What is Kisan Vikas Patra?

Kisan Vikas Patra (KVP) is a popular and safe small-savings instrument that doubles the invested money in 10 years and four months at the current rate. This scheme is backed by the government. After withdrawing it, the government relaunched it on November 18, 2014. The money raised through the KVP is used in welfare schemes for farmers.

Features of Kisan Vikas Patra

- Eligibility: One has to be a resident Indian to purchase this product.

- Entry age: No age limit is mentioned.

- Minimum investments: Minimum: Rs 1,000. Maximum: There is no upper limit.

- Other aspects: Premature encashment is allowed.

- Account-holding categories: Individual, Joint, Minor through the guardian, and Minor above 10 years.

- Nomination: The facility is available for existing investors.

- Exit option: Premature withdrawal is permitted at a cost for investors.

Interest rate for Kisan Vikas Patra

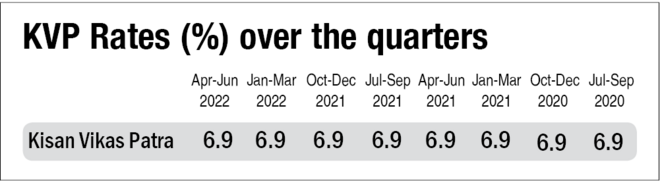

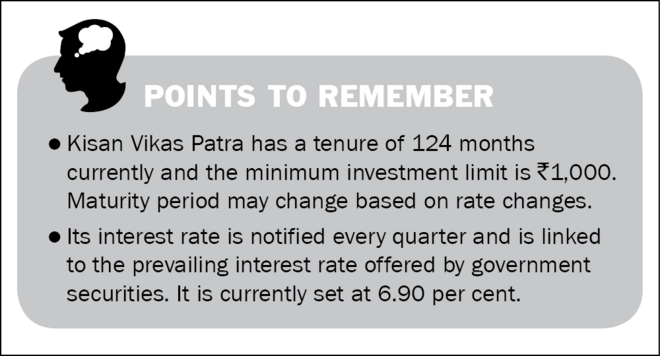

The interest rate for KVP is 6.90 per cent compounded yearly.

Maturity period of Kisan Vikas Patra

The maturity period may change based on rate changes. Currently, it is 124 months; 10 years four months.

Capital protection and inflation protection

The capital in the KVP is completely protected, as the scheme is backed by the Government of India. The KVP is not inflation protected. This means that whenever inflation is above the current guaranteed interest rate, the deposit earns no real returns. However, when the inflation rate is under the guaranteed rate, the KVP can manage to give a positive real rate of return.

Investment objective and risks

The main objective of the KVP is to double the sum deposited. The objective of doubling the investment is easy for any investor to understand. The government backing and guarantee make it a popular route of investments for small savers.

Suitability and alternatives

- Suitable for conservative investors seeking assured returns from a lump-sum investment.

- Not suitable for investors who can assume some risk by investing in equity-linked investments, which can generate much higher returns in the long term.

- Alternatives can be Equity mutual funds/ Direct stock investing (for those who can assume risk), RBI Savings Bonds, Company Deposits, Bank fixed deposits, though the rate of return is lower.

Guarantees

The interest rate in the KVP is guaranteed. Currently, it is 6.90 per cent compounded yearly. The KVP rates are notified every quarter as per the prevailing government-bond rates. However, once you have made an investment, the rate will remain unchanged for you throughout the tenure.

Liquidity

Liquidity is offered as loans and withdrawals, which are subject to conditions. The minimum lock-in period is 30 months, after which it can be encashed by paying a penalty. Also, it can be transferred from one person to another any number of times.

Tax implications

There is no tax benefit on the deposit or the interest that the KVP earns. There is no tax deducted at the source.

Where to buy

One can buy the KVP at any head post office, general post office, any designated nationalised bank, or State Bank of India.

How to buy

- You have to fill the KVP application form available at the post office or the designated banks.

- Original identity proof for verification at the time of buying is required.

- You can choose a nominee.

Other information

- The KVP can be encashed at any post office or nationalised bank in India, provided one has obtained a transfer certificate to the desired post office or bank.

- The KVP is transferable across post offices and designated banks for existing investors.

- Interest income is taxable but no tax is deducted at the source.

To view the current rates on the schemes, go to vro.in/s34211