost of direct large-cap mutual fund investing in India versus the US - 1.1 per cent vs 0.5 per cent - can be justified by the colossal scale of the US asset management industry, which is almost 15 times the size of the Indian industry. However, the cost of 'distributing' (which is distinct from the cost of 'manufacturing') large-cap equity mutual funds in India is very high, at around 0.6 per cent (see the last two columns of the table ('Expense ratios and returns of prominent large-cap funds'). This distribution cost pushes the expenses of large-cap equity mutual fund investing in India into unaffordable territory.

Beyond mutual funds, the other popular way for investors to access the Indian stock market has been via online discount brokerages. Here too, we find the cost of opening a demat account is relatively high in spite of the rise of discount brokerages. For the large discount online brokerages in India, the brokerage charge for intraday equity trading ranges from 0.03 per cent to 0.05 per cent and around Rs 300 for account opening and maintenance each8, whereas a discount brokerage like Robinhood in the US operates with a $0 commission fee for trading and $0 as account-opening and management fees9.

So, given the expenses associated with accessing the Indian stock market, how can its benefits be taken to the masses? The answer lies in one of the least-talked-about but most-effective forms of savings in India - the National Pension System (NPS).

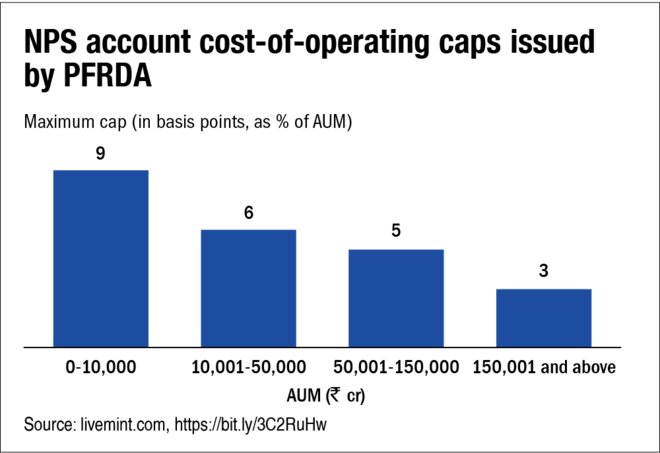

Launched in 2004, the NPS has strengthened even though the manufacturers of the product have spent almost no money publicising it. The NPS is a collection of low-cost funds inside a low-cost pension wrapper with some tax breaks thrown in for the saver. As a result, it allows everyone - rich and poor - to participate in the rise of the stock market at minimal cost. As of August 2021, Rs 6.3 lakh crore was being managed under the NPS10. The cost of operating an NPS account is capped by the PFRDA, the pensions regulator, using a sliding scale (see the chart 'NPS account cost-of-operating caps...').

The equity allocation under the NPS is capped at 75 per cent for investors until the age of 50. It gradually and automatically tapers down by 2.5 per cent each year until it reaches 50 per cent by the age of 60. The remaining amount is invested in fixed-income instruments, real estate investment trusts (REITs), alternative investment funds. Therefore, the NPS is a savings product which also solves the asset-allocation needs of a retail investor.

Widespread adoption of the NPS will give India something akin to the 401(K) in the United States, which has driven the massification of equity investment there. Over the last 40 years, as equity investments have become the main mode of savings for American households, the corpus invested in 401(K) has risen from $0.9 trillion in 1990 to $6.7 trillion in 2020, a CAGR of 6.9 per cent11, in a country where nominal GDP growth CAGR has been around 4.3 per cent12.

1India-only-emerging-market-to-get-equity-fpi-inflows-in-2020, 2021

2Domestic portfolio inflows, 2020

3Why more and more individual investors in India are investing in stock market, 2021

4Nifty 50 TRI historical data

5Household Finance Committee Report, 2017

6Karnataka 4th largest investor in mutual funds, 2021

7Household financial savings drop for second straight quarter, debt mounts RBI data, 2021

8Finology.in-compare Groww, Zerodha, and Upstox

9Robinhood fee schedule

10http://www.npstrust.org.in/assets-under-management-and-subsribers

11Asset retirement plan by types in the US, 2021

12World Bank GDP (in current US$) data for United States, 2020