In our previous part of the story, we learnt the reasons which make most companies in Marcellus' Consistent Compounders portfolio similar to Type 3 companies defined in the first part of the story.

Here is an example of a Consistent Compounder which has focused on free-cash-flows-oriented initiatives.

Titan: A case study

In India, all jewellers outsource manufacturing of gold jewellery to the karigar (goldsmith) community which is highly unorganised and marked with outdated practices/technologies of manufacturing, along with poor work conditions. The resulting challenge is inefficient supply chain in form of higher wastage, high manufacturing lead times, leading to high investment in RM/WIP (raw material/work-in-process) inventory of a high-value commodity like gold. Titan radically disrupted the status quo, starting with the basics by engaging with karigars to upgrade their working conditions by providing health benefits, financing procurement of modern equipment, and investing in land and building for four 'karigar centres' designed to improve lifestyle of karigars. Moreover, once the basics were addressed, Titan worked with karigars to train them around efficient practices like theory of constraints and lean manufacturing, resulting in significant improvements in manufacturing efficiency. As a result, over the period FY05-FY11, manufacturing lead time at vendors reduced from about 35 days to about six days, effectively reducing WIP inventory at vendors by one-sixth and improved Titan's ability to offer faster turnaround times and improved stock availability to its customers. While most of the plain gold jewellery manufacturing is outsourced to karigars, bulk of Titan's diamond jewellery products are manufactured in-house, where Titan used robotics to automate manual processes. This has improved capacity by 10 times over FY05-11 and has freed up hundreds of man-days of its workers.

Investment implications

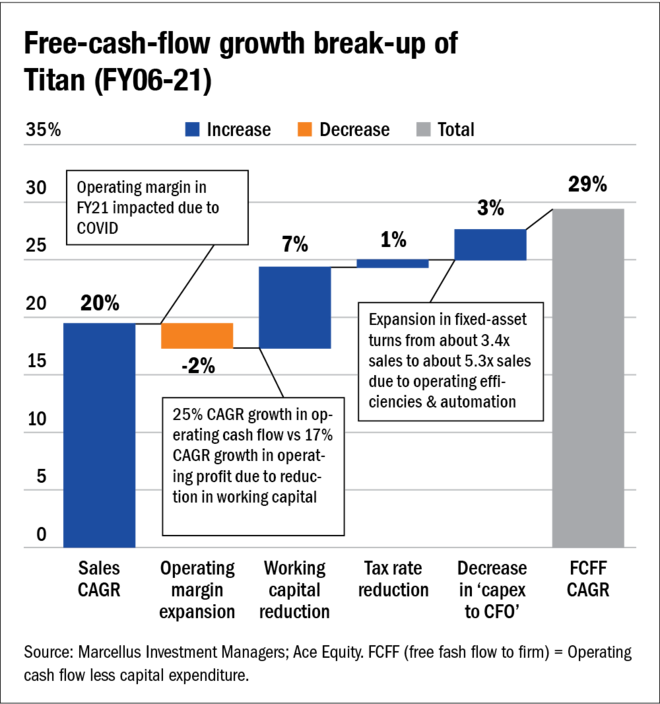

There are four possible drivers of free cash flows of a firm:

1) Volume growth or revenue growth

2) Operating margins or profit growth

3) Reduction in working-capital cycles or operating-cash-flow growth

4) Increase in asset turnover or free-cash-flow growth

When it comes to high-quality companies, investors who have focused only on volume growth and profit growth (or only P/E multiples) and have ignored the other two factors have only partially been able to understand the long-term compounding ability of these companies. Having said that, building an understanding around working-capital cycles and asset-turnover prospects is far harder than understanding a company's earnings growth prospect for two key reasons. Firstly, it requires greater depth of research around the business's operating efficiencies. And secondly, it requires a greater degree of patience from an investor, because free cash flows can be far more volatile in the short term compared to profits or book value per share.

Note: All the firms named in table/chart are part of Marcellus Investment Managers' portfolios.

Previous parts of the story:

Free cash flows: Primary drivers

Free cash flows: Consistent Compounders Portfolio