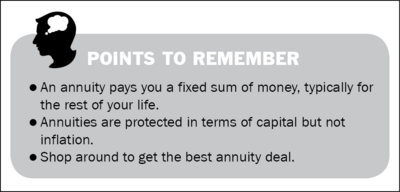

'Annuity' means a fixed sum of money that is paid out to the purchaser every year in return for a lump sum, usually for as long as the purchaser lives. An annuity is typically priced on the basis of product features, longevity and interest rates. Annuities in India are typically 'deferred annuities' or annuities that are purchased on the maturity of a pension plan or NPS scheme. However, immediate annuities that begin paying out immediately after purchase are also available.

Features of annuity

- Eligibility: You should be a resident Indian.

- Minimum entry age: Most issuers offer it to adults above 18 years.

- Maximum entry age: 65 years in most cases.

- Tenure: Fixed option

Lifelong - Payout: Fixed sum

Increasing or decreasing annuity, depending on the plan. - Other aspects: Annuity payout can be monthly, quarterly, half-yearly or yearly.

- Policy holding: Individual

Joint, either-or-survivor - Nomination: Facility is available

Suitability and alternatives

- Suitable for investors looking to derive an assured regular income from their savings.

- Not suitable for investors who do not need any regular income.

- Alternative can be SWP from debt-oriented mutual funds, which can offer better, though not guaranteed, returns, Post Office Monthly Income Scheme, Senior Citizens Savings Scheme*, Pradhan Mantri Vaya Vandana Yojana*

*For senior citizens only

Investment objective and risks

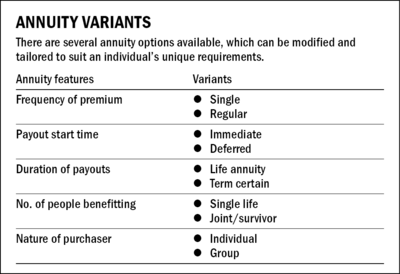

The main objective of an annuity is to provide income in retirement. An annuity can be purchased on retirement or earlier. It can be structured to provide fixed as well as variable income, with or without an insurance cover. There are several options within annuities, which address the specific needs of individuals seeking a defined income source in retirement.

Capital and inflation protection

The annuity payout is fixed and guaranteed as per the terms of the policy through the tenure of the annuity. An annuity is not inflation protected, as the payout is fixed and does not match the inflation-adjusted cost of living. However, certain annuity variants offer increasing annuity payouts, which attempt to match inflation.

Guarantees

The annuity is assured and guaranteed according to the terms and conditions of the annuity contract.

Liquidity

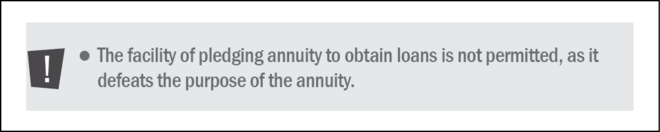

Annuities typically do not have exit options. Certain types of annuity contracts may offer some level of liquidity.

Tax benefits

In the accumulation phase of a deferred annuity plan, the contributions qualify for tax deductions under Section 80CCC, with a limit of Rs 1.5 lakh in a financial year. At the time of vesting, up to one-third of the corpus can be withdrawn tax-free under Section 10(10A), with the remaining paid out as an annuity, which is treated as income and taxed accordingly.

The five payout options offered in an annuity are as follows:

- Life annuity: Annuity for life.

- Life annuity with return of purchase price: Life annuity for the annuitant with return of the originally paid amount on death of the annuitant to the beneficiary

- Joint life, last survivor without return of purchase price: The annuity is first paid to the annuitant. After the death of the annuitant, the spouse receives a pension equal to the annuity paid to the annuitant.

- Joint life, last survivor with return of purchase price: The annuity is first paid to the annuitant. After the death of the annuitant, the spouse receives a pension equal to the annuity paid to the annuitant. After the death of the last survivor, the originally paid amount is returned to the nominee.

- Life annuity guaranteed for five/10/15 years and thereafter: A guaranteed annuity is paid for the chosen term (five, 10 or 15 years) even if the annuitant is not alive. After that, the annuity continues as long as the annuitant is alive.

Where to buy annuity

All life insurers offer deferred annuities, while many offer immediate annuities.

How to buy

Once you have evaluated the amount of annuity needed, look at the available options and fill the appropriate proposal form. You will need to provide the following:

- Date of birth and identity proof, such as the Aadhaar card, passport, driving licence, PAN or voter ID card

- Medical-examination certificate if you include an insurance cover with the annuity

- Nominee details

- Bank account details where the annuity payout will be transferred

How to manage the policy

- You can buy an annuity through a cheque, demand draft or electronically.

- You will be given a policy certificate with the details like your name, annuity type and tenure, with terms and conditions listed.

Other information

- There is a free-look period during which, you can return the policy if you are not happy with it. It varies from 15 days to a month, depending on the insurer.

- Understand the costs and charges on the facilities offered.

- Understand the working of the policy through its tenure, along with the terms and conditions.