Whenever any investor is asked questions about their investing, they tend to focus entirely on what they have invested in. That sounds like quite the natural thing to do, and I personally do it all the time. Isn't that the question, you might ask? If I'm asked about my investing; naturally, I will answer with what I have invested in.

Actually, when I carefully examine my personal investments, I realise that there is a far more useful and interesting answer to the question: why I did what I did, and how I went about doing it. If you really want to know about my investing process, then just a list of what I am invested in doesn't cut it. The journey I undertook, the route I chose and why I chose it are just as important as the destination I reached.

The reason it's important is that how you do something is actually more important than what you do. Let's say that I told you that I hold Rs 1 crore worth of X equity mutual fund and that this is about 20 per cent of my total financial assets. That's fine, you say, and set off to emulate that. You too go off, liquidate some investments and put 20 per cent of your financial asset base into equity fund X. You and I are now at par as far as this fund is concerned, right?

Obviously not. When I told you that I had Rs 1 crore in fund X, I could have invested it all two days before that or it could have been built up over 10 years with monthly SIPs or it could have been invested a long time ago and then just left alone. I could be planning to hold it for many more years, or I may have already filed for a redemption. How I got to the current situation, why I decided to do so and where I'm going - all these are far more important and useful pieces of information than just where I stand today.

What vs why and how

We tend to feel that what matters more is what you are going to do, and not how you are going to do it. In my experience, the truth is very different. There are no good ideas that are secret. The basics of investing success: diversification, asset allocation, cost averaging, focusing on fundamentals, etc., are available to everyone. Moreover, it's also available easily and at either zero or very low cost. There are no barriers to ideas. You can have all the good ideas in investing, delivered to the device in your pocket at any moment that you choose.

And yet, just like in business, and just like in many other aspects of life, it's the execution that matters. Some investors seem to pick up the great ideas and just run with them and succeed but many do not. However, the problem is actually a little bit deeper than business. Unlike business, this is not about competence, but rather what the main activity of your life is. After all, investing is not the main business of your life. You cannot spend all your time learning the nitty gritty of the actual implementation of the best ideas. Unlike business, you cannot even hire someone experienced to manage things for you...or can you?

It turns out that you can, and that is what you are here with Value Research. And how are we going to do that? That's where Value Research Premium comes in. This is a process that has four parts to it:

- Provide a way for you to articulate your goals clearly.

- Suggest a set of investments and a pattern of investments for those goals.

- Verify that your existing investments fit the goals, and suggest changes if they do not.

- Continuously monitor your investments to make sure they are heading for your goals; suggest changes if any are required.

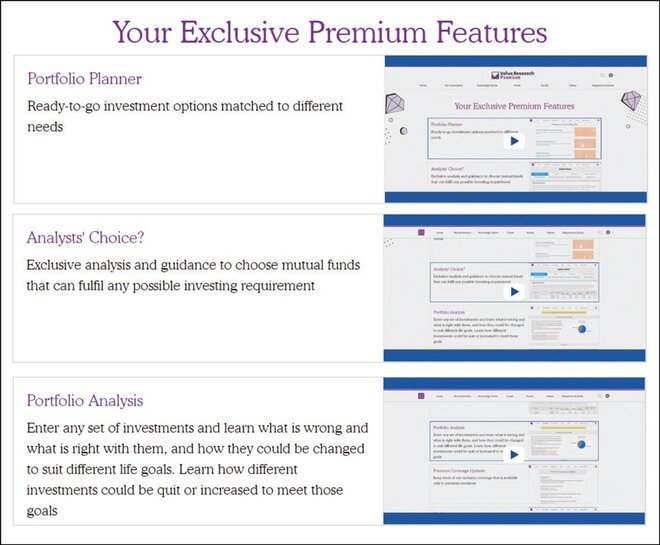

All these can be implemented by features that we have integrated into Premium. Here's an overview of those which directly work towards meeting your financial goals:

Portfolio Planner: These are custom portfolios that are suggested to you as part of your Premium membership. The algorithm that we have evolved takes into account your goals, your income, your saving capacity and a number of other factors.

Analyst's Choice: Often, investors want to choose their own funds for some particular investment purpose. There are over 1,500 available to you and even with the help of our rating system, it's a lot of work to zoom in to the right set. However, that won't be a problem for you because as a Premium member, you will have access to Analyst's Choice. Instead of the 37 official types of funds, we have created eight investor-oriented categories which match precisely with actual financial goals that you have. In each of these, my team of analysts and I have carefully selected a handful of funds that will serve you with the best outcomes.

Portfolio Analysis: Only a few members are starting their investing from scratch. For most of you, a big question is whether your existing investments fit into your goals? This is often a hard question to answer because there are a lot of implications of switching old investments, not the least of which is taxation. In the Premium system, you can get an evaluation and a suggested fix-list based on our expert teams' inputs.

And a lot more

Of course, those are just headline features. There are a lot more that will help you keep track of your investments, returns, diversification, taxation and practically everything else that will help you achieve your financial goals. Take a look at Value Research Premium for the full details.