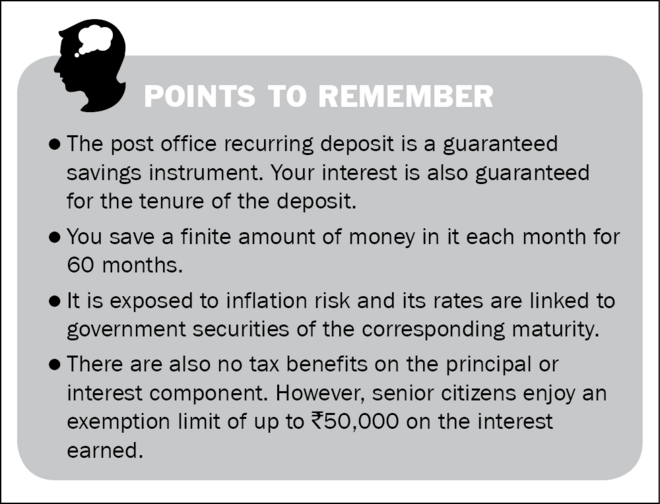

The Post Office Recurring Deposit (PORD) is a systematic savings plan, where you save small but finite equal sums of money each month for a period of 60 months. The savings in the post office recurring deposit earn fixed interest, which can be used to accumulate sizeable and predetermined savings over time.

Features of Post Office Recurring Deposit

- Eligibility: You need to be a resident Indian preferably with a post office savings account.

- Entry age: No age limit is mentioned. Minors above 10 years can open an account in their name directly.

- Investments: Minimum-Rs 100 and above in multiples of Rs 10 thereof. Maximum-There is no upper limit.

- Tenure: 60 months (5 years).

- Account-holding categories: Individual, Joint, Minor through the guardian, and Minor above 10 years.

- Nomination: Facility is available.

- Exit option: Premature closing of the account is permitted with a penalty.

Investment objective and risks

- The main objective of the post office recurring deposit is to provide an assured return, compounded quarterly, on every monthly deposit made over 60 months. Though it offers no tax incentives, it is a preferred instrument amongst small savers because of the government backing that it offers.

- There is no risk associated with this investment.

Suitability and alternatives

- Suitable for conservative investors seeking assured returns by investing regularly for medium-term goals up to five years away.

- Not suitable for long-term wealth creation, given its inability to provide any meaningful returns above the rate of inflation.

- Alternatives can be a bank recurring deposit. SIP in debt mutual funds is also a viable option and can offer better returns, though not guaranteed.

Post office RD interest rate

The rate of interest in post office recurring deposit is 5.80 per cent compounded quarterly.

Capital & inflation protection

The capital in the post office recurring deposit is completely protected, with guaranteed returns, as the scheme is backed by the Government of India. The PORD is not inflation-protected. Whenever inflation is above the guaranteed interest rate, the scheme earns no real returns. But when the inflation rate is below the guaranteed rate, it does manage a positive real return.

Guarantees

The principal and interest on the Post Office Recurring Deposit are absolutely guaranteed. The interest rate is currently 5.80 per cent per annum compounded quarterly. The interest rate on this deposit is notified quarterly and is aligned with G-sec rates of the similar maturity, usually with a spread of 0.25 per cent. However, it will remain unchanged for the depositor once he has made the deposit.

Liquidity

One-time withdrawal of up to 50 per cent of the balance is allowed after one year. However, it is treated as a loan and can be repaid in one lump-sum or in equal monthly instalments till maturity of the post office recurring deposit along with interest @ 2% + RD interest rate applicable to the PORD account. The account can also be closed prematurely after three years from the date of account opening but in such a case, Post Office Savings Account interest rate will be applicable.

Tax implications

There is no tax advantage on these deposits and the interest earned on maturity is treated as income from other sources when computing income tax.

Where to open an account?

You can open the account in any post office.

How to open an account?

Once you have selected the post office to open the post office RD account, you will first need to open a post office savings account to link the monthly payment to the PORD and you will need the following documents:

- An account opening form, which the post office will provide

- Two passport size photographs

- Aadhaar card. In the absence of the same, you need to provide a copy of the acknowledgement of your Aadhaar application

- Address and identity proof such as the Aadhaar card, a copy of the passport, PAN (permanent account number) card, driving licence, voter identity card, or ration card

- Carry the original identity proof for verification at the time of account opening

- Choose a nominee

How to operate the account?

- You need to credit the initial account opening sum to the account with a pay-in slip.

- Payment can be made in cash, by cheque or instructing the bank to transfer money to the post office RD.

To view the current rates on the schemes, go to vro.in/s34211

*Joint B accounts are the accounts that can be operated by either of the account holders/either of the survivors.