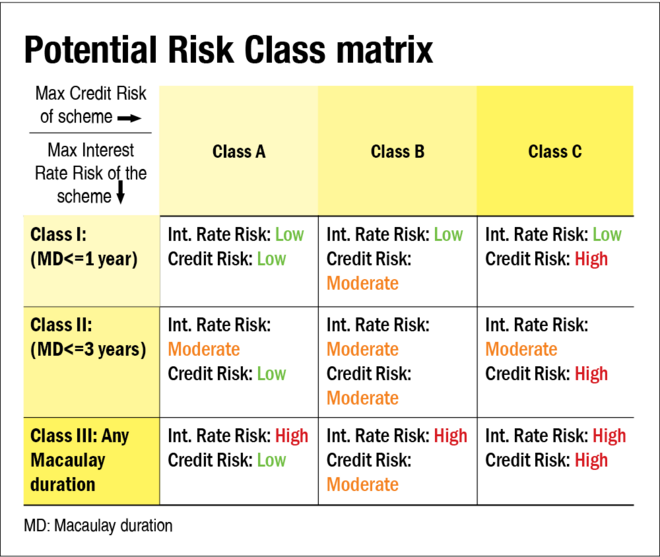

In June 2021, SEBI introduced the Potential Risk Class (PRC) Matrix for debt funds. In December 2021, AMCs rolled it out for each of their debt funds. The PRC matrix tells the maximum credit and interest-rate risk a fund can undertake.

On this 3 × 3 matrix, every fund house has placed each of its debt funds in one of the nine cells. For instance, cell A-III means that a fund placed in it will largely stick to high-rated bonds but will have the flexibility to invest in bonds maturing in more than seven years. Therefore, you can expect an A-III fund to be always low on credit risk but potentially high on interest-rate risk. Do note that the risk-class matrix sets the maximum level of credit risk and interest-rate risk a fund will ever take. On an ongoing basis, the fund manager can choose to run the portfolio at a lower level of risk. For example, a fund that sets its PRC at B-II can well run a portfolio at A-I, A-II or B-I levels as well.

In case of debt funds, where risk considerations supersede returns, it's extremely useful for an investor to know where the boundaries are and what the fund will never do. And that is precisely what a thoughtfully done PRC matrix placement can tell.

But unfortunately, a look at the PRC disclosures of the top AMCs across select fund categories (see the infographic 'PRC matrices of nine select debt categories') reveals that most of them have chosen the easier route of keeping fairly loose boundaries, thus retaining a high degree of flexibility to assume greater risks. This diminishes the utility of the PRC. For example, when a wide range of funds from low duration to dynamic bond find a place in the same cell (B-III), PRC doesn't help an investor in narrowing down to the suitable ones.

But two AMCs, IDFC Mutual Fund and Invesco Mutual Fund, deserve praise for setting much more well-defined boundaries. This serves investors in two ways: (1) provides more precise information about what the fund will and will not do; and (2) creates finer distinction between the different funds in their line-up to aid fund selection. These two AMCs also stand out for taking a much conservative stance on credit risk across product categories, including credit-risk funds. Overall, their PRC disclosures set them apart and speak well about their investment discipline.

The other noteworthy observation is in the case of medium-duration funds, where fund houses differ in their investment-management approach. While several of them view it as a quasi-credit strategy, thereby investing in lower-rated bonds to generate higher returns, others refrain from doing that. The PRC clearly brings out that distinction. So, if these funds fit into your investment objective but you are wary of credit risk, the PRC tells you the select few which will never go overboard on it.

While PRC doesn't guarantee that accidents won't happen, it could go a long way in ensuring that the investment-management teams don't get distracted into assuming unwarranted risks even during times when temptations are high. Two AMCs have made good use of it but for many others, it looks like a missed opportunity.