With the activation of the RBI Retail Direct portal by PM Narendra Modi on November 12, retail investors can now invest directly in government securities (G-secs), such as central-government bonds, treasury bills, sovereign gold bonds and state-development loans.

Until now, if you wanted to invest in G-secs, you had to either take the indirect route through debt funds or go through other intermediaries/stock exchanges. There was no direct avenue available.

No fees, except for the one for the payment gateway, will be charged for opening and maintaining the Retail Direct gilt account (RDG account) and for submitting bids in primary auctions. This makes the new scheme doubly interesting. In the first part of this two-part series, we'll see how to use this portal.

How to open an RDG account

To open an RDG account, you should have a savings bank account, a PAN number, a valid document for KYC, an email ID and a mobile number. Next, just go to www.rbiretaildirect.org.in and register on it. Once you register, the portal will request you to initiate the KYC process. The post-registration window pretty much sums up the steps that one has to go through. Post this, your login credentials will be emailed to you.

Registered investors can use the portal to view their account statement, nominate, pledge/lien securities held in the RDG account, gift G-secs to other Retail Direct investors and for grievance redressal.

Using the primary-market dashboard

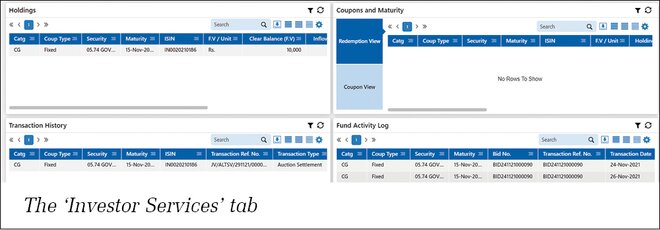

The primary market is where G-secs are sold for the first time. In the 'Primary Market' dashboard of Retail Direct, the bonds available for bidding can be viewed under 'Auction Watch'. In the bottom right corner, one can check their activity i.e., bids, allotments, etc. The portal also provides an 'Investor Services' tab, which highlights the details of all holdings, transactions, etc.

We tried to bid for a central-government bond. First, we selected the bond and then filled in the bidding amount. On confirming, we received an SMS from CCIL (Central Clearing Corporation of India) and an email from the Retail Direct portal to make the payment against the bid request. In about two days, we received the allotment details over SMS and email.

Using the secondary-market dashboard

The secondary market is where buying and selling happen after the initial public sale of the security. To buy and sell bonds in the secondary market, you will need to separately request access via the RBI Retail Direct 'Primary Market' dashboard. For that, click the green link in the top-right corner - NDS-OM (it stands for Negotiated Dealing System-Order Matching Segment). Post approval (which for us took about one-and-a-half-day), you will receive the login details.

When you log in, you will be redirected to the NDS-OM dashboard. By clicking on the help (?) button in the top right corner, you can access the user guide to help you understand the various functions.

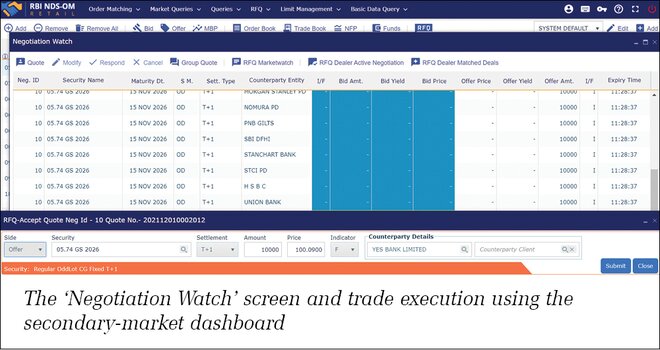

To test the efficiency of the NDS-OM portal, we tried to sell the security which was allotted to us. We used the 'RFQ' (Request for Quote) module for the same. This allows you to request quotes from primary dealers, who are specialised market makers in G-secs.

On clicking the RFQ menu, we selected 'Group Quote' from the dropdown. This enables one to place a bid/offer negotiation quote against a group of members. The portal also provides you the facility to create one's own group of members.

Once the order was placed, we got responses from the counter parties. This gives us the flexibility to seek best quotes from a group of counterparties. One can see the quotes in the 'Negotiation Watch' screen and respond by double-clicking on the same. One can negotiate or accept the quote offered.

On accepting and subsequently confirming the offer, it results in trade of the security. Notice the indicator value changed to 'F' from 'I'. This means the offer now is firm and not indicative anymore.

While there was no email communication post this step, one can always download the 'Deal Ticket,' which mentions all the trade details. This can be accessed by clicking on the 'RFQ Dealer Matched Deals'.

As per the normal standards, the sale proceeds were credited to our bank account on the settlement date (T+1) at the end of the day.

In next part, we'll explore what alternatives you have that can substitute investing in G-secs directly through the RBI portal.