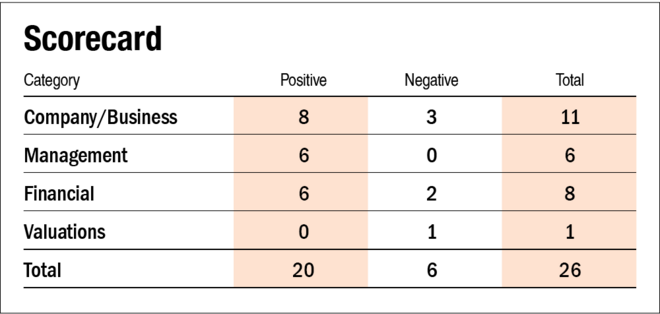

In our story, C.E. Info Systems IPO: Information analysis, we shed light on the key details of the IPO, along with important information about the company. Here we will answer some questions about the company and evaluate it on parameters like management, financials, valuations, etc.

IPO questions

The company/business

1) Are the company's earnings before tax more than Rs 50 crore in the last 12 months?

Yes. In the trailing twelve months (TTM) ended September 2021, the company reported a profit before tax of Rs 117.9 crore.

2) Will the company be able to scale up its business?

Yes. The continuous adoption of the company's solutions by new-age companies across sectors and industries will help it scale rapidly.

3) Does the company have recognisable brands truly valued by its customers?

Yes. The company's products are critical for its customers. And given its unique offerings, the brand is truly valuable.

4) Does the company have high repeat customer usage?

Yes. The company enters into long-term contracts of three to five years with its customers.

5) Does the company have a credible moat?

Yes. The company's ability to provide a combined offering of map data, location content and platform through one integrated system, along with its ground-validated proprietary digital-map database for locations across India, gives it a credible moat.

6) Is the company sufficiently robust to major regulatory or geopolitical risks?

Yes. The company is sufficiently robust to major regulatory or geopolitical risks.

7) Is the company's business immune from easy replication by new players?

Yes. With a head start of over 25 years, the company has built a ground-validated proprietary digital-map database for locations across India. Besides, it has developed indigenous tools, technologies and systems for data acquisition, processing, productisation and dissemination. All these are difficult to replicate, thereby creating a high entry barrier in the map and navigation business.

8) Are the company's products able to withstand being easily substituted or outdated?

Yes. The location component of data is extremely important and therefore, the company's products can neither be easily substituted nor outdated.

9) Are the customers of the company devoid of significant bargaining power?

No. While the company enters into contracts with its customers, its customers are mainly large enterprises with greater leverage in negotiating contractual agreements.

10) Are the suppliers of the company devoid of significant bargaining power?

No. For tech companies like C.E. Info Systems, suppliers are its employees. With intense competition for talent in the marketplace, especially those with advanced skills, the company's bargaining power is low.

11) Is the level of competition the company faces relatively low?

No. Even though the company's platform is quite unique, it has to compete with different companies in different market segments.

Management

12) Do any of the company's founders still hold at least a 5 per cent stake in the company? Or do promoters hold more than a 25 per cent stake in the company?

Yes. Post-IPO, the promoter and promoter group will hold about a 53.7 per cent stake in the company.

13) Do the top three managers have more than 15 years of combined leadership at the company?

Yes. Chairman and managing director Rakesh Verma (one of the promoters) has been associated with the company since its incorporation in 1996.

14) Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

Yes, we have no reason to believe otherwise.

15) Is the company free of litigation in court or with the regulator that casts doubts on the management's intention?

Yes, the company is free from any material litigation.

16) Is the company's accounting policy stable?

Yes. As per the auditors' report, the accounting policy is stable.

17) Is the company free of promoter pledging of its shares?

Yes. The company's shares are free of any pledging.

Financials

18) Did the company generate a current and three-year average return on equity of more than 15 per cent and return on capital employed of more than 18 per cent?

No, the company's three-year (FY19-21) average return on equity was 12.1 per cent and a return on capital employed of 17.4 per cent. For FY21, the company generated a return on equity of 16.6 per cent and a return on capital employed of 24.8 per cent. Note that, due to the company's cash and current investments being, on average over FY19-21, about 40 per cent of its total assets, the ROE and ROCE figures are optically lower.

19) Was the company's operating cash flow positive during the last three years?

Yes, the company has reported positive operating cash flow during the last three years.

20) Did the company increase its revenue by 10 per cent CAGR in the last three years?

No. The company's revenue increased from Rs 135.3 crore in FY19 to Rs 152.5 crore in FY21 at a CAGR of 6.2 per cent.

21) Is the company's net debt-to-equity ratio less than one or is its interest-coverage ratio more than two?

Yes. The company is debt-free as on September 30, 2021.

22) Is the company free from reliance on huge working capital for day-to-day affairs?

Yes. The company has a strong cash position and its operations do not require huge working capital.

23) Can the company run its business without relying on external funding in the next three years?

Yes. With low capital requirements and high operating leverage, the business generates strong free cash flows, which the company can put to good use.

24) Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

Yes. The company is debt-free as on September 30, 2021.

25) Is the company free from meaningful contingent liabilities?

Yes. The company is free from meaningful contingent liabilities.

Stock/valuations

26) Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No, the stock will only offer an operating-earnings yield of 1.4 per cent on its enterprise value.

27) Is the stock's price-to-earnings less than its peers' median level?

Not applicable. There is no listed peer for the company. Post-IPO, the company's stock will trade at a P/E of around 63.4.

28) Is the stock's price-to-book value less than its peers' average level?

Not applicable. There is no listed peer for the company. Post-IPO, the company's stock will trade at a P/B of around 13.5.

Also read about C.E. Info Systems IPO: Information analysis to learn about key IPO details and important information about the company.

Disclaimer: The authors may be an applicant in this Initial Public Offering