What is Pradhan Mantri Vaya Vandana Yojana scheme?

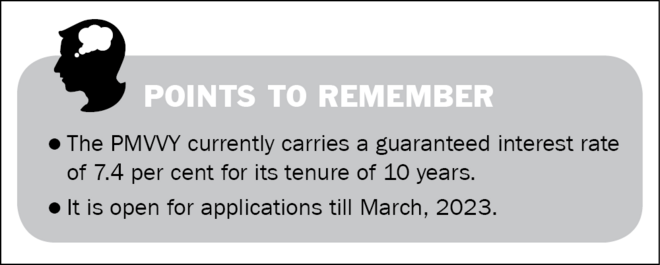

Prime Minister Narendra Modi announced his intention to launch a scheme for senior citizens in his New Year's eve address in 2016. This eventually crystallised into Pradhan Mantri Vaya Vandana Yojana (PMVVY). The scheme (though marketed as a pension) is essentially a fixed deposit with LIC and has a guaranteed interest rate of 7.4 per cent (for FY 2021-22) for a period of 10 years. Effective from FY 2020-21, annual reset of rate of return will occur in every FY. But the interest rate will remain constant for you for the entire tenure of the scheme. On the expiry of this term, you will get your principal back.

Features of Pradhan Mantri Vaya Vandana Yojana

- Eligibility: You must be 60 years of age or above

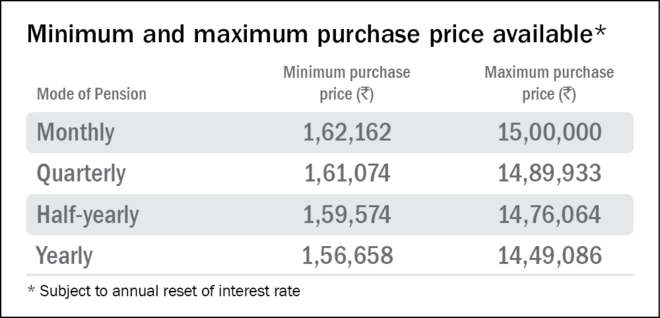

- Investment: Minimum Rs 1.57 lakh. Maximum Rs 15 lakh.

- Tenure: 10 years

- Other features: Premature exit is available in the case of a critical illness. 98% of the deposit will be refunded in such a case.

Pradhan Mantri Vaya Vandana Yojana interest rate

7.4 per cent and is subject to annual reset.

Investment objective and risks

The investment objective of the PMVVY is to provide senior citizens with a guaranteed rate of return on their long-term deposits. PMVVY deposits are vulnerable to inflation.

Suitability and alternatives

- Suitable for senior citizens looking to derive assured regular income from their savings.

- Not suitable for investors who do not need regular income.

- Alternatives can be Senior Citizens Savings Scheme, Annuity plan of a life insurance company, Post Office Monthly Income Scheme, SWP from a debt-oriented mutual fund which can offer better, though not guaranteed, returns.

Capital and inflation protection

The capital in the PMVVY is fully protected. However, there is no inflation protection.

Guarantees

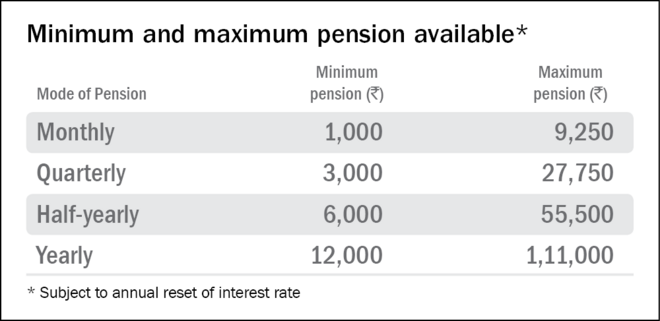

The interest rate on the PMVVY is guaranteed. You can choose monthly, quarterly, semi-annual or annual payout. Opting for an annual payout raises your return slightly.

Liquidity

Premature exit is possible in the case of critical illness and 98 per cent of your deposit will be refunded. The scheme was earlier open till March, 2020. However, it has been further extended till March, 2023. You can buy it online or offline from LIC.

Exit option

The deposit in the PMVVY is locked in for its tenure with the exception of the exit option mentioned above. However, on the death of the depositor, it will be returned to the beneficiary.

Loan

Loan facility is available on completion of three policy years. The maximum loan that can be granted will be 75 per cent of the deposit. The rate of interest to be charged for the loan amount shall be determined at periodic intervals. For the loan sanctioned till April 30, 2021, the applicable interest rate is 9.5 per cent p.a. and will be recovered from the pension amount payable under the policy. However, the loan amount will be recovered from the claim proceeds at the time of exit.

Pradhan Mantri Vaya Vandana Yojana tax benefit: Tax implications

The interest on the PMVVY is fully taxable. There are no tax deductions on the capital contributed to the PMVVY.

How to buy

You can invest in the PMVVY offline by visiting a LIC office or online through www.licindia.in

To view the current rates on the schemes, go to vro.in/s34211