In our previous story, we read about the factors that boost the S-curves for companies. In this story, we will see the investment implications when it comes to the S-curves.

An investor looking to buy and hold high-quality stocks over a long time period needs to be able to differentiate between businesses which can deliver longevity of consistently healthy free cash flows and those that run a high degree of uncertainty in their fundamental prospects.

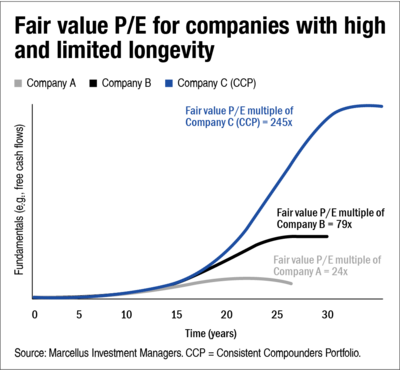

As highlighted in chart 'Fair value P/E for companies with high and limited longevity', even if two companies have the same slope of the S-curve (i.e., rate of growth of fundamentals), greater longevity of the business has a disproportionate impact on the company's fair value (25 times P/E multiple vs 250 times P/E multiple). This differentiation is essential, both in order to avoid premature exits from investments in great-quality franchises due to concerns around expensive valuations (example, P/E multiples higher than 30 times), and to avoid being tempted into investing in inferior-quality franchises just because they are trading at apparently cheap valuations (a 10 times P/E multiple might actually be super-expensive).

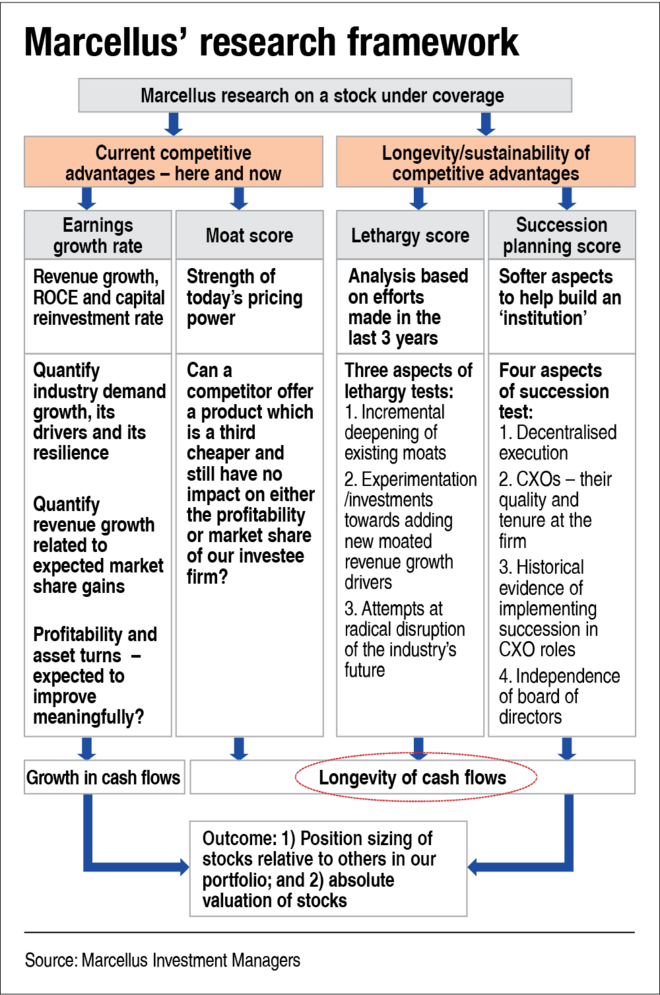

At Marcellus, we assess and quantify the longevity of S-curves using our proprietary 'longevity framework' (see chart 'Marcellus' research framework').

Note: Asian Paints, Berger Paints, HDFC Bank, Pidilite, Titan and Page Industries are part of many of the portfolios managed by Marcellus Investment Managers.

Previous parts of the story: