As the market touches newer highs, most investors want to know if the market has turned overvalued, how far this bull run will go and when a correction is due. To get an answer, we spoke with Vineet Maloo, Fund Manager, Aditya Birla Sun Life Mutual Fund. He manages Aditya Birla Sun Life Balanced Advantage Fund, which manages over Rs 6,000 crore (as of October 2021).

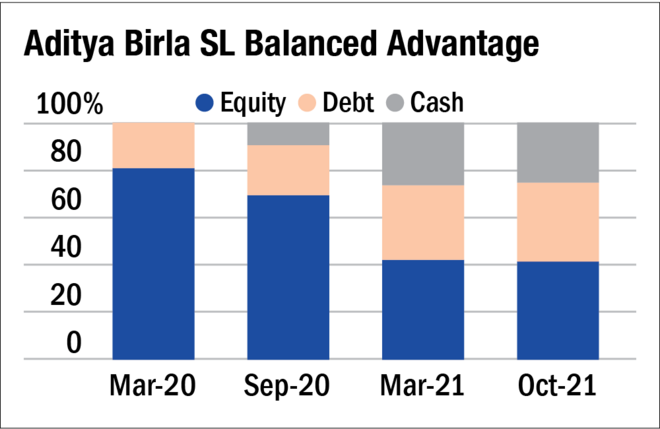

By SEBI's mandate, balanced advantage funds can dynamically manage their equity-debt allocation. Hence, their asset allocation is a gauge of market valuations. When markets are heated, they tend to increase their debt allocation. In bear runs, they increase their equity allocation.

So, let's find out where the markets are headed.

What's your view on the market valuations currently? What's your outlook for the market over the next one year?

Globally, equity markets have climbed a wall of worry and are at record highs, driven by strong earnings growth. Headline valuations are at a 15-35 per cent premium to their long-term averages in the US, Eurozone and emerging markets. Even in India, one-year forward P/E multiples are at a 20 per cent premium to their long-term average. However, the economic growth and earnings trajectory have not normalised yet. And hence the valuation multiples could look elevated.

Given the elevated headline valuations and with Fed tapering, rising yields and a stronger dollar, FII flows to emerging markets, including India, can be impacted. So, volatility should be the base-case assumption in the near term.

India has been late in the recovery process versus developed markets but has the potential now to catch up. Consequently, a recovery in earnings growth is also expected and view remains constructive on the Indian market for the next one year to three years. Overall, the market may offer moderate returns over medium- to long-term.

What changes have you made in your equity portfolio over the last few months as the bull-run gained momentum? Which pockets are you bullish on? Which would you avoid?

Our Balanced Advantage Fund portfolio has not changed substantially over the last three months. The fund has added some exposure to banking, industrials and cement. If you take a three-year view, cyclicals like industrials, capital goods, etc., are good because they can bounce back after a long time. India can get into the capex mode and it can drive order inflow for the industrials and capital-goods sector.

To capture the overall recovery, one can also take the route of banking and financial services. Since the bank balance sheets are in pretty good shape now, they should benefit from the pick-up in credit growth.

Real estate and allied or dependent sectors like building materials, home improvement, etc., are interesting areas. Some recovery is visible in housing demand. Lower interest rate and flat property prices have resulted in faster absorption of the housing inventory.

On the other side, there has been reduction in exposure to the IT and metal sectors. The cyclical upturn in the IT sector has possibly been played out. However, the secular tailwind can be better captured by stock-specific exposure, rather than allocating extra capital to the sector. As metal names have delivered strong returns, fund has taken some profits and reduced exposure in that space.

What are your stock-selection and asset allocation criteria?

ABSL Balanced Advantage Fund follows a set of simple rules based on the measure of market valuation. The trailing four-quarter P/E ratio of the BSE 100 index is used as a barometer for overall market valuation. There are certain adjustments made to underlying earnings to make them more representative. Based the adjusted P/E ratio, there is an equity-allocation matrix which is followed religiously. The fund manager has to maintain equity exposure within the pre-defined band and is free to choose the exact exposure inside that range.

For choosing stocks, the fund follows a conservative strategy and relies on bottom-up analysis. The focus is to understand the gap between fair value and market price and the margin of safety available.

Also in the series:

'Temper down expectations in the near term'

'The medium-term view has turned cautious'