Since April 2020, after the March crash, the markets have rallied spectacularly. A number of reasons are being given for this fantastic rise in the markets: a liquidity rush to fight the pandemic, a receding pandemic, an economic rebound, good profit numbers of listed companies, etc.

So far so good. However, for the serious stock investor, perhaps the biggest challenge is where to invest in a bull run. With stocks and their valuations growing wings, your best investment ideas seem to be out of reach.

In this series of articles, we bring to you stocks that have given better returns than the Sensex over the last one year but are still available at a discount to their historical valuations.

In order to arrive at these stocks, we applied the following filters:

- Market cap more than Rs 1,000 cr

- EPS growth of more than 15% pa over the last five years

- Current and five-year average ROE & ROCE more than 15% (for finance companies, only ROE)

- Positive cash flows over the last five years (not applicable for finance companies)

- Trading at a discount or a premium of less than 10% from 5Y median P/E (P/B for finance companies)

From the list of stocks that we so obtained, here are two large ones.

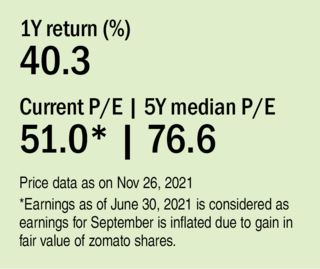

Info Edge: Clicking on a better tomorrow

Incorporated in 1995, Info Edge India Ltd runs a group of search-related websites that cater to various segments, such as recruitment (Naukri.com, iimjobs.com), matrimony (Jeevansaathi), real estate (99acres), and education (Shiksha). Apart from this, the company has its stake in a portfolio of companies, such as Zomato, Policybazaar, etc.

Over the last year, the great performance of the company's shares could be attributed to Zomato's Rs 9,000 crore IPO. Info Edge made a return of nearly 1,000 times on its investment when it sold 2.32 per cent of its stake in the IPO and post IPO, it still continues to hold 15.23 per cent. Since the markets were already anticipating a huge cash inflow following the IPO, the share price increased spectacularly over this period.

Apart from its core operating companies, Info Edge's shareholding in other portfolio companies is expected to create a lot of value in the future. For instance, the company owns around a 14 per cent stake in Policybazaar, which is all set to come out with an IPO in the latter part of 2021. Besides its existing shareholding, it is very likely that the market is assigning a premium to the management's ability to identify further opportunities at an early stage. This has created an overall positive outlook for the company. Info Edge's growth in the future will now hinge on the performance of not only its own operating businesses but also that of its portfolio companies.

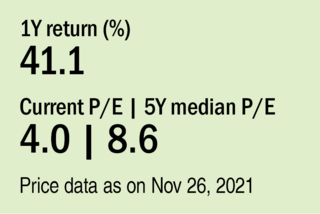

NMDC: Thriving on demand

Incorporated as National Mineral Development Corporation in 1958, NMDC is involved in exploring and mining iron ore and diamonds. Besides, it is engaged in the production and sale of sponge iron and the generation and sale of wind power. It is the largest iron-ore producer in India and has seven mines across the country. Apart from starting its own steel plant, it owns a 92 per cent stake in an Australian company called Legacy Iron Ore Ltd., which is involved in the exploration of iron ore, gold and base metals.

The company's share price grew significantly, owing to a rapid increase in global commodities prices, which also resulted in an increase in the price of iron. As a result, the company posted all-time high sales for FY21 and profit after tax, too, jumped by 74 per cent. Factoring in the bullish investor sentiment about the infrastructure sector, it wasn't surprising that the share gave a return of 90 per cent during the year.

Although the global price of iron ore has been volatile during the last few months, the company's status of being a low-cost iron-ore producer is expected to safeguard its position as a profit-making PSU. While the management expects an increase in sales and production during the year, the quantum of profits would hinge on the prices of iron ore and steel (its new plant will commence production from Q3FY22). While the commodities sector is cyclical in nature, the continued demand for additional infrastructure and increased construction should play out well for the company in the future.

Disclaimer: The stocks discussed above are not our recommendations. Do your own due diligence before investing in them. If you are interested in our recommendations, please visit www.valueresearchstocks.com