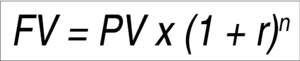

The compounding formula is very simple. It is something we learn in school but never fully appreciate.

Here,

FV is the future value

PV is the present value

r is the rate of interest, and

n is the number of years

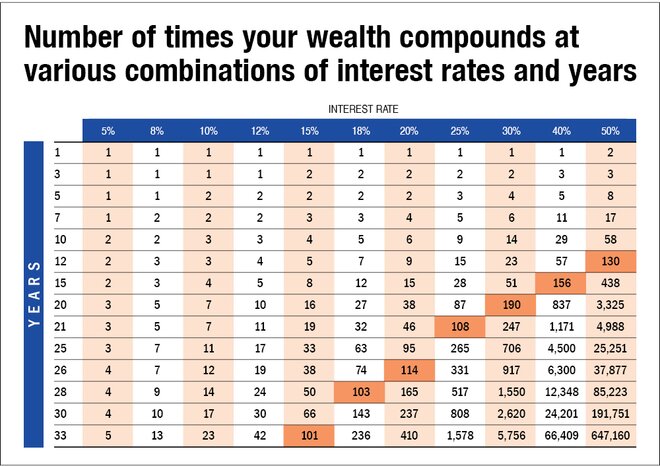

When it comes to investing, the majority of people will focus on the interest rate (r), rather than the number of years (n). It is interesting because it is actually the 'n' that makes compounding possible in the first place. Granted that a high 'r' is great, but chasing it for higher returns is not the only way because sustaining a decent return for a long period of time can do wonders. If you don't believe me, then take a look at the following table.

This table shows the number of times your wealth compounds at various combinations of interest rate and time. Take the number 101, at the intersection of 15 per cent return and 33 years. This means that your initial amount compounds 101 times at 15 per cent interest when held for 33 years. A similar interpretation can be made for other numbers as well. Mathematically, 100 times returns are possible through the following combinations:

15 per cent for 33 years,

18 per cent for 28 years,

20 per cent for 26 years,

25 per cent for 21 years,

30 per cent for 18 years,

40 per cent for 17 years, and

50 per cent for 12 years

Now you might notice that the 100 times compounding happens way faster at the 25 per cent and above interest rates. There have been companies in the past that have compounded at those high rates and there will be companies that will compound at such rates in the future as well. While they seem tempting, what you should really wonder is this: Am I equipped to find such companies? Am I capable of researching them and then bold enough to back my conviction? Be honest when you answer these.

The other great aspect of compounding is that it is back-ended. What does that mean? Look at the column for the 15 per cent interest rate. Notice that it takes 28 years to reach 50 times, however, in another 5 years, you get to 100 times. This is common across all interest rates and gets more pronounced as rates increase. This is why Charlie Munger says, "The big money is not in the buying or the selling, but in the waiting." Patience is key to financial success.

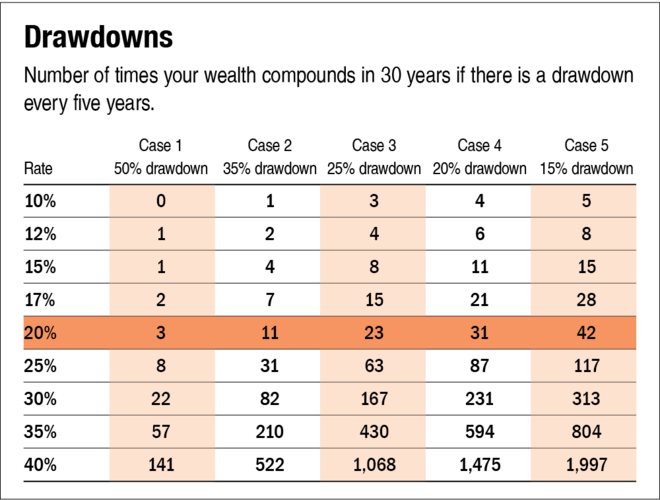

Now, not everything is as smooth as the table depicts. You see, the path to 100 times mentioned above is not linear. You are not going to get the same return year after year. There will be ups and downs. And that makes things quite tricky (or rather interesting). So let's focus on the 'down' part of it.

The table shows how much your initial amount will compound after undergoing a drawdown every five years in a 30-year investment horizon under various interest rates. Take the 20 per cent row, for instance. Under case 1, with a drawdown of 50 per cent every five years, even though the interest rate is a respectable 20 per cent, your wealth only compounds three times as much. Similarly, under case 2, with a drawdown of 35 per cent every five years, your wealth compounds 11 times. Now mathematically, compounding at 20 per cent interest for 30 years should compound your wealth 237 times. This should enable you to see the perils involved in investing. These drawdowns can be caused through external events like COVID-19, global financial crisis etc., or investor-related factors like speculating in stocks, rather than looking for good companies. While the drawdown examples may seem a bit extreme, one thing is clear - mistakes and irrationality do not get rewarded in the long-run.

So what should you do to reap the benefits of compounding? First, it is better to stay invested for a long period of time than to chase higher returns. It won't be easy. You'll have to tackle the psychological biases that we humans are ridden with. Second, start early. Most people begin thinking about their financial security quite late in life. By starting in your 20s or early 30s, even with small amounts, the results will be astounding.