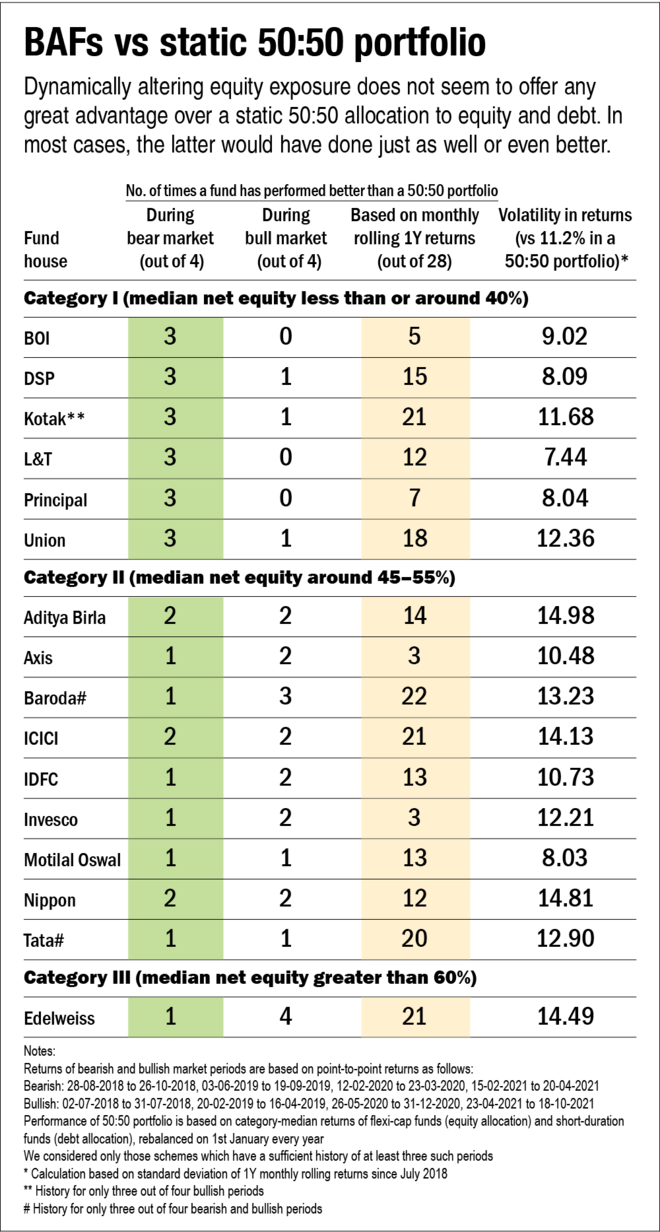

To find out whether the dynamic allocation adds any value for investors, we compared BAFs with a 50:50 portfolio of equity (flexi-cap funds) and debt (short-duration funds), with the portfolio rebalanced at the start of every year. Flexi-cap equity funds and short-duration debt funds should be part of an investor's core portfolio and are therefore suitable for this comparison. We compared the performance during different phases of the market, along with one-year rolling returns in the past three-four years of their existence. Though it is a limited timeframe, the results suggest that dynamically altering the equity exposure does not offer any significant advantage. In most cases, a 50:50 allocation would have done just as well or even better than a BAF (see table 'BAFs vs static 50:50 portfolio').

We examined the quantum of underperformance or outperformance of individual funds as against the 50:50 portfolio. Funds with median net equity of up to 40 per cent captured the downside better but couldn't encash on the upside as much. The performance of the Kotak and Union funds stands out in this segment of DAAFs. Among funds with a median net equity of 45-55 per cent, schemes of Baroda, ICICI and Tata have done a decent job. However, the ICICI fund takes riskier calls on the debt side as compared to other schemes as it holds 5-10 per cent of the assets in both papers rated AA & below and perpetual bonds. The last segment has only one fund from Edelweiss AMC. Its asset allocation is more like an aggressive hybrid, which shows in its outperformance during bullish periods.

Though returns are critical, investors must also be concerned about volatility. We looked at whether BAFs are less volatile than a 50:50 portfolio and thus safeguard investors' mental peace? There is not much good news on this front either. Most BAFs (nine funds out of 16) have been more volatile (based on standard deviation of one-year monthly rolling returns since July 2018) as against the 50:50 portfolio. The ones with lower volatility have generated much lower returns.

Please note that this analysis is based on a limited available history since July 2018. A longer performance history across various market cycles can lead to a more robust and accurate analysis.

Also in this series:

Part 1: Balanced advantage funds: What drives their popularity?

Part 2: Balanced advantage funds: A case of 'pinky' promise or 'pompous' promise