Anand Kumar

Anand Kumar

To re-emphasise what we mentioned in the previous chapter, if you don't have time or expertise to research direct stocks, the best way to invest in them is through equity mutual funds.

The charm of mutual funds is that you have a professional fund manager who decides what stocks to buy, and when to buy and sell.

The responsibility of growing your money lies with them - just like you hire a lawyer to look after your legal matters and a chartered accountant to pay your tax.

There is one difference, though.

Unlike other professionals, a mutual fund manager offers their blanket service to a large group of investors.

Let's explain it to you in more detail.

How does a mutual fund work?

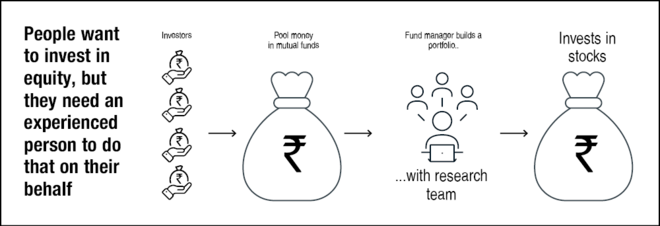

Since many people want to put their money in equity, the fund manager collects their money and invests it on their behalf.

Say there are 1,000 such people, and all are willing to invest Rs 10,000. The fund manager would now invest this pooled money of Rs 1 crore (10,000 x 1,000) and buy stocks based on their expertise.

Aprajita Anushree

Aprajita Anushree

That's the macro part.

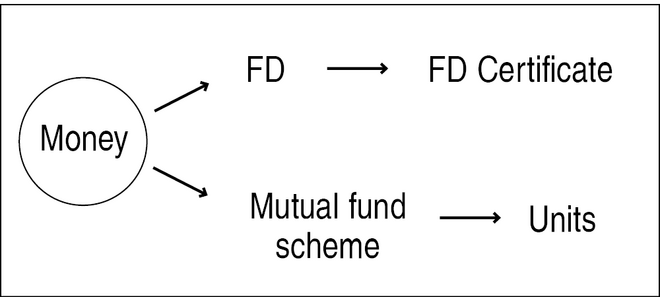

From your point of view, you get a few units of a mutual fund upon investing.

These units represent your share of ownership of the fund. But how do you know how much they are worth at any point in time? That is where NAV comes in.

Aprajita Anushree

Aprajita Anushree

What is an NAV?

The worth of each mutual fund unit is called Net Asset Value (NAV).

If the NAV grows, so does the value of your mutual fund investment.

An example can better explain this question.

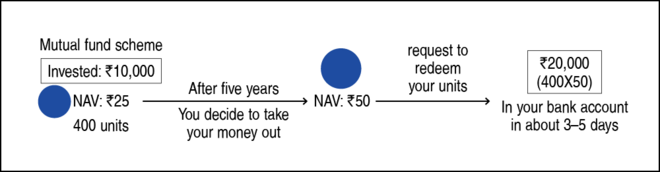

Assume you invested Rs 10,000 in a mutual fund scheme when its NAV was Rs 25.

That means you received 400 units at the time of investing.

Five years later, when you decide to take out your money, you see the NAV has grown to Rs 50 - meaning you will receive Rs 20,000 (400 units x Rs 50) within three business days in your bank account.

Aprajita Anushree

Aprajita Anushree

Therefore, from your perspective, you only need to look at the difference between NAV at the time of buying and selling.

In essence, this is how a mutual fund helps you make money. It's simple, straightforward and easy to understand.

Are mutual funds safe?

Yes, they are structurally safe and regulated by SEBI (Securities and Exchange Board of India), just like the Reserve Bank of India regulates banks.

The companies running these mutual funds (known as Asset Management Companies) must meet many legal requirements.

For instance, they are legally obligated to release detailed data about how they operate and where they invest.

Everything is transparent, giving you and I and every one the power to monitor them.

Moreover, to ensure our money is safe, SEBI has directed that AMCs also have a portion of their own money invested in their mutual funds.

Having said that, don't mistake safety for a guarantee of returns.

A mutual fund can inflict losses by making poor investment decisions on your behalf.

But you shouldn't really lose sleep.

While it is true that equity doesn't guarantee returns and can subject you to sharp ups and downs on a day-to-day basis, the risk diminishes substantially over a longer time frame of five years or more.

For example, in the last seven years (as on December 31, 2022), even the worst diversified equity fund delivered returns at the rate of 9-10 per cent per annum!

So you see, even after making a poor choice, you would have been better off than any investment alternative such as Public Provident Fund (PPF), fixed deposits (FDs), and gold.

What is the minimum amount you can invest in a mutual fund?

For most funds, it is possible to start investing with as little as Rs 500-1,000.

To give you perspective, you would be unable to buy even a single share of many companies for that low an amount!

A single Reliance share costs upwards of Rs 2,000; even smaller companies' stocks can cost more than that. For instance, the stock price of Honeywell Automation is worth of Rs 35,000 as we speak!

Yes, a single stock can cost that much money!

However, with mutual funds, even with a minimum investment of Rs 500-1,000, you can benefit from a diversified portfolio of 25-30 stocks or more.

Is it possible to withdraw money anytime?

Unlike many other investments, most mutual fund investments are highly 'liquid'.

'Liquid' means an investment that can be withdrawn without any delay.

If you wish to exit your mutual fund, you can expect your investment to land in your bank account within three business days.

While you must refrain from withdrawing prematurely if you are keen to build long-term wealth, you at least have an exit route.

What are the costs?

You need to pay a percentage of your investment amount every year. This is called the 'expense ratio'.

Mutual fund companies charge an expense ratio to manage your money.

The expense ratio is used to pay the salaries of fund managers and employees and commissions to agents, among others.

Please note that no company can charge you more than 2.25 per cent of expense ratio.

What's the best mutual fund investing strategy?

There's a mutual fund for every need.

The funds are suitable based on:

- how much risk you are comfortable taking

- how much time you are willing to invest

- your objective (to save tax, earn income on your investment, etc.)

No matter what type of investment you want, there will be a variety of funds that suit you.

The universe of mutual funds is vast. At the broadest level, there are three types of funds - equity, debt and hybrid.

As the name suggests, equity funds invest in equity shares or stocks. Debt funds invest in fixed income securities like bonds. And hybrid funds invest in a mix of both equity and debt instruments.

There are sub-branches too, but let us not overwhelm you.

Let us not look at each type of mutual fund. That'll only confuse you.

Instead, we'll keep it simple and focused and show you how to choose your first mutual fund in the next chapter.