In our previous part of the story, we learnt about the primary drivers of free cash flows. Here we will see how investors may become a victim of incomplete understanding which can impact their valuations.

Why focus only on free cash flows in the case of Consistent Compounders?

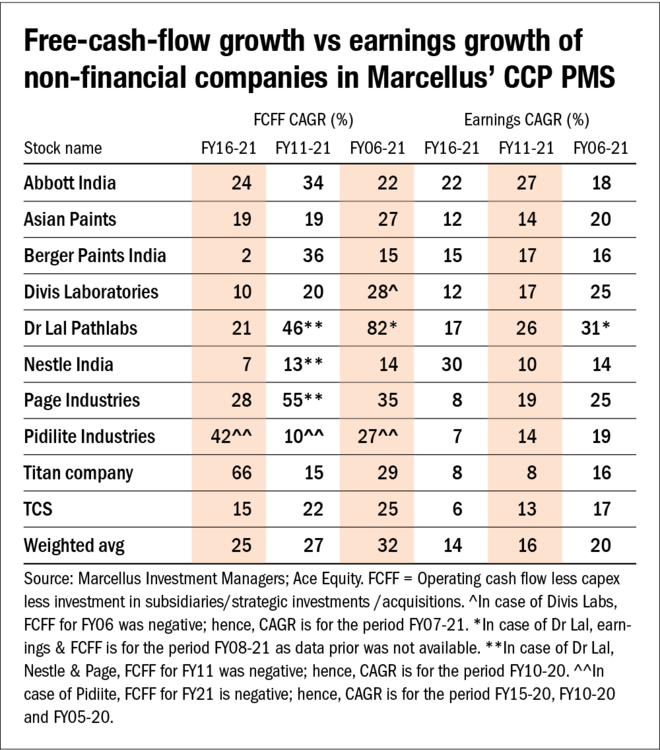

In Marcellus' Consistent Compounders Portfolio (CCP), there are several companies whose growth in free cash flows tends to be far greater than the growth in their profits. As shown in the table 'Free-cash-flow growth vs earnings growth...', FCFF (free cash flow to the firm) CAGR of our portfolio companies (ex-financials) has been 11-12 percentage points higher than the earnings CAGR consistently over the past five, 10, 15 years. As a result, investors focusing on only the income statement or profits of these companies often get an incomplete understanding of their competitive advantages and hence valuations.

A combination of the following three reasons makes most companies in Marcellus' Consistent Compounders portfolio akin to Type 3 companies defined in the previous story.

1. Focus on in-house manufacturing and distribution of products and services which are of day-to-day essentials

Our portfolio companies sell essential products and services such as pathology diagnostics, infant milk powder, undergarments for daily wear, OTC medication for daily consumption, etc. The small ticket sizes of these essential offerings orient their businesses towards large volumes of sales. Distribution of small-ticket, high-volume products to every nook and corner of India gives rise to complexities around management of inventory, receivables as well as payables in the supply chain.

Additionally, even though these companies have the option to outsource manufacturing at the back end and distribution at the front end, most of them have chosen to keep these functions in-house. For example, Nestle manufactures most of its product at its own factories. Page Industries is the only apparel manufacturer which employs its entire labour workforce on their payrolls, does not rely on wholesale-oriented distribution and also owns all fixed assets related to its manufacturing plants. Asian Paints directly sells its products to paint dealers on the high street, without any involvement of distributors or wholesalers and also manufactures all its products at its own manufacturing plants.

Due to in-house manufacturing and distribution of small-ticket, high-volume products and services, our portfolio companies have a massive opportunity for deriving operating efficiencies around working-capital cycles and asset turns.

2. Lack of price hikes to suffocate competition

In our June 1, 2020, newsletter (https://bit.ly/3nAW0Ix), we had highlighted that firms in Marcellus' CCP Portfolio - like Asian Paints, Abbott India, Dr Lal PathLabs - have historically avoided hiking product prices meaningfully. This is because by focusing more on volume of sales (rather than value), these companies do not intend to leave any room for their competitors to start any price wars to gain market share. Such firms consistently derive incremental operating efficiencies through investments in technology, systems and processes. These operating efficiencies help offset the adverse effect of inflation in raw material and operating cost, and hence negate the basic need to hike product prices. If competitors cannot match the quantum of such incremental operating efficiencies, they get suffocated because of lack of price hikes from the market-leading player.

3. Investments in technology to derive operating efficiencies which further strengthen their moats

There are several technology-based ingredients of competitive advantages of our portfolio companies which drive a greater rate of free-cash-flow growth compared to profit growth. For example, superior understanding of the end consumers' demand and preferences helps the manufacturer reduce dead inventory in its supply chain/distribution channel and convert working capital into cash much quicker compared to the competition. A faster cash-conversion cycle then helps the manufacturer to carry out activities such as making quicker payments to raw-material vendors and avoiding price hikes despite generating high returns on capital employed. Moreover, there exists immense scope for deriving operating efficiencies through initiatives such as the use of technology to automate manufacturing processes, reduce cycle times, derive raw-material procurement efficiencies to sweat the fixed assets harder.

Most of the tech-investment-related competitive advantages are difficult for competitors to replicate, either because they are based on proprietary data, or because they were done over a period of time as part of the DNA of the organisation, rather than investments that were done at a single point of time in the past.

There is more to the story: