As the market touches newer highs, most investors want to know if the market has turned overvalued, how far this bull run will go and when a correction is due. To get an answer, we spoke with Harish Krishnan, EVP & Fund Manager-Equity, Kotak Mahindra AMC Ltd. He manages Kotak Balanced Advantage Fund, which manages Rs 11,813 crore (as of October 2021).

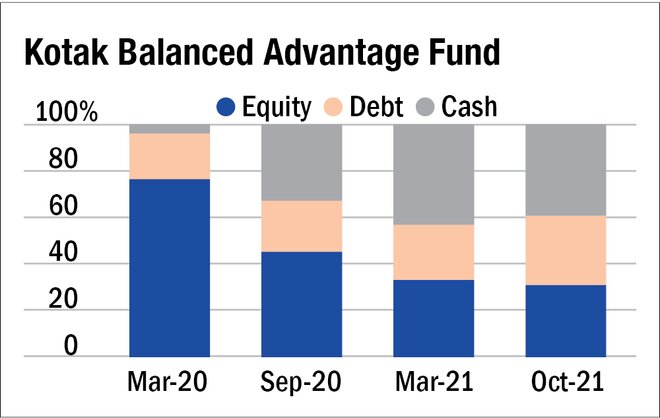

By SEBI's mandate, balanced advantage funds can dynamically manage their equity-debt allocation. Hence, their asset allocation is a gauge of market valuations. When markets are heated, they tend to increase their debt allocation. In bear runs, they increase their equity allocation.

So, let's find out where the markets are headed.

What's your view on the market valuations currently? What's your outlook for the market over the next one year?

Corporate India is exiting from COVID-19 pandemic stronger than it entered into it. However, the key question is how much of this is already priced in. Over the last 18 months, Indian markets have had a dream run, outperforming most global markets significantly. We plotted the number of doublers in any five-year period over the last 20+ years, and thanks to this dream run, almost 70 per cent of NSE 500 stocks have doubled in the last five years - one of the highest readings in the last 20+ years. Similarly, when we look at BSE SME IPO index, which is up five times in last six months or the fact that many companies which have poor-quality balance sheets have significantly outperformed in the last six months, all point to the fact that one is better advised to temper down expectations from the market in the near term. Of course, the fact that fundamentals are strong implies that we will advise investors to use such opportunities to allocate to equities in the event of intermittent volatility.

What changes have you made in your equity portfolio over the last few months as the bull-run gained momentum? Which pockets are you bullish on? Which would you avoid?

If we plot themes that have improved their relative competitive positioning in a post-COVID world over pre-COVID times, we find exporter and investment cycle to be best placed, as they have benefitted both from strong global growth, weak currency, improving balance sheet of India Inc driving investments, and improving real-estate cycle. Consumer discretionary is also likely to do well, as we think top 10-15 per cent of household have higher savings, which will be spent as economy opens up post-COVID. Bottom-of-pyramid consumption is where we think India is worse off post-COVID compared to before, as incomes have impacted the lower end of households. Given this broader top-down assessment, our preference is to play investment cycle via capital goods, cement, real estate and home building, and stronger financials. We are playing the export theme via IT services, select pharma and chemicals, and engineering export companies. In Kotak Balanced Advantage Fund, we have large weights in consumer discretionary via auto, retailers, aviation, eating out, etc., as well.

Over the last few months, at the margin, we have booked profits in mid- and small-caps, selectively participated in IPOs, as well as increased allocation to compounding plays over deep cyclical plays.

What are your stock-selection and asset allocation criteria?

In our asset-allocation funds like Kotak Balanced Advantage Fund, we use a two-factor model of valuation and sentiment to arrive at net equity levels. This fund which has flexibility to move from 20 to 80 per cent is currently at 31 per cent in equities (we were fully invested in March-April 2020, taking benefit of depressed valuations and sentiments at that point of time).

In terms of stock-selection framework, our preference is to buy 'Best of Breed' companies across various sectors, and backing them up especially when the sector faces some transient headwinds. We look at business through lens of scalability and sustainability and management track record (alignment with minority investors, capital allocation, etc.) and valuations (we prefer growth and quality at a reasonable price) to evaluate companies.

Also in the series:

'The medium-term view has turned cautious'

'View remains constructive over the next one year'