What is Senior Citizen Savings Scheme?

Retirement brings with itself several complications and doubts, but there are savings products that are safe and ensure guaranteed retirement income. The Senior Citizen Savings Scheme (SCSS), launched in 2004, is a deposit scheme introduced by the Government of India to provide guaranteed returns to senior citizens. This scheme ensures a regular income stream for senior citizens post- retirement.

Features of Senior Citizen Savings Scheme

- Eligibility: You need to be a resident Indian to open an account.

- Entry age: 60 years. 55 years for those who have retired on superannuation or under a voluntary or special voluntary scheme. The retired personnel of defence services (excluding civilian-defence employees) are eligible to invest on attaining the age of 50 years subject to the fulfilment of the specified conditions.

- Investments: Minimum: Rs 1,000. Maximum: Rs 15 lakh (Rs 30 lakh jointly with spouse). Deposits have to be in multiples of Rs 1,000. Only one deposit is allowed.

*Starting April 1, 2023, the government has increased the investment ceiling for the Senior Citizen Savings Scheme (SCSS) from Rs 15 lakh to Rs 30 lakh for individual accounts and from Rs 30 lakh to Rs 60 lakh for accounts held jointly with a spouse. - Tenure: Five years; can be extended by three more years.

- Account-holding categories: (i) Individual (ii) Jointly with spouse (iii) Multiple accounts allowed.

- Nomination: Facility is available.

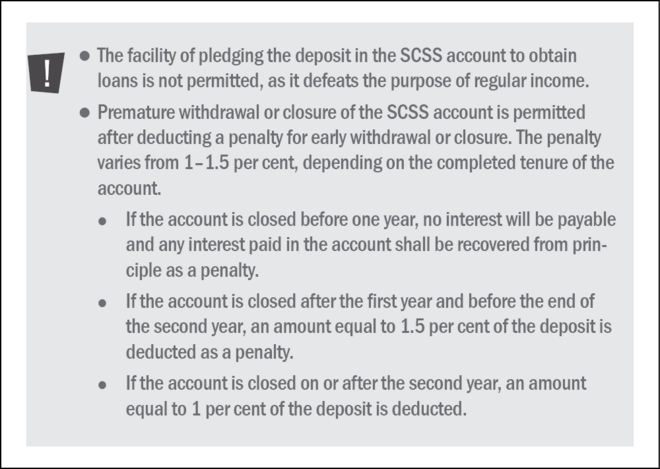

- Exit option: Premature closing of the account is permitted with a penalty.

Capital protection and inflation protection

The capital in the SCSS is completely protected, as the scheme is backed by the Government of India. The SCSS is not inflation protected, which means whenever inflation is above the current interest rate, the deposit earns no real returns. However, when the inflation rate is below the current interest rate, it does manage a positive real rate of return.

Investment objective and risks

The main objective of the SCSS is to provide an assured return every quarter to senior citizens, which helps them create a guaranteed regular income flow.

Suitability and alternatives

- Suitable for senior citizens looking to derive an assured regular income from their savings.

- Not suitable for investors who do not need any regular income.

- Alternatives can be Pradhan Mantri Vaya Vandana Yojana, Annuity plan of a life insurance company, Post Office Monthly Income Scheme, SWP from a debt-oriented mutual fund, which can offer better, though not guaranteed, returns.

Senior Citizen Savings Scheme interest rate

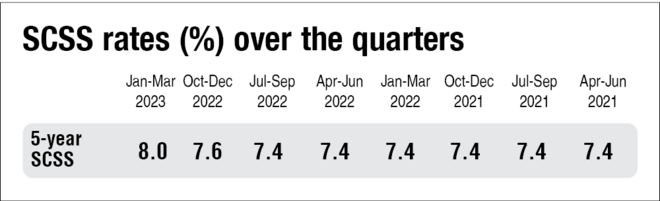

Currently 8.2 per cent per annum compounded annually. The interest is paid on the last working day of March, June, September and December.

The interest rate for your deposit is fixed for the full 5-year term, meaning that you will receive the same rate even if the interest rates for the SCSS scheme change over time.

Guarantees

Interest rates are aligned with G-sec rates of similar maturity, with a spread of one per cent. The government has decided to review the SCSS rates quarterly. However, once a subscriber has enrolled, the rates will remain unchanged for the tenure. For the Apr-Jun 2023 quarter, the rate has been set as 8.2 per cent compounded annually. The payout of interest is quarterly.

Liquidity

The SCSS is liquid, despite a five-year lock-in. One can make withdrawals subject to conditions and penalties.

Tax implications

The sum invested in the SCSS on or after April 1, 2007, is eligible for a tax deduction under Section 80C of the Income-Tax Act. Interest earned above Rs 50,000 is fully taxable and is also subject to TDS. As per section 80TTB, senior citizens are allowed to take deduction of interest earned from all types of deposits with banks, co-operative banks and post offices subject to an overall maximum limit of Rs 50,000.

Where to open a SCSS account

The SCSS account can be opened at any head post office or general post office. Select branches of several designated nationalised banks - Indian Bank (including merged Allahabad Bank), Union Bank of India (including merged Andhra Bank and Corporation Bank), State Bank of India, Bank of Baroda (including merged Dena Bank and Vijaya Bank), Bank of India, Bank of Maharashtra, Canara Bank (including amalgamated Syndicate Bank), Central Bank of India, Indian Overseas Bank, Punjab National Bank (including merged United Bank of India), UCO Bank and IDBI Bank offer the SCSS. ICICI Bank is the only private bank that offers the SCSS.

How to open a SCSS account

Once you have selected the bank to open the SCSS account, you will first need to open a savings bank account. You will need the following documents:

- An account-opening form, which the bank will provide.

- Two passport-size photographs.

- Aadhaar card. In the absence of the same, you need to provide a copy of the acknowledgement of your Aadhaar application.

- Address and identity proof, such as the Aadhaar card, passport, PAN (permanent account number) card or declaration in Form 60 or 61 as per the Income-Tax Act, 1961, driving licence, voter's identity card or ration card.

- Carry the original identity proof for verification at the time of account opening.

To view the current rates on the schemes, go to vro.in/s34211