The international fund category is not a new kid on the block but definitely one of the most popular ones of late. The charm of overseas investing picked up, particularly after COVID made its landfall when international funds started outperforming diversified domestic equity funds such as flexi-caps. Further, there is also a growing realisation among Indian investors that investing part of their corpus in international markets can help in better diversification. Riding on the trend, there has been a flurry of international fund launches over the last year. In fact, out of the 63 funds that this category hosts as of now, around one-third were launched in 2021 alone.

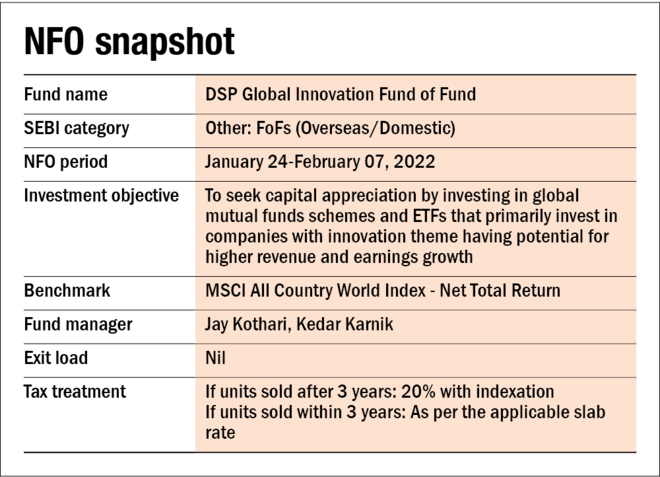

Now, adding another scheme to its bouquet of overseas funds, DSP Mutual Fund has rolled out a new fund offer (NFO) on January 24, 2022. It is an open-end scheme and will close for subscription on February 07, 2022.

About the strategy

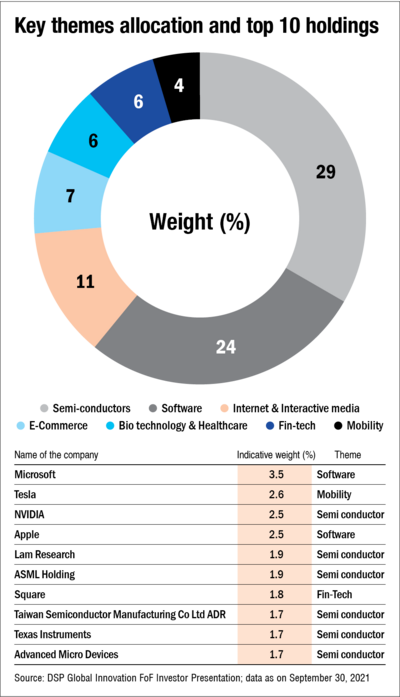

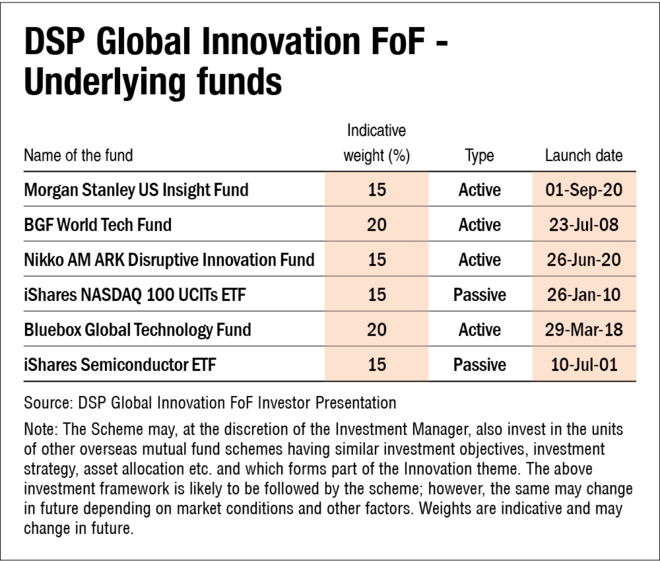

The newly launched fund is a fund of funds (FoF) that aims to invest in marquee global active and passive funds and ETFs who, in turn, invest in innovation and technology-driven companies with a long-term horizon. As per the investor presentation, the fund seeks to invest in six funds, out of which two are passive, making nearly 30 per cent of the portfolio.

As per the AMC, the weight of individual funds can oscillate between 10-50 per cent. The above indicative weightage has been decided based on multiple factors such as theme level allocation, active and passive allocation, overall market capitalisation, overall geographical allocation, portfolio overlap and overall portfolio volatility and returns. These weights would be rebalanced on an annual basis.

The key themes that this fund provides exposure to include semiconductors, software, internet and interactive media and e-commerce. The combined expense ratio of the six underlying funds of this new fund comes to 0.74 per cent (based on the indicative weight of each fund) as of November 2021 and the expenses of the FOF will be over and above that.

Portfolio design - Update

As per the SEBI rules, each fund house can invest a maximum of US$1 billion (roughly Rs 7,400 crore as of today) in overseas markets (excluding foreign ETFs). Further, there is an overall investment limit of US$7 billion for the mutual fund industry as a whole. In the case of investments in overseas ETFs, the amount is capped at US$300 million per AMC and US$1 billion for the industry.

On account of the limitation of the industry level limit of US$7 billion in overseas securities/mutual funds, SEBI advised that DSP Global Innovation Fund of Fund should initially invest only in overseas ETFs until this limit is increased in consultation with the RBI. "Until the limit of $7 BN is enhanced, DSP Global Innovation Fund of Fund will begin by investing 50 per cent each into the iShares PHLX Semiconductor ETF and iShares NASDAQ 100 UCITS ETF. We intend for the portfolio to eventually reflect our original design, once the limit is enhanced," said the fund house in its release.

Thus, with a 50 per cent weight to iShares Semiconductor ETF, this fund becomes more thematic in its current avatar.

About the performance

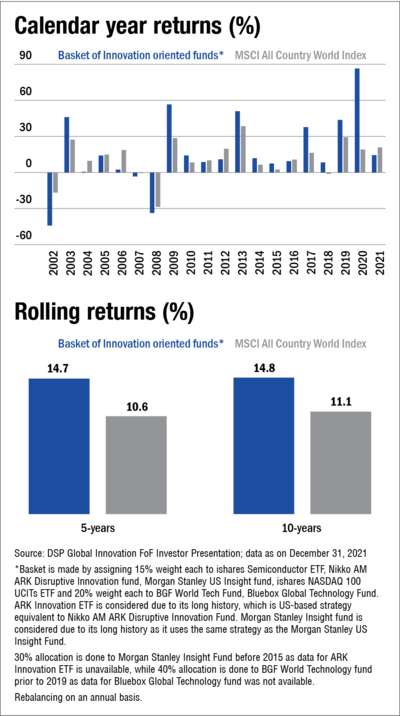

In terms of calendar year returns, there is a nip and tuck fight between the basket of six funds that this new fund would invest in and its benchmark - MSCI All Country World Index, with each scoring 10 times above the other over the last 20 years.

To get a better long-term picture of equity investing, it makes sense also to compare the rolling returns of the two. On that front, the basket of underlying funds of this FoF emerges as a winner. However, investors should note that these are historical trends and cannot be extrapolated into the future.

Further, the fund house has highlighted in its presentation that this basket of innovation-oriented funds has witnessed periodic high drawdowns and volatility in returns compared to the fund's benchmark. Hence for better investment experience, investors should hold this fund for the long term through SIP.

About the AMC

Managing total assets of around Rs 1.07 lakh crore, DSP ranks 10th across 41 AMCs in India (as per data on December 31, 2021). Out of this, Rs 60,209 crore pertains to equity funds spread across 24 schemes.

When it comes to international funds, the AMC has six funds in its product basket, besides the one being launched now. Out of these, four funds are thematic, based on themes like agriculture, energy, gold and mining. The other two are FoFs. One of them is a global fund that invests around 40 per cent in debt and the rest in equity, and the other fund is US-based. These six international funds collectively manage close to Rs 2,178 crore, just about 3.6 per cent of the fund house's equity franchise.

Also read: Three questions you should ask before investing in an NFO