Indians' love for gold is well known. However, it is a significant contributor to the current account deficit. Given this, the Indian government has come up with Sovereign Gold Bonds, the Gold Monetisation Scheme and gold coins. Let's look at them, one by one.

SOVEREIGN GOLD BOND SCHEME

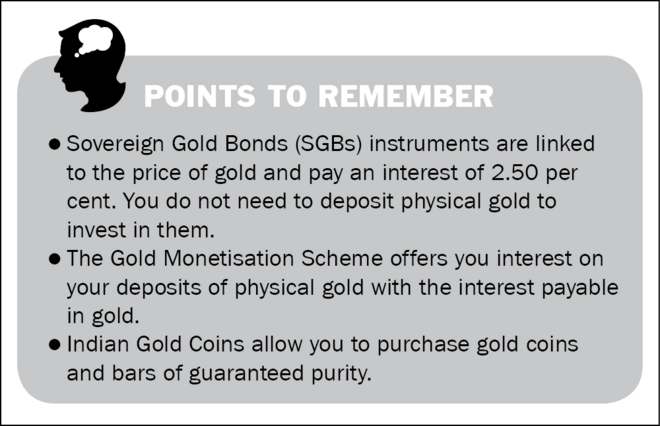

With the intent to provide gold-like returns, along with some interest, the government has launched Sovereign Gold Bond Scheme. Sovereign Gold Bonds (SGBs) are offered every year in tranches. The first tranche was offered in November 2015. In the financial year 2022-23, two tranches of SGBs have already been issued. The latest series III tranche has been issued from December 19 - December 23, 2022.

Features

- Eligibility: Restricted for sale to resident Indian entities, including individuals, HUFs (Hindu undivided families), trusts, universities and charitable institutions.

- Investments: Investors are required to buy a minimum of one gm of gold. The maximum limit that can be subscribed is four kg for an individual in a financial year and 20 kg for other subscribers.

- Interest: A fixed rate of 2.50 per cent per annum payable semi-annually on the initial value of the investment. This is taxable.

- Tenure: The tenure of the bond is eight years, with an option to exit from the fifth year onwards. Capital-gains tax on maturity is exempt for individuals.

Investment objective and risks

The main objective of the Sovereign Gold Bond Scheme is to reduce the demand for gold in the physical form by encouraging people to buy it in the paper form. The rate of interest is currently fixed at 2.50 per cent per year, payable on a half- yearly basis.

Suitability and alternatives

- Suitable for investors who want to make a lump-sum investment in gold for a period of five to eight years.

- Not suitable for investors who wish to buy gold in the physical form.

- Alternatives can be Gold exchange traded funds and Gold mutual funds.

Gold bonds are issued by the RBI on behalf of the government. Under the scheme, gold bonds are issued in multiples of 1 gm. The Scheme offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. SGBs are free from issues like making charges and purity. These bonds can be held in demat form, eliminating the risk of loss of scrip.

Capital protection and inflation protection

There is no capital protection in Sovereign Gold Bond Scheme. Investors get returns linked to gold prices. There is a provision of interest payment. The interest payout is fixed and guaranteed for the tenure of the scheme. This scheme is not inflation protected. The price of the gold bond is linked to gold prices. If gold prices combined with interest payments, outpace inflation, the bond gives positive real returns but not otherwise.

Guarantees

The interest payout is fixed and guaranteed for the tenure of the scheme. The quantity of gold for which, the investor buys gold bonds is protected.

Liquidity

The scheme has a lock-in period of five years. Gold bonds can be transferred, however. Also, if you hold these bonds in demat form, then you can trade them on the stock exchange anytime, even before five years, but liquidity and price risk may exist.

Taxation

Capital-gain tax arising on the redemption of SGB (i.e. at the time of maturity after eight years) to an individual has been exempted. The indexation benefit will be provided to LTCG arising to any person on the transfer of bonds.

Exit option

The tenure of the bond is for a minimum of eight years, with the option to exit in the fifth, sixth or seventh year. To redeem the gold bond, investors can approach the intermediary concerned 30 days before the coupon payment date. Request for premature redemption can only be entertained if the investor approaches the intermediary at least one day before the coupon-payment date. Redemption proceeds are credited to the customer's bank account. On maturity, the investor gets the equivalent rupee value of the quantum of gold invested.

Where and how to buy

Gold bonds can be bought through banks, post offices and the Stock Holding Corporation of India. They are available both in demat and paper forms. Know-your-customer (KYC) norms are the same as those for the purchase of physical gold.

GOLD MONETISATION SCHEME

The Gold Monetisation Scheme allows you to earn interest on the gold you own. It also saves the storage cost for gold. To gain benefit from the scheme, you need to deposit gold in any physical form, jewellery, coins or bars. This gold will then earn interest based on its weight. You get back your gold in the equivalent of 995 fineness gold or Indian rupees, as you desire (this option is to be exercised at the time of deposit).

The deposited gold is lent by banks to jewelers at an interest that is a little higher than the interest paid to the customer. The minimum quantity of deposits is pegged at 30 gm to encourage even small deposits.

Features

- Eligibility: Restricted for sale to resident Indian entities, including individuals, HUFs (Hindu undivided families), trusts, universities and charitable institutions.

- Tenure: One to three years; five to seven years; twelve-fifteen years.

- Minimum deposit: 30 gram (any form - bullion or jewellery).

- Interest and taxation: Interest paid in gold or rupee terms as per the bank scheme. Fully tax exempt, no capital gains.

Tenure

The designated banks accept short-term (one to three years) bank deposits, as well as medium (five to seven years) and long- term (twelve to fifteen years) government deposits. Premature withdrawal is allowed with a penalty subject to a minimum lock-in period which differs from bank to bank.

How to open an account

You need to first go to a collection and purity-testing centre to ascertain the purity of your gold. You can deposit your gold if it clears the criterion set for gold content. You will be provided with a certificate of purity and gold content. You will need to present the certificate to the bank where you want to open the account. Remember that since the gold that you deposit will be melted, you won't get back the gold in the same form as you had deposited.

Taxation

The earnings from the scheme are exempt from capital-gains tax, wealth tax and income tax.

Redemption

You can take cash or gold on redemption, but the preference has to be stated at the time of deposit.

Interest

Interest to be paid to the depositors of gold can be valued in gold or denominated in INR as per the bank's scheme. For example, if it is paid in gold and a customer deposits 100 gm of gold and gets 1 per cent interest, then, on maturity, he has a credit of 101 gm. On the other hand, if it is paid in rupee form, it will be calculated on the value of gold prevailing on the date of creation of deposit. The interest rate is decided by the banks concerned.

INDIAN GOLD COIN

The Indian Gold Coin is part of the Indian Gold monetisation program. The government has launched the Indian gold coin, with the Ashoka Chakra on one side and Mahatma Gandhi's picture on the other. It is the only BIS hallmarked coin in India. The coin is available in denominations of 5 gm and 10 gm. Recently, the government has allowed minting of Indian Gold Coin in smaller denominations of 1 gm and 2 gm also. Gold bars/bullion of 20 grams are also available. The Indian Gold Coin has advanced security features and tamper-proof packaging.

Features

- Purity: 24-carat purity and 999 fineness. As per the new rules, it will be made available in 24-carat purity of 995 fineness also.

- Availability: Distributed through designated and recognised MMTC outlets, jewellers, banks and post office.