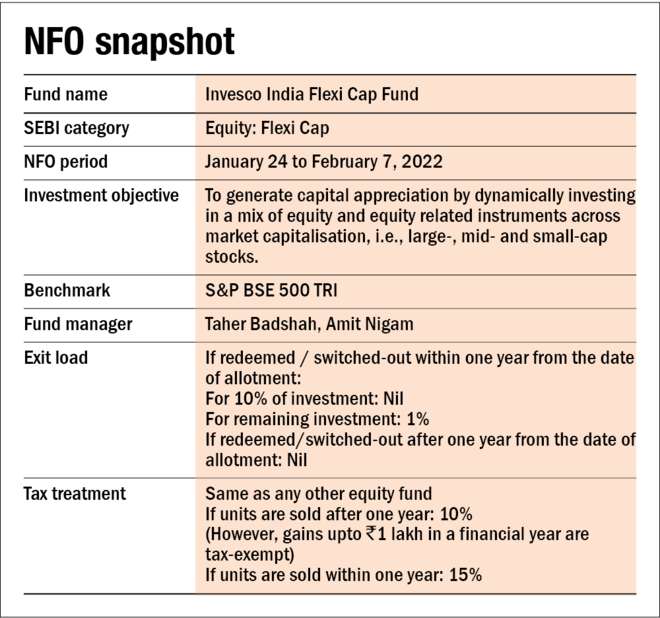

Invesco Mutual Fund has floated a new fund offer for the launch of its Flexi-cap fund. The fund will dynamically manage its equity holdings across large-cap, mid-cap, and small-cap stocks.

The new fund offer (NFO) is open for subscription since January 24, 2022, and will close on February 7, 2022. The fund will be managed by Taher Badshah and Amit Nigam. The fund is benchmarked against S&P BSE 500 TRI. Here are the key details of the new fund offer:

On September 11, 2020, SEBI came out with a circular for multi-cap schemes, wherein it asked fund houses to invest a minimum of 25 per cent in all large-, mid- and small-cap market segments. Majority of the AMCs exercised the option of converting their existing multi-cap scheme into a flexi-cap in order to retain flexibility in their existing portfolio mandate to dynamically invest across market-caps. Invesco was one of the few AMCs that decided to comply with the new regulation for multi-caps and hence ended up having no offerings in the new flexi-cap category.

Since the regulation came into effect, we are seeing many fund companies looking to fill the gap in their product line-up either in the multi-cap category or, as in Invesco's case, the flexi-cap segment.

About the strategy

Invesco India Flexi Cap Fund would aim to identify winners across sectors and market cap based on the relative attractiveness of investment opportunities. It intends to capture the stability of large-cap and growth potential of mid- & small-cap with an option to dynamically change the allocation. The fund's mandate facilitates longevity of stock ownership as the fund does not need to rebalance the portfolio due to market cap changes and provides necessary diversification enabling it to generate consistent returns while lowering risks.

Flexi-cap funds enjoy a greater degree of flexibility as they don't have any restrictions regarding the minimum allocation to any market-cap segment. However, most flexi-cap funds tend to have a lower allocation to mid- and small-cap stocks than the large-cap stocks.

The performance comparison of an average regular plan of flexi-cap funds and the S&P BSE 500 TRI reveals that the former was an outperformer on a five-year rolling return basis till about the middle of 2019. Of late, the regular plans of most of the flexi-cap funds are trailing the benchmark.

About the fund manager

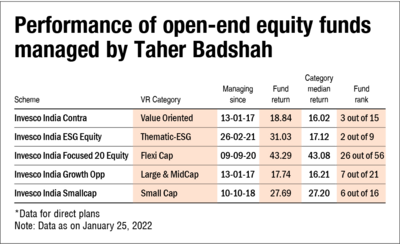

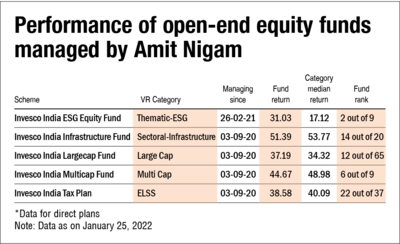

The fund will be managed jointly by Taher Badshah and Amit Nigam. The duo also manages the ESG scheme of the fund house together.

Taher holds a Master's in management studies (MMS), with specialisation in finance from S.P. Jain Institute of Management and a B.E. degree in electronics engineering from the University of Mumbai. With over 26 years of experience in the Indian equity markets, he is the CIO-Equities at Invesco. He joined the AMC after his six-year-long stint at Motilal Oswal Asset Management where he was the Head of Equities. In the past, he has also worked with Kotak Mahindra Investment Advisors, ICICI Prudential Asset Management, Alliance Capital Asset Management, etc.

Amit Nigam holds a PGDBM degree with specialisation in finance from IIM Indore and a B.E. degree in mechanical engineering from IIT, Roorkee. He comes with more than 20 years of experience in Indian equity markets and has had stints at Essel Finance AMC Ltd (as Head of Equities) which is now Navi AMC Ltd, BNP Paribas Asset Management India Pvt Ltd (as Fund Manager), etc.

About the AMC

Invesco is an independent global investment management firm with $1.5 trillion in assets under management around the globe. It employs more than 8,200 employees worldwide with an on-ground presence in 20 countries, serves clients in 120 countries, and is a publicly-traded company on NYSE. It owns Invesco Mutual Fund in India which has an average asset base of over Rs 55,622 crore for the quarter ending December 2021.

As per the end of December 2021 disclosures, the AMC manages a total of Rs 43,067 crore of investors' money in 36 funds which ranks it 17 out of 41 in the industry. The fund house currently has 16 open-end equity schemes with AUM of Rs 24,753 crore, ranking it 17 out of 38 in this space.

Here is the break-up of AMC's open-end active equity funds as per Value Research's star rating system as of 31 December, 2021.

Also read: Three questions you should ask before investing in an NFO